A-Mark Metals: An unusual way to trade gold’s breakout rally, from this hedge-fund manager.

Praetorian Capital Management founder Harris Kupperman

Comment:

We’re very familiar with this business model, and if his analysis on the particulars is correct (we see no problem with it at first glance, and his logic is spot on), this is the industry to be in.

When run properly, they perform like a bookie would but with an upside call attached. This is a metals marketmaking business at its core. Multiples should be similar to an exchange like CME, though not as high due to the physicality of product and smaller network. But it’s the same model as an exchange and its primary guarantors in combination

Premium:

ING’s latest commodity report focuses on Gold is attached at bottom

Here’s the unusual way to trade gold’s breakout rally, from this hedge-fund manager.

Getty Images/iStockphoto

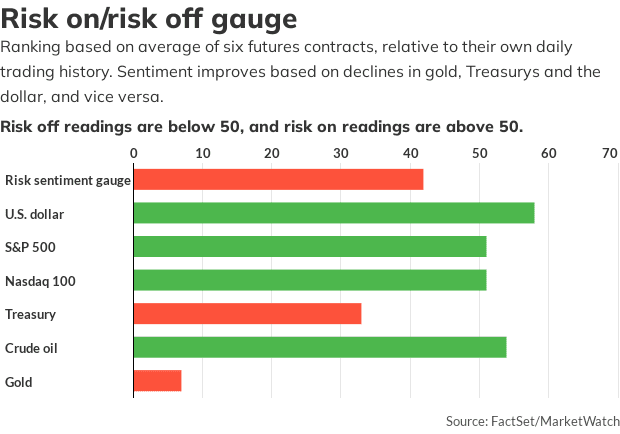

A post-eclipse hangover? Stock investors are seemingly on the sidelines, a day ahead of inflation data.

Meanwhile, gold is punching out its umpteenth high for the year on Tuesday, and our call of the day, from Praetorian Capital Management founder Harris Kupperman, offers a fresh way to profit from that.

Kupperman, who expects rising domestic and global tensions to drive volatility this year, is less excited by gold itself. “Capital flees and effectively goes to sleep in the form of precious metals — until stability returns, and capital can be returned to the economy again,” says the hedge-fund manager in a blog post.

He dislikes miners — “no leverage to the metal” and “every pitch is the same, mostly ending in sorrow,” and sees gold royalty companies as sophisticated return-of-capital “Ponzi schemes.”

Kupperman, who correctly called the 2022 tech meltdown, is focused gold’s role as a gauge of global fear levels. “I want to play the fear — the visceral and instinctual panic into metals and out of paper. I think that’s the better trade—especially as the elites find ways to cap the price of gold, or at least divert people’s attention from it.”

For that, he flags one stock — A-Mark Precious Metals (AMRK), a “dominant wholesale dealer in precious metals, with a substantial presence in sales to retail consumers, along with ownership in two mints.”

“They’re fully hedged against metal price moves, and instead earn a spread between the price that they pay and the price that they charge customers, usually referenced to the spot price,” he said.

A-Mark sold 2.6 million ounces of gold and 156 million ounces of silver in 2023, for total revenues of $9.287 billion, he notes. The company functions “like an exchange,” prospering on volumes, with elevated capital returns funding deals, customer growth, buybacks and dividends.

Its web traffic has spiked in the past on various crisis — COVID, lockdowns, the U.S. Capitol attack, Russia’s invasion of Ukraine, last year’s banking upheaval, he says, adding that crisis leads to demand for metals and expanding spreads over spot prices, good for A-Mark.

From fiscal 2021 to 2023, A-Mark earned roughly $7 per share after adjustments, including a stock split. The past three more mellow quarters, saw earnings averaging around $2.50 to $3 per share annually, which he suggests is a baseline for the company.

A close of $32.73 on Friday implies an 11 to 13 times earnings multiple for this business, “which simply seems low…given the amazingly high returns on capital that the business has had over the years, even during periods where results have been weaker,” he says.

Given that the demand for metals is set to expand, he thinks A-Mark can earn up to $10 a share. And with that, a 25-times multiple — implying $250 a share — isn’t far-fetched, given royalty companies with “substantially higher risk profiles” trade on higher multiples, he says.

“In my mind, AMRK trades cheaply, only because most investors do not yet know about it or associate it with the preferred way to ‘play’ gold,” he said, adding that owning a miner make no sense when an investor can own a precious metals exchange and prosper off increased volumes and spreads.

“When this reality becomes better known, I think that AMRK will trade at a premium multiple to the sector, especially as the market cap expands, allowing it to be added to additional passive indexes,” he says.