Bloomberg Asks: How High Can Gold Go?

Seriously.

Gold’s Acceleration and the Structural Setup

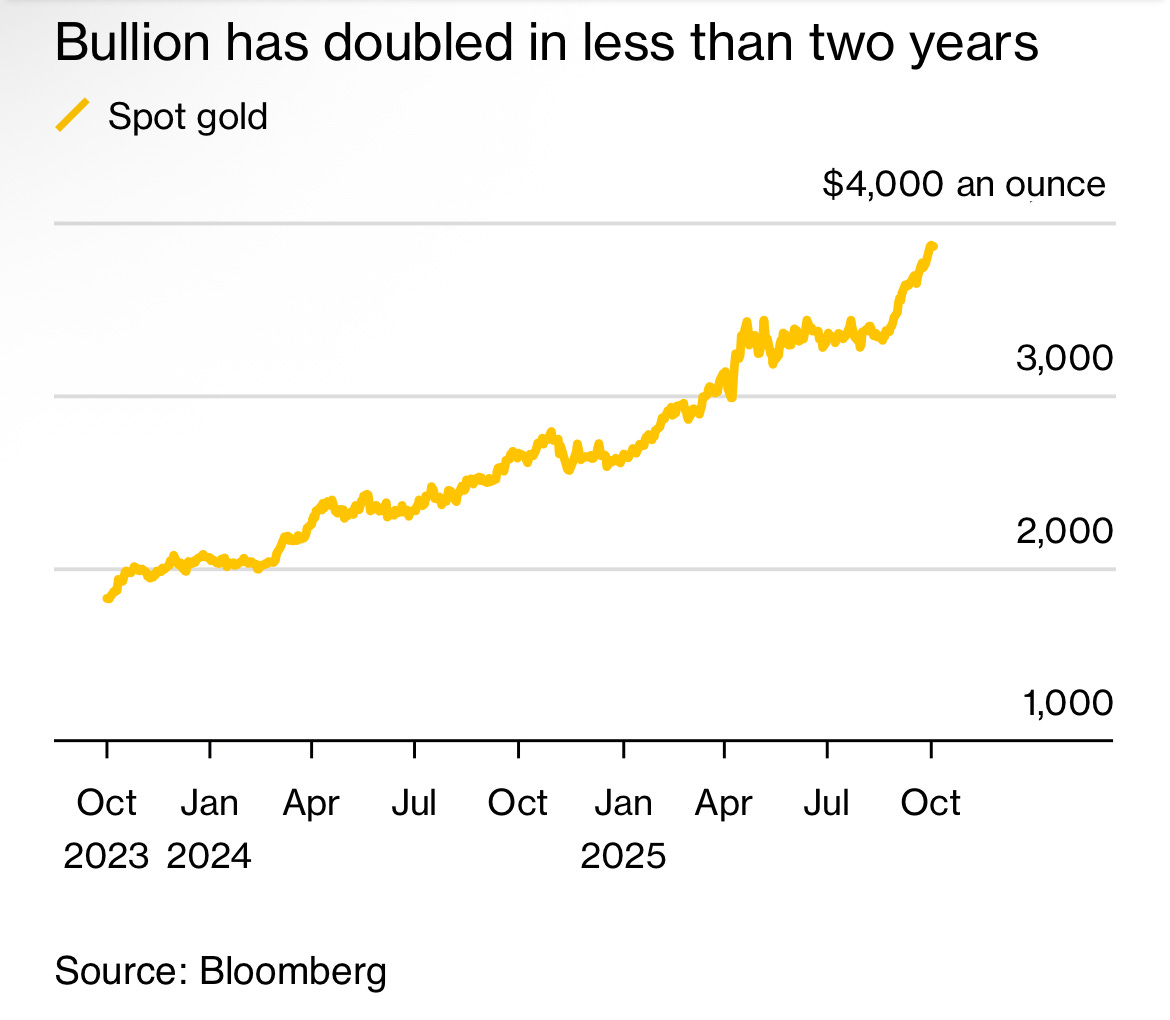

Gold continues to surge toward record levels as multiple macroeconomic pressures converge. The report from Bloomberg this morning situates the metal’s momentum within a broader backdrop of political instability, falling real rates, and eroding confidence in the U.S. dollar.

“Gold was on a tear even before Donald Trump came to power. Now a government shutdown in the US could push the metal past $4,000 an ounce — a doubling in less than two years.”

The key drivers outlined include declining interest rates, persistent inflation above the Federal Reserve’s target, and the weakening dollar. Together they recreate the conditions reminiscent of the 1970s, when loose monetary policy combined with inflationary pressure to propel gold into a multi-year bull cycle.

Policy Erosion and Dollar Strain

The report identifies a compounded political dynamic that reinforces these market mechanics. The U.S. administration’s public criticism of the Federal Reserve, along with direct interference in its rate policy, has introduced new uncertainty into the dollar’s role as a reserve anchor. A recently initiated rate-cutting cycle adds further weight to this weakening trend.

“A cycle of interest rate cuts that kicked off last month — and the US administration’s attacks on the Federal Reserve — have piled pressure on the greenback.”

Bloomberg draws attention to the resulting loss of institutional credibility, noting that trust in U.S. policymaking has been diminished both domestically and internationally.

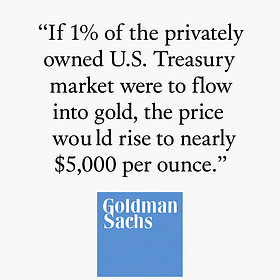

ETF Demand and Private Flows

Private investment has become a defining feature of this phase of the rally. September alone saw inflows exceeding 100 tons into exchange-traded gold funds, the largest accumulation in more than three years. ETF holdings remain below their 2020 highs, indicating continued room for growth.

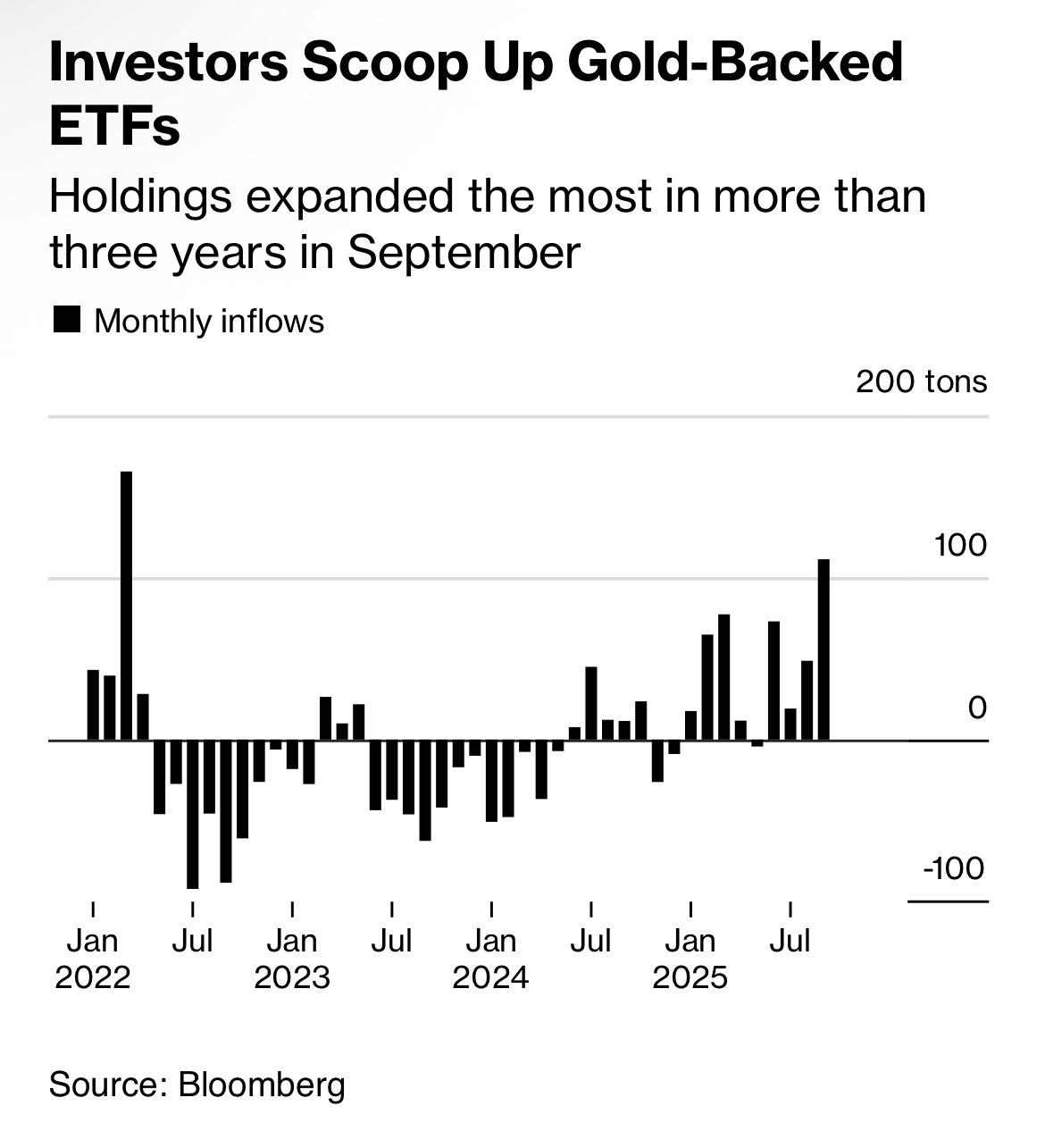

“Goldman Sachs Inc. has predicted the metal will soar to nearly $5,000 an ounce if just 1% of privately-held US Treasury holdings go into gold.”

From this perspective, the report frames ETF demand not as an isolated trading phenomenon but as a potential structural shift in asset allocation, reflecting distrust in both cash and government securities.

Central Bank Behavior and Strategic Realignment

The institutional layer of demand remains equally significant. Central banks continue to accumulate bullion, a trend that began after Russia’s invasion of Ukraine and has since broadened. The report attributes this pattern to the erosion of geopolitical trust and the rising appeal of politically neutral reserve assets.

Trump’s governance style is cited as an accelerant, having introduced volatility into U.S. policy continuity. The piece notes that this unpredictability has contributed to global diversification away from U.S. assets.

China’s Gold Endgame

Bloomberg’s reporting also highlights China’s strategic actions to capitalize on the rally. Beijing has been inviting foreign central banks to store portions of their gold in China, while developing trading and storage hubs in Hong Kong. This represents a gradual but deliberate attempt to elevate China’s role in global bullion settlement and custody.

*Exclusive: China’s Next Move is HQLA/REPO Status

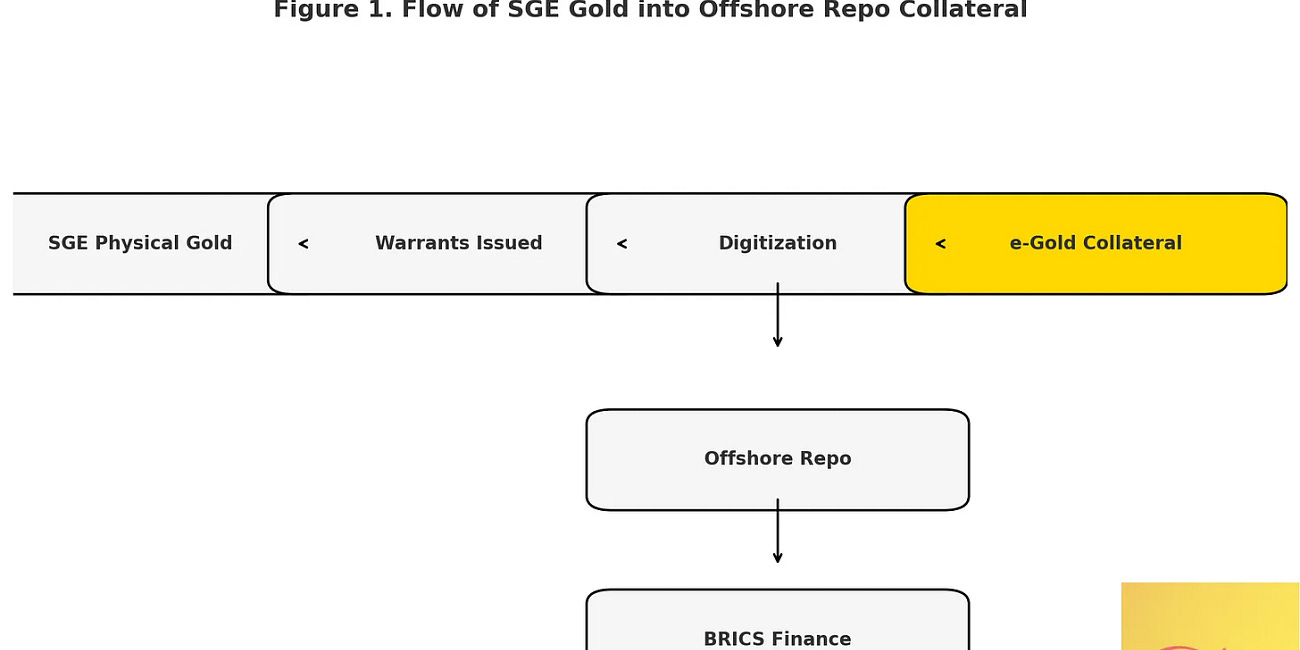

China is positioning itself for a monetary shift that could (will) redefine collateral markets. The country has accumulated thousands of tons of gold in recent years, and its vault1 and warrant systems are expanding.

The next step may be to move gold beyond the role of a passive reserve and into the realm of an active financing instrument. At the center of this idea is the possibility of designating gold as a High-Quality Liquid Asset (HQLA) for repo transactions.

In today’s financial system, U.S. Treasuries dominate repo collateral pools, accounting for roughly 50 to 65% percent of global usage. Collateral eligibility decisions carry systemic implications, determining which assets can serve as the foundation of short-term funding markets.

“Officials have been courting foreign central banks, encouraging them to store some of their gold reserves in China.”

These initiatives align with China’s broader objective of deepening yuan-linked gold infrastructure. By positioning Hong Kong as an international gateway, Beijing extends its influence in both monetary and physical gold systems.

China Enters Central Bank Gold Storage Business

GFN (Beijing) — China is aiming to become custodian of foreign sovereign gold reserves, a move that would enhance its standing in the bullion market and accelerate its push for a financial system less reliant on the dollar.

Market Winners and Capital Formation

The current rally is producing direct benefits for mining companies. The report notes that global miners have raised record proceeds through equity issuance this quarter, led by China. The standout case is Zijin Gold International’s $3.2 billion Hong Kong listing, which surged nearly 90% within three days of trading.

These developments signal the intersection of financial and industrial strength within the gold ecosystem, with Asian markets leading in capital formation and investor appetite.

“Those are returns that only gold investors can dream of.”

Bottom Line:

Bloomberg’s analysis situates gold’s ongoing rally as a function of three overlapping forces: (1) macroeconomic tailwinds of low rates and high inflation, (2) policy erosion within the United States undermining dollar credibility, and (3) a re-architecture of global gold ownership led by China and supported by central bank diversification.

The convergence of private capital, institutional reallocation, and geopolitical strategy now defines gold’s ascent beyond $4,000 per ounce.

Enjoy your Holiday

Tks Professor Vinny 😁