Good morning: The following is a re-edit of this morning’s post with additional material and graphics. It should also read better.

Also: 2025 is coming and that means tons of New Year’s predictions. We will send all of these, and alert you to those covering all our interests here. Goldman’s is first and attached at bottom…. it is in slide deck format.

Fort Knox: Nothing But Moths and Half-Eaten IOUs

Contents: (1050 words)

A Bold Claim from the Comex Trading Floor

Vanishing Gold Reserves

IOU Expansion Under Clinton and Greenspan

Mutual Benefits and Suppressed Gold Prices

Demand for Monetary Gold Dies

Erosion of Trust and Limited Supply

Russian Confiscation and Its Aftermath

Nations Demand Their Gold Back

The Scramble When Nations Call

China: Gold’s Slow and Steady Rise is No Accident

A Bold Claim from the Comex Trading Floor

Years ago, a floor broker with deep ties to major bullion banks made a startling statement: Fort Knox holds "nothing but moths and half-eaten IOUs." We all laughed back then. But as time passed, I realized he was right.

Recently, something Egon von Greyerz said brought that old memory rushing back:

"In reality, a central bank only holds an IOU issued by a bullion bank. If the central bank attempts to reclaim its gold, it will never get it back, as the gold has likely been sold to buyers in China or India, who have purchased it outright with no obligation to return it."

The Vanishing Gold Reserves

It's true. The Fed, the Treasury, and most central banks, when it comes to Fort Knox gold, only hold IOUs issued by bullion banks that have already sold the borrowed metal. Over the years, that gold has found its way into more patient hands. There's simply not as much investable gold available as there was decades ago, even with new production.

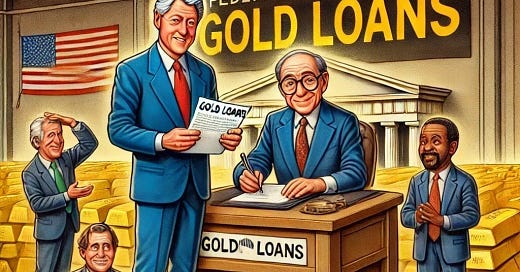

IOU Expansion Under Clinton and Greenspan

This IOU process ramped up during the Clinton era, with Greenspan encouraging bullion banks to borrow gold for carry trades. Goldman Sachs and Citigroup led the charge back then. But why did this happen?