Open interest Change implies another higher price base, even if OI shrinks more

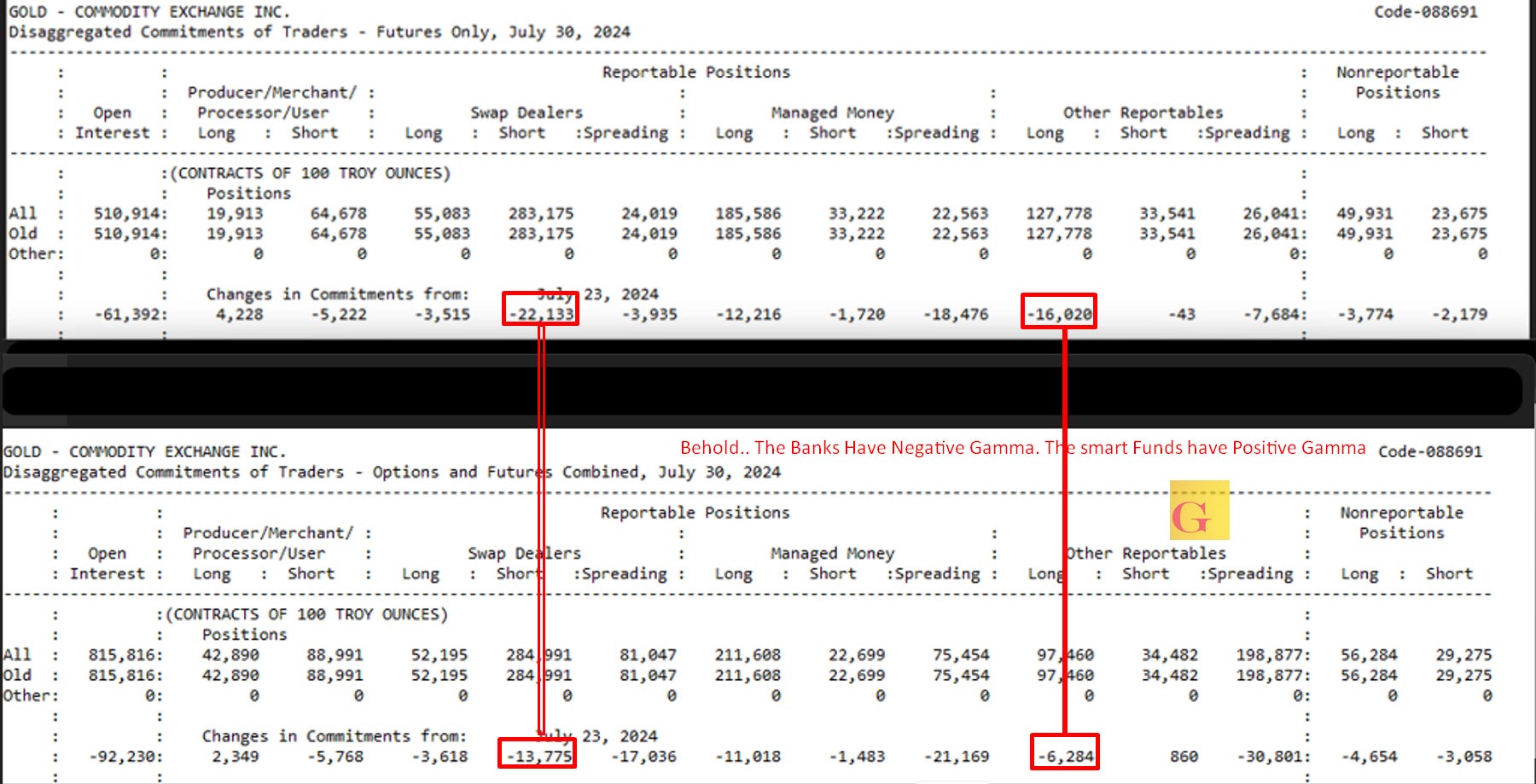

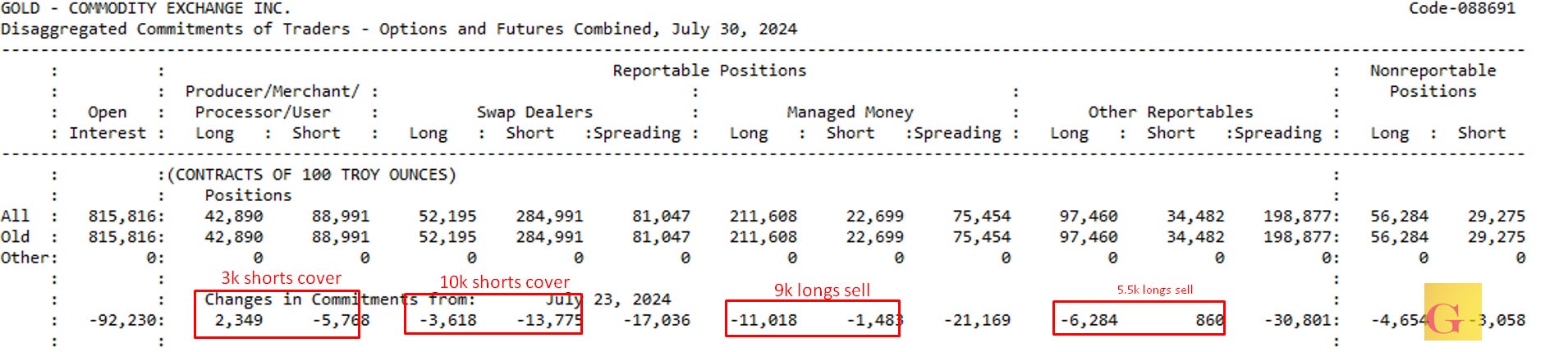

Lots of More short covering.. and its not just funds

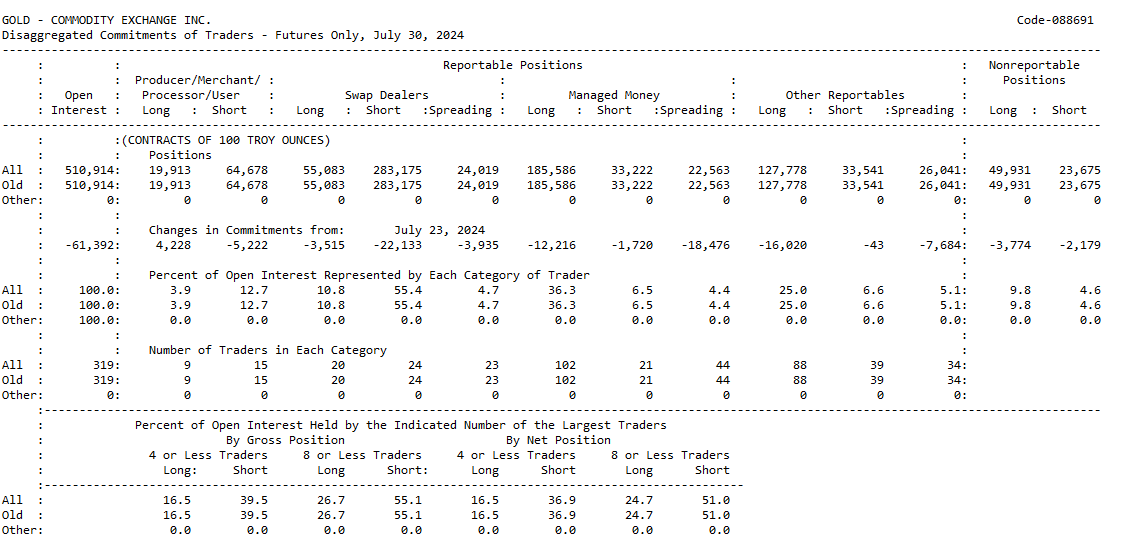

Clean COT Data

Notes:

Banks have Negative Gamma.. smart funds have positive gamma. Banks did not buy the dip as much as Funds did last week

( that day i bought where OI came in was either banks covering shorts and/or funds hedging gamma.. it kept happening for 4 trading days thorough the 26th through the 31st.)

Numbers Dont Lie. Gamma is Your Friend…

Futures Only

Futures and Options