Housekeeping: New daily format based on requests and some ideas.

Today:

Market Rundown

Excerpts: Gold Bulls, Oil Bears, AI…

Analysis: CA, GS

1- Market Rundown

Good Morning. The dollar is flat. Bonds are stronger, mostly in the front part of the curve. Stocks are mixed +/- 25 bps. Gold is down $1.00. Silver Fu is up 4c. Oil is up 15c. NG is down 1c. Crypto is all down between 1 and 2.5%. Grains are weak with Soy down 80bps.

2- Report Excerpts

Credit Agricole on Gold:

In today’s note to clients, Credit Agricole notes Gold has outperformed all G10 currencies after rallying vs the USD by 2.6% so far in April and by 4.9% since the start of 2023. Pretty impressive

They list some key reasons:

renewed weakness in global real yields

USD selloff across the board.

Latest CFTC data has signaled that speculative accounts have been aggressively buying the XAU in recent weeks.

We would note #3 isn’t exactly a long term bullish driver, and add caution when this type of behavior becomes obvious.

But it is (correctly) not overbought yet according to their models:

That said, gold looks far from overbought, if we compare current market longs with the levels from 2019-21. Moreover, recent IMF data on central bank gold holdings has signaled that official demand for the precious metal has accelerated in early 2023. Last but not least, investor demand for ‘gold proxies’ like crypto currencies remains weak.

DEBT CEILING SUMMER

One thing they note that the market pundits have seemed to forget about is the US Debt ceiling situation. While we acknowledge this is almost always a hyped- up non event, this time it is coinciding with a very sensitive market environment.

Therefore, any mention of it will likely force pent up buying to get more impulsive. This will last throughout the Summer. Knowing how these things are rescued at the 11th hour as well, it could add a lot of upside volatility to the market before being resolved.

And the resolution of these things is always to print more money. The dip, if it comes, will be a function of hot money exiting on ceiling resolution. Essentially those very same “speculators” in # 3 above.

(Nice gold chart-book as well at bottom)

Activation of The SPR Put

Collab with BKK

One Bank hedges their bullishness on Oil. Goldman put out an ostensibly less bullish recommendation on Oil yesterday. Despite the headline being very cautious, the risks described are not as big as they initially warn; at least not regarding the fundamentals…

First they note the risk:

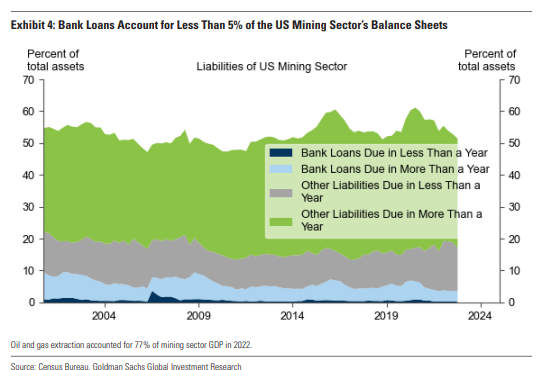

While Sunday’s surprise cut activated the OPEC put and banking turmoil seems to have calmed, we are monitoring the risk from tighter credit to US crude supply. After all, the US oil sector is capital-intensive and concentrated in a small number of regions, where a few regional banks have a significant market share.

Then they measure those risks:

We see only a modest direct impact of tight credit on US oil production (unless a major banking crisis occurred). First, the insured deposit share of these regional banks is high at 70%.

Second, bank debt accounts for less than 5% of the sector’s balance sheet, and producers tend to have access to well-diversified revolving credit facilities. Third, the sector is in a strong position to fund capex with high cash levels and cash flows, and record low leverage.

They note direct impacts of credit deterioration on oil production would be insignificant in their opinion. But the indirect risks longer term would be larger

The indirect risks to production from any resurgence in banking turmoil are likely larger. Banking turmoil drove the March oil selloff—and any renewed declines in prices and cash flows would raise the dependence on banks—and has coincided with a large fall in producer capex plans.

Just Monday we (BKK and VBL) said something similar extrapolating the idea from their bullish report in Opec Controls the Spice: “Shale Oil is also a real estate play. Real estate loans, as we all have learned lately, are mostly done by regional banks. Regional banks are all underwater. No new credit, no new oil on the shale side.”

Overall this report is good. We’d caution however this is not reason to get long or short Oil. This report itself is a Put for the bank’s bullishness.

The bottom line here is: Bank failure (doubtful it will happen now that they are watching) will not hit crude oil prices from deposit or financing risk. What will hit oil in that moment will be the perceived immediate deflationary effect of such an event.

Bank financing drying up is fundamentally bullish for replacement barrel costs. However, it is not bullish the moment such news comes out, if it comes out.

In such an event Oil time-spreads could be in play as well as US demand versus overseas demand as expressed in Brent/TI spreads

Good Luck

More Below…