Just yesterday after looking at the US Treasury holdings report we said, “China sells more treasuries for gold. This is brand new information. I think the FT broke it, but here's the key. In December, China sold $57 billion in U.S. treasuries, and we would add bought $4 billion in gold.”

Here’s Bloomberg Macro Analyst Simon White’s analysis of the Treasury market in light of these things. His conclusion is two fold. First on the Treasury/Gold situation

"US Treasuries’ loss is gold bullion's gain.”

Indeed, Since 2022 , gold reserve assets have risen twice as much as dollar-denominated reserve assets have fallen since 2022. (graphic below)

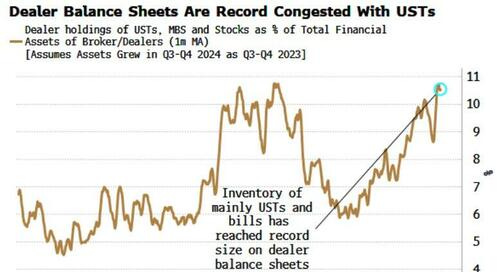

His second observation is where it gets interesting. The extra Treasuries hitting the market have to go somewhere. That “somewhere” is on the balance sheets of Bond dealers who are obliged to make markets in auctions.

Primary dealers must backstop Treasury auctions. The inventory of USTs on their balance sheets had been building. Their inventory has kept hitting new records — even as the curve has disinverted. The zeal for Treasuries is waning.

Ironically, the lack of global demand for treasuries can actually makes domestic liquidity seize up.

Reduced demand for Treasuries from banks could leave dealers continuing to hold the bag and, ironically, lead to tighter financial conditions.

Interesting and something we had not considered. As a result we’re reaching out to pros familiar with this plumbing and asking if this is a mountain or a molehill. How important are dealers anyway?

Enjoy.