GoldFix: Gold Will Go Parabolic This Time- Paulson

There’s a very limited amount of investable gold.

Welcome. GoldFix Weekly is original content. The goal is to give you, the reader, some basis for looking at markets as you prepare your own trading week. Second, it aims to give you more tools, or at least the basis for developing your own tools to navigate markets. To that end we expect there will be changes based on feedback.

ATTENTION: The GoldFix Weekly Report is accessible by Premium Members for a nominal monthly fee. Goldfix Daily reports and GoldFix Morning Podcasts will remain free to all. More content will be added as time goes forward. It will continue to strive to be the best original content for both investors seeking insight, and active traders who want to grow. Thank you.

This Issue

Markets: weekly summary

Precious: gold summary

News: stories on metals and markets

Technicals: active trading levels

Tools: educational videos and research

Charts: related markets

Calendar: next week

Disclaimer: read this

1. Markets

Capital Markets Summary

The USD was down to one-month lows, sliding for 9 of the last 10 days.

Precious Metals gained as investors’ confidence started to fade.

Crypto markets surged this week as traders sought alternatives to the dollar.

Stocks, Gold, and Silver

Stocks were mixed with professionals seemingly willing to buy any dip. Nasdaq was the week’s outperformer. The Dow lagged the rest of the majors to end the week unchanged. Value stocks went nowhere as growth dominated. This fits with the dramatic surge in “Defensive” stocks this week.

Consumer Defensives did well, Banks did not.

Treasuries were mixed on the week with the long-end marginally higher in yield and shorter-end marginally lower…

Oil prices rallied on the week, thanks to gains on Thursday largely, with WTI back above $70 intraday but ending back below.

There have been 10 other years in which the S&P 500’s gain through August surpassed 20%, according to data compiled by Bloomberg. The final four months of those years brought everything from a 21% advance to a 32% decline. All this left the S&P 500 with an average loss for the Sept-Dec. period of 2.1% and a median gain of 2.2%. - Full article

No Bad Data Please

On Friday The Fed announced a suspension of one of its key data models. The Nowcast model it uses to track DP as now been retired pending some re-educational changes.

Zerohedge notes:

We find it odd how the NY Fed did not suspend its nowcast model on the way up in late 2020 when a similar level of pandemic confusion was present but when all the adjustments were in the upward direction and nobody really cared if they are accurate or not.

There are two ways to interpret this sudden and unexpected development from some of the “smartest” economists in the room. Either i) nobody knows anything (which is true for most economists), or ii) the underlying economic data is now so ugly that instead of lipsticking, adjusting and goalseeking it to make it look attractive (on a seasonally adjusted, pro forma basis of course) in its “tracker”, the NY Fed has simply decided to no longer even cover it. Our money is on both i) and ii).

At this rate, they will be suspending CPI and PPI calculations as well. Transparency only works when it is going well we guess. See story link in News section below.

Complete Watchlist HERE

2. Precious

Every week day we do a morning broadcast for traders, investors, and people seeking to just be more literate on markets. Below are links to some previous podcasts.

GoldFix Broadcast- Stock market overview, technical levels, and market insights

Bitcoin Brief- Crypto commentary, education and trading levels

We encourage you to surf the content and join us daily.

Recap

For most of the week, gold and silver ignored their relationships to the dollar and bond markets. They frequently ignored their relationships with each other as well. Markets saw everything trade in reasonably narrow ranges despite the dollar weakening.

The biggest divergence was Thursday post the ADP employment number. First a little background. The ADP private payroll comes in the day before the actual Jobs number. We cannot remember a time when it was an accurate predictor of the Friday numbers.

Last Thursday it came in very low. We wrote on this in the daily report.

For the second month in a row, the ADP Private Payroll employment report has been a complete disaster, and one month after the the ADP missed by almost half printing at 330K in June (missing expectations of 683K), moments ago ADP reported that private payrolls in August rose just 374K, which while a modest improvement from July’s downward revised 326K (which was the lowest since February), was again a huge miss to the 638K expected, and was in fact below the lowest forecast by polled economists (+400K)

The dollar weakened as it should have. But gold went lower. Worse; Silver was higher. Normally we’d sit back and wait for the markets to sell silver and buy gold but that didn’t happen. Next, we expected the dollar to rally and gold to get slammed. That didn’t happen either.

We continued:

Gold has no reason to be down as we write this. Yet it is. Silver is up. Copper climbed off its lows. The dollar is weaker on the back of disappointing ADP data. And so these things had buoyed it higher this morning. Then, after rallying at 8:30 presumably on the data release, it inexplicably gave all its gains back and then some. We can only assume the options gravitational pull is bigger than originally perceived. The good news is the market did not drop below the teens.

The conclusion headed into Friday was ADP was wrong again and the gold market smelled that. There other possible conclusion was the gravitational pull of the $1800 strike was still exerting itself.

Whatever the reason, the market was not making sense for the session.

The reason came Friday. ADP was correct for a change. The Jobs number came in disastrously low, the dollar dropped and gold screamed higher. So what happened?

The dollar was correct but gold did nothing Thursday because… it is gold? No. Funds are reticent to speculate in it now; especially in light of the post Basel 3 rules. And that inefficiency is a good thing. Never have we felt so strongly about the metals drivers exerting upward pressures on the complex more than now. The lack of efficiency is a sign of hot money leaving the market. Day to day means less and week to week means more for active traders now.

Which is why we looked closely at Friday behavior in context of every Friday since the flash crash a month ago. Someone is buying “below the fold” when few media are watching. Might be nothing. Might be something. Remember bad news comes out on Friday.

Gold closed higher 4 Fridays in a row now. This may be a pattern worth watching.

Premium Weekly Report: Click for description

3. News

1-John Paulson on Why Gold Goes Parabolic

John Paulson, Paulson & Co. president and portfolio manager, explains why gold goes parabolic and why it’s a good investment now. He’s on “Bloomberg Wealth with David Rubenstein.” This was recorded Aug. 12 at Paulson’s home on Long Island.

CLIP: Paulson Explains His New Gold Bet

From Paulson’s conversation with Bloomberg’s David Rubenstein:

Do you think that gold is a good investment today?

Yeah, we do. There’s a very limited amount of investable gold. It’s on the order of several trillion dollars, while the total amount of financial assets is closer to $200 trillion. So as inflation picks up, people try and get out of fixed income. They try and get out of cash. And the logical place to go is gold. Source: Bloomberg

2- Analysis: Paulson Explains Why This Time is Different

Listen to Paulson’s explanation of QE above. He describes what went wrong with his play on Gold in 2009-2012 correctly. He states that The Fed printed money but sterilized that printing by raising capital requirements for banks that received it. Essentially freezing the money at the banks. This is called ‘sterilizing" the QE. Here is a quick explanation of one way the Fed does it.

Sterilizing QE:

Let’s say the Fed wants to purchase mortgage-backed securities in an attempt to inject money into the housing sector. The first—and most probable—way it would “sterilize” the money it’s putting into the market would be offering commercial banks interest to deposit money at its deposit facilities. This is keeping the money in a closed loop or a walled garden. The money is printed, but earmarked for narrow uses.

Roche Kelly explains that a central bank pursuing such a policy “is just moving money around in the market from one place to another…It’s saying, we think there’s money out there but we’re not sure where it is.” Commercial banks have money sitting on their books doing nothing and will (in general) gladly put it to use in a safe deposit facility with the central bank. Source

What it means:

Paulson claims this time is different and he is right. Much of the money printed this time went directly to citizens. We are seeing that fallout in inflationary pressures now. The caveat is this: The government can direct funds from one asset class to another and frequently does. What is to say there will not be another “trick” to get gold in line?

All we’re saying is: Gold can and should go parabolic when things go bonkers. But how long will the government let it? Not long. From experience watching major players abort other Gold accumulations, it just doesn’t happen easily. Silver on the other hand, will have more room if gold catches fire. Just know printing money isn’t enough. That money has to be out and about, not just in a closed loop.

Paulson hit a home run on his housing trade in 2009. He didn’t advertise that trade. Why advertise this one? Not saying he is wrong. We are saying if he’s talking about it, he has already bought. Now let’s see who else buys.

Finally: Paulson is talking of investable gold for a reason. We think he has thought this through better this time.

Other News

Silver - An Undervalued Asset Class In today’s world of debt creation and central bank balance sheet expansion, one asset can still be bought at the same price it was over 40 years ago. www.goldsilvervault.com

Facing Inflation Threat, German Investors Loading Up on Gold | SchiffGold Germans are loading up on gold as a hedge against growing inflationary pressures. schiffgold.com

Paulson on Parabolic Gold Aug.29 – John Paulson, Paulson & Co. president and portfolio manager, explains why gold goes parabolic and why it’s a good investment now.

Silver unlikely to track gold again, may "never go back as money", here's why - Lobo Tiggre [EDIT- Based on an interpretation of the gold silver ratio which we find faulty- VBL]

4. Technical Analysis

Report Excerpts Courtesy MoorAnalytics.com

Gold

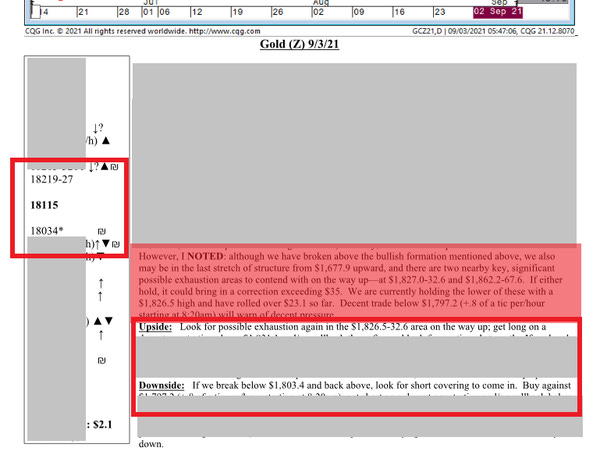

Macro: If we break above $1,826.5 and back below WITHOUT taking out $1,831.01 decently, look for pressure to come in. Get long on a pullback after a decent penetration above $1,858.3 (+1 tic per/hour starting at 8:20am) and look for continued strength. Look for possible exhaustion in the $1,862.2-67.6 area on the way up.

GoldFix Broadcast- Stock market overview, technical levels, and market insights

Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

Bitcoin

Macro: The decent trade above $47,355 (-35 per/hour) has brought in $3,890 of the decent strength we are looking for above. If we break back below $50,475-55 decently, look for decent pressure. I would be wary of key possible exhaustion areas above at $51,475-760 and $53,276-390—we came just shy of the lower of these with a $51,260 high and started to roll over.

Bitcoin Brief- Crypto commentary, education and trading levels

Crude Oil, Natural Gas, and Gasoline

Natural Gas Note: CAUTION- we may now be nearing the end of the last stretch of the structure upward from the lows in February 2020 and would be aware of possible exhaustion levels at 4955-98 and higher—one of which could bring in a bearish correction exceeding 460 tics. I warned in the Post Market Synopsis that on the day this warns of pressure before (if) resuming higher trade if we cannot take out 4727 to maintain upside momentum—we came off 55 tics before short covering off the low. Tuesday has a good likelihood of seeing range expansion.

Technical Reports: Go to MoorAnalytics.com for 2 weeks Gold, Oil, and Bitcoin reports free

5. Tools

Research Reports (Private Links. Not for redistribution)

In a world where traditional boundaries are collapsing, perhaps the most important financial boundary that has eroded is that between monetary and fiscal policy. These two spheres merged after the Great Financial Crisis of 2008; its disappearance was epitomized by the appointment of a central banker, former Federal Reserve Chair Janet Yellen, as U.S. Treasury Secretary.

Governments now buy most of the money they print (the Fed has purchased 76% of all of the debt issued by the Treasury during the pandemic), monetizing their debt but also eroding market pricing and economic discipline. Full Report access

6. Charts

Gold

Silver

Premium Weekly Report: Click for description

7. Calendar

Some of the upcoming week’s key data releases and market events

MONDAY, SEPT. 6

Labor Day holiday – none scheduled

TUESDAY, SEPT. 7

None scheduled

WEDNESDAY, SEPT. 8

10 am Job openings July

2 pm Beige book

THURSDAY, SEPT. 9

8:30 am Initial jobless claims (regular state program) Sept. 4

8:30 am Continuing jobless claims (regular state program) Aug. 28

FRIDAY, SEPT. 10

8:30 am Producer price index Aug.

10 am Wholesale inventories (revision)July

Main Source: MarketWatch

RELATED CONTENT

8. Disclaimer

Disclaimer: Nobody is telling you to do anything here. Anybody who tells you to do something without first intimately knowing your personal situation is irresponsible at best and manipulative at worst. Worse, anyone who acts on other people’s opinions without first doing an inventory of their own situation shouldn’t be surprised if they lose money.