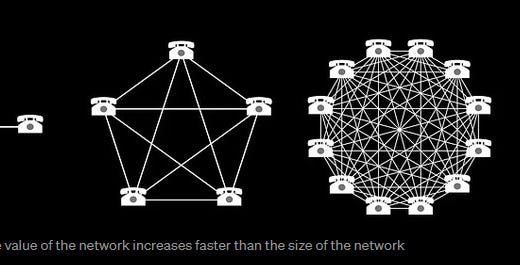

ZeroHedge Edit- Bitcoin Cracks $100,000 and BCA's $200k "Network Effect"

It's All Perception Now

While we should expect a near-term retracement, bitcoin’s structural uptrend is intact with an ultimate destination of $200,000+

-BCA Research

INTRO:

Authored by GoldFix,ZH Edit

Bitcoin has breached $100,000 today as ant…