**Included at bottom. Rabo’s latest in PDF form**

Inflation Has Become A Bigger Risk For Stretched Gold Prices

Authored by Simon White, Bloomberg macro strategist,

Gold’s relationship with inflation is variable, but we are at the point in the cycle where the precious metal’s sensitivity to CPI is heightened.

Overbought gold is thus particularly exposed should today’s inflation data come in softer than expected.

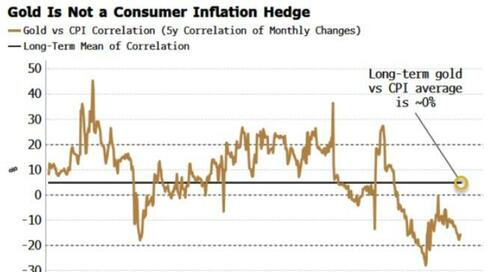

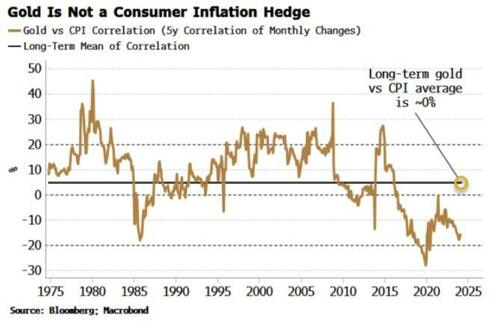

Gold is not a straightforward inflation hedge - the correlation between gold returns and consumer prices is very close to zero over the long term. Instead, the interplay between inflation and rates is a better prism through which to understand gold.

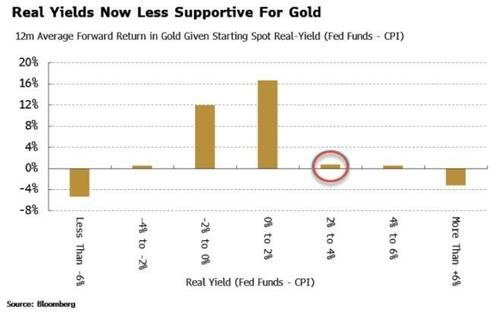

Real interest rates and gold are generally taken to move inversely to one another. This observation is known as Gibson’s Paradox (named a paradox by Keynes as it contravened standard economic theory), while Gibson’s Rule states that for every percentage point the real fed funds rate was below 2%, gold should rally 8% over the next year.

It sounds a great rule of thumb. Unfortunately the data does not bear it out. If we look over the past 50 years of the real fed funds rate (deflated using CPI) and the subsequent one-year return of gold (in dollar terms), the relationship is not linear. What we find is something more parabolic, with a sweet spot for gold returns when real rates are between -2% and +2%.

Over the past 18 months or so, real rates have been in and around this sweet spot, and over the last six months gold is up almost 30%.

Now, however, real fed funds is 2.3%, i.e where the red circle is in the chart above. We are moving away from the sweet spot. Gold is now therefore more sensitive to inflation, as a drop in it would take real yields further to the right in the chart, and imply poorer forward returns.

Inflation continues to be biased higher, but there’s little to stop one weaker-than-expected print at today’s data, which would be liable to trigger a selloff given how overbought gold currently is.

Nonetheless, real yields are unlikely to deviate too far from their sweet spot in the medium term, meaning any dips in gold are unlikely to last too long.