IMPORTANT NOTE: In the interest of time and maxing out value, we will be sending the ACTIVE TRADER post with the prior day’s video some times. Video content frequently overlaps somewhat day to day, the numbers and trading ideas do not. -Tx

About Moor Analytics:

Moor Analytics produces technically based market analysis and actionable trading suggestions. Reports are sent to clients twice daily, pre-open and post close.

As long as the Technical Podcast remains in Beta it will be accessible to premium subs. When Beta ends it will be available as standalone (fee and email separate) in the Active Traders tab. We will still quote Michael heavily in the Market Rundown. So, unless you are a day trading type, you won’t miss it. Founders will continue to get it.. But Founders rates will increase afterwards once it’s set up properly.

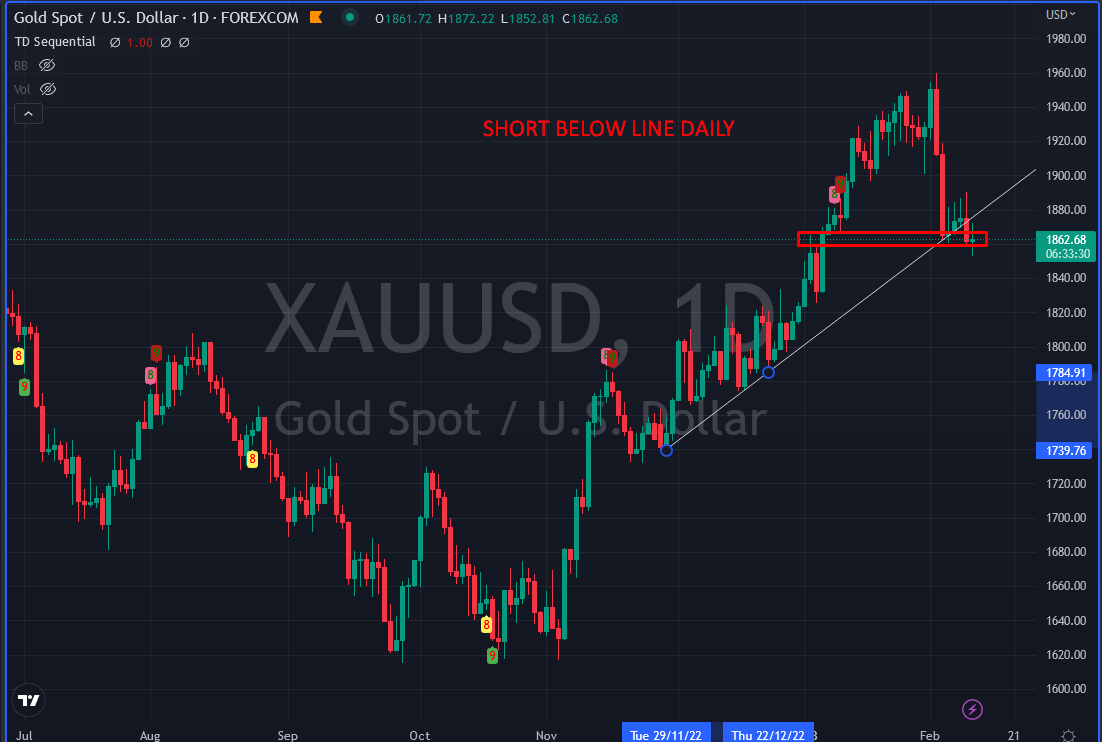

GOLD:

The buyer on the white trend line is filled. The next buying is looking at the flat line going across in red.

Bear Case: Flat line support never works. The big buyer is done for now and rallies will be sold. These are technical bottom fishers.

Bull case: If we get above that trend line again, it could run hard. Why? Because there are a bunch of people selling short and/or puking longs below this trend line. if it can withstand that selling, then they will be kindling for the next run up

OIL:

Russia cut oil production in response to the pricecaps.

Amena is the real deal when it comes to processing OPEC politics…

Russia did not consult with Opec-Plus on the 500k voluntary cut. However this does not mean that Russia is seeking to leave the group, far from it. #OOTT #Opec

Continues Below…