The China "Tell" — Goldman Pushes Back Amidst Massive China OTC Buying.

$3,000 Analyst adds upside risk to their target now

Goldman's $3,000 Gold Forecast: Analyst Pushback Amidst China Surprise

Contents:

Summary

Reasons Goldman Remains Steadfast

Dollar Strength Does Not Drive Investor Gold Demand, Rates Do.

Central Banks Don’t Want the Dollars Anyway

Hedging Global Crises With Gold and Dollars

Market Neutral Impact of China’s Easing

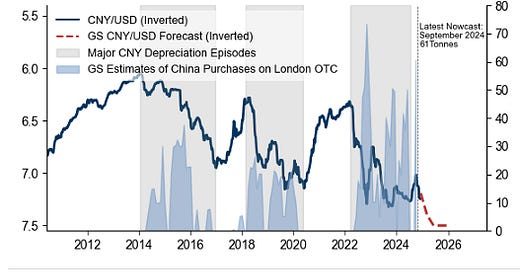

China Buys 10x More Gold Than Publicly Stated

Two-Way Risks to the Forecast and Conclusion

Additional Takeaways

Bonus: WGC on Indian Demand

1- Summary:

Goldman Sachs analyst Lina Thomas forecasted that gold would hit $3,000 per ounce by the end of 2025. The main reasoning? Relentless central bank purchases, particularly from China’s voracious appetite for the metal.

However, the thesis quickly faced skepticism, as competing colleagues questioned whether gold could continue its ascent amid a strengthening U.S. dollar—a hallmark of consensus trades tied to Trump’s return.

Thomas, however, countered the skepticism in a note asserting that gold may still rally to $3,000 even if the dollar remains strong. She even noted that there is now upside risk to that price target adding $50+ if things continue as they have been. This report also allows for the Fed reducing rate cuts to only one more in 2025.