0DTE

Presentation and Questions on 0DTE Options for GoldFix Founders with a little background on VBL.Works just fine as audio with notes attached if you prefer. Introductory piece sent the day before.

Table of Contents

Intro:

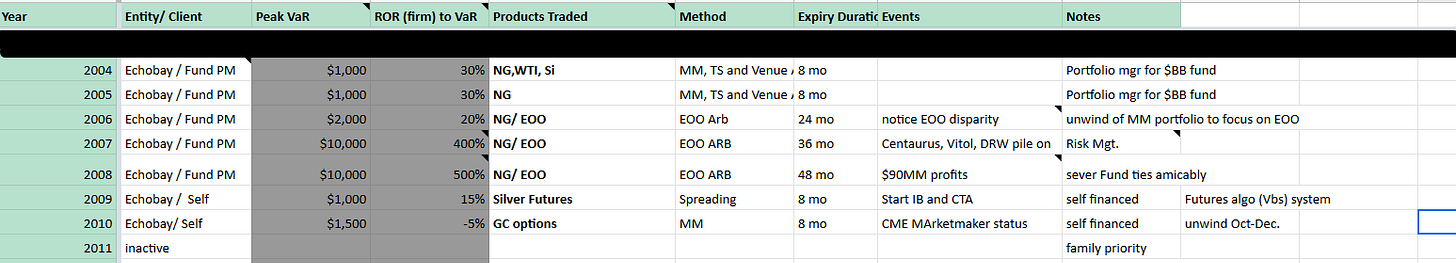

CV/Trading Bio Excerpt

VBL’s trading between 2004-2011

Market Participants

History Evolution: Metals in 1993

The Players’ Strategic Goals in more detail Real Life

Roach Motel but No Systemic risk- Funds will Die

Big Crowded Trade Risk

How will it Happen? Markets are not always efficient

How It Likely Ends Ugly

The Delta Game

Questions

Market Participants

Speculators- the buyers

seeking directional risk exposure

Investment Funds- The Sellers

using them for covered call writing dividends

Marketmaker/dealers- buyer/sellers

Retail- buyers

Intro: Hedge Fund Track Record

2004-2011 ROR

0DTE History Evolution

Initial use was to hedge or speculate 1 day event risk

Effectively very expensive 1 day insurance

They almost always trade at higher volatility than they should relative to their longer dated cousins due to their low notional values and their lottery ticket aspects.

it's like buying retail versus buying wholesale

The Loosies Concept: Cigarettes to poor people.. buy a pack, stand in front of store and sell loosies cheaper than the store did.

The higher volatility premium eventually attracts the crowd who do covered call plays

This eventually creates a marketplace with short term speculators buying, and long term investors selling and market makers filling the void both ways.

Between #6 and 7 the regulators step in usually after some player gets burnt