Beyond $3,600: Gold’s Path in the Shadow of the 1970s

Hartnett’s analysis this weekend presented a clear analogy between the economic environment of the late 1970s and current conditions.

Gold’s Path in the Shadow of the 1970s

Introduction

Hartnett’s analysis this weekend presents a clear analogy between the economic environment of the late 1970s and current conditions. Rising bond yields, policy experimentation, and political pressure on central banks have combined to create a framework where gold becomes the necessary hedge. The discussion draws on parallels to the Nixon era, stagflation, and the eventual monetary repression that followed.

“This ends with gold higher either way.”

*Hartnett: The 1970's Are (Very) Definitely Back

Must Listen. This is a long one with a ton of material. It intentionally was kept to a clean translation with little digression. This is about Booms, Busts and Stagflation. It’s about Gold and how it all truly rhymes with the period of 1970-1979. We are somewhere between 1972 and 1975 based on Hartnett's assessment.

Inflationary Echoes of the 1970s

The late 1970s featured stagflation, wage and price controls, and eventual currency debasement. Today, the sequence appears familiar. Bond yields in the UK, France, Japan, and the US are at multi-decade highs, while policymakers float mechanisms such as yield curve control to contain costs. These measures recall the Nixon administration’s efforts to suppress wages and prices.

The report highlights how governments, faced with fiscal strain, resort to “pricekeeping operations.” These efforts lower yields artificially but force investors to reallocate toward equities and gold. The historical template suggests a cycle of temporary relief followed by renewed inflation, requiring higher gold prices to restore balance.

The Role of Yield Curve Control

Yield curve control was not officially used in the 1970s but wage and price freezes performed a similar function. Both repress natural market signals in order to maintain stability. The report emphasizes that once yield suppression begins, bondholders lose their inflation hedge. As a result, capital flees toward gold, equities with inflation bias, or foreign markets.

“Yield curve control cheats the long-term bondholder out of yield to hedge against inflation.”

The analogy is powerful. Just as Nixon froze wages to blunt union demands, modern policymakers repress bond yields to blunt debt servicing costs. Both policies are temporary, both distort incentives, and both accelerate gold’s strategic role as a neutral refuge.

The Nixon Playbook Revisited

Between 1970 and 1972, the US engineered a pre-election boom. Fed funds fell from 9 percent to 3 percent, Treasury yields dropped from 8 percent to 5 percent, and the dollar declined by 10 percent. Wage and price controls pushed inflation down briefly, equities surged, and gold was revalued.

The report suggests a similar trajectory today. Fiscal dominance, political pressure on the Federal Reserve, and a looming election cycle push policymakers toward accommodation. Yet the underlying forces of inflation remain, and history indicates that once temporary controls expire, inflation returns stronger.

“The Nixon playbook suggests 2025–26 would require price controls to contain inflation.”

Lessons for Positioning

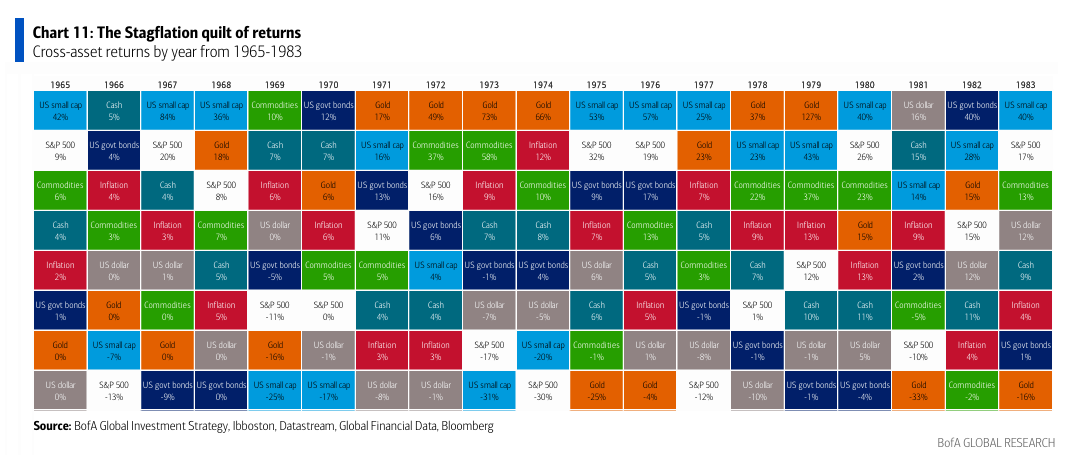

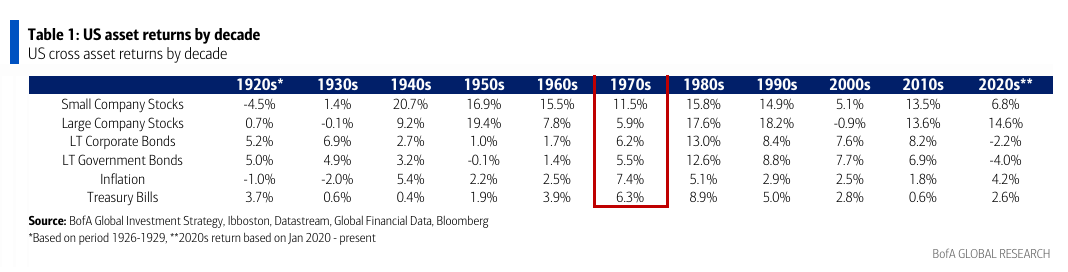

In the 1970s, equity leadership shifted over the decade. Large-cap growth stocks dominated early but collapsed in the 1973–74 recession. Value stocks, small caps, commodities, and real estate led later. Gold, meanwhile, outperformed during policy volatility and preserved purchasing power as inflation accelerated.

The report warns that today’s valuations are already stretched, with equities trading at higher multiples than in the early 1970s. This raises the risk of disappointment. By contrast, gold remains under-owned relative to institutional portfolios, a gap the analyst argues must close.

Bottom Line:

The parallels to the 1970s are pretty explicit. Rising yields, policy repression, and political subservience of central banks create the conditions for inflation volatility. The result is a forced repricing of gold higher to absorb systemic stress.

“Policy volatility makes gold indispensable.”

Just as the 1970s ended with gold as the ultimate hedge against political and monetary experimentation, the present cycle points in the same direction.

/////end//////////

I hate to be a simpleton, but here's my question. The Nixon playbook calls for Trump to revalue gold (which I suspect will happen). But re-valuation of Treasury gold is simply an accounting gimmick as I understand it. Thus, and assuming that Trump/Bessent/the Treasury revalues gold at the then-market price, what will be the practical effect on gold's price? Will this simply put a floor on the price of gold at the newly-revalued market price, or will this cause further upward appreciation of gold?

Alternatively, if the revaluation is appreciably higher than the market price, what might happen?

So interesting with both historical and present knowledge...

Cheers