Analysis: The Fed Adds Instability | Market Rundown

Increased information and "transparency" has likely increased volatility

Today:

Market Rundown

Fed Transparency and Price Discovery

1- Market Rundown

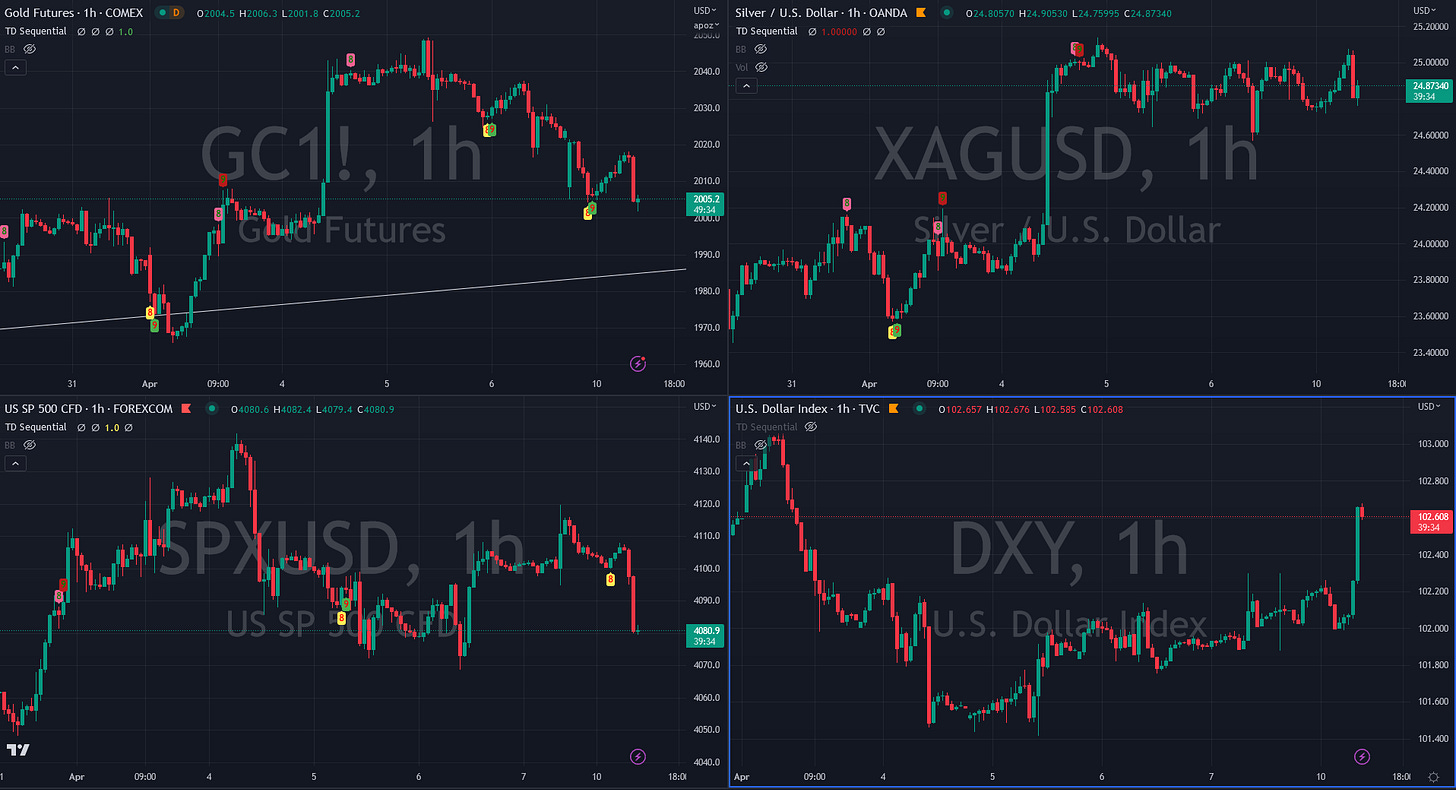

Good Morning. The dollar is up 54. Bonds are stronger pronouncedly at the back end. Stocks are down 60 to 100bps. Gold is down $17.00. Silver Fu are down less at 15c. Oil is down $1.00. Nat Gas is up 14c. Crypto is down.

What is going on?

Many of the world’s markets are still closed. The most likely driver of price action today is the New BOJ Governor stating he will not change Japan’s ultra-low interest rate policy. The USD rallied, and stocks took a hit. This continued “easier” Japanese monetary policy implies the US is less likely to take its footoff the rate hike brake.

Two years ago the BOJ announcemnt would have been bullish for US Stocks. But today, the market is definitely looking at rate hike behavior as the Fed’s dreaded norm, not QE. At least today it is.

Finally, for an analysis of what we thought would happen in Gold, and what seemingly has, here is yesterday’s Gold and Silver Week Ahead:

Conclusion: Given what we said about $2050 these past few days. If we were forced to put a trade on (we are *not*) it would be this:

Flat here with a bias to sell if short on a hard break below 2016

Biased bullish if and only if it breaks above $2050

2- Fed Transparency and Price Discovery

If you feel “buy and hold” investing has become materially harder over the decades, you are not wrong. One would think that it has gotten easier given the increase in data and much more transparent Fed. But it has not as DataTrek noted in a recent email comment.

Data analysis exploded in the 2010s and is all publicly available. Therefore markets should be more efficient in discounting economic knowledge. But that is remarkably not the case.

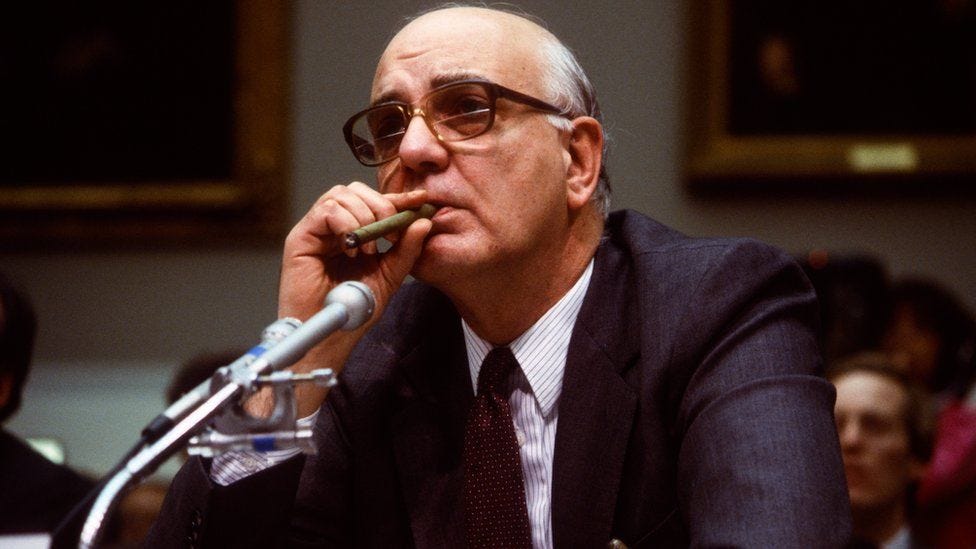

Additionally, stock market volatility is actually higher now than it was 30 years ago in the days of faxed earnings reports and cigar smoking Fed Chairmen. Let’s look at both of those measures of Fed efficacy in being more transparent.