Housekeeping: Good Afternoon

Jordan Roy-Byrne of the Daily Gold just published a structured case for why gold and silver are set for a sustained bull market. His argument is built on historical cycles, macroeconomic shifts, and technical analysis. He then connects these trends to declining real yields, currency devaluation, and a changing global monetary system. That book is titled: Gold & Silver: The Greatest Bull Market Has Begun (free with email)

The book positions gold as a beneficiary of structural shifts in debt markets and central bank policies. He argues that a secular bond bear market will force capital into alternative stores of value, with gold at the top of the list. He also explores the geopolitical angle—dedollarization and foreign central bank gold accumulation—as a key force underpinning the metals' rise.

Download the book here

I was asked to contribute the Chapter on De-Dollarization as a contributor to the bull market he describes and happily did so gratis, as is this post

For those tracking the next major move in precious metals, Jordan provides a clear roadmap. Despite the bold title, he avoids hyperbole in his analysis, sticks to data, and presents a view that, while bullish, is rooted in historical precedent rather than speculation.

In the end here, Jordan effectively challenges conventional asset allocation and forces the reader to reconsider gold and silver’s role in a portfolio.

Personal note: am currently in the middle of reading the final version now after having discussed large chunks of his ideas for the last 18 months during our monthly conversations.

Gold and Silver by Jordan Roy-Byrne; Download the book here (email required)

Book Description

185 pages

Over 90 charts

Research and analysis on the history of capital markets and how it applies to today.

Historical fundamental drivers of Gold & Silver and specific drivers today and next decade

History and fundamental background of gold mining stocks and junior mining stocks.

Includes Outlook/Predictions for next 10-15 years.

Book Introduction

My expectations and framework for the future changed after the first edition of this book in 2015 but have crystalized over the past few years.

Initially, some ten years ago, I argued that the stock market was in a cyclical bull market within a secular bear that could not end until Gold made a final run, similar to 1976 to 1980. While I was correct that the precious metals sector was at a major low, my larger framework was wrong.

In writing the second edition of this book in 2019, I correctly argued that the stock market was in a secular bull market and the best historical comparison for precious metals was the early 1960s.

As 2025 beckons, the reality is clear. Gold's breakout out of its 13-year cup-and-handle pattern, coupled with the new secular bear market in Bonds, undoubtedly signals the beginning of a new secular bull market in precious metals and hard assets. However, it will only be confirmed and begin in earnest once the secular bull market in stocks and conventional assets ends.

The continued secular bull markets in US stocks and the US Dollar (which are aligned) are the root answer to many questions concerning precious metals. This is why gold mining stocks are extremely under-owned and trade at historically low valuations despite a record Gold price, strong operating results and improved financial health. It's partially why the leveraged plays on Gold (gold stocks, Silver, junior resource companies, and exploration companies) have underperformed despite a spectacular breakout in Gold and a 70% gain over the past 24 months.

We can use two key indicators to track when Gold and the entire precious metals sector are ripe for a huge move. First, I analyze Gold against the total return of a 60/40 investment portfolio. The conventional investment portfolio places 60% of capital in stocks and 40% in bonds. This ratio confirmed new secular bull markets in Gold and precious metals at the end of 1971 and 2001 but has yet to do so since our publishing. The second indicator is the stock market falling below its 40-month moving average, which occurred roughly one year after secular peaks in 1930, 1968, and 2000.

Beyond the secular turning point, which could occur within a few years, we explore everything we think is most important to you as an investor, be it a generalist or precious metals investor. We explore the history of markets and market cycles to assess what will come in the next 15 years.

Concerning precious metals, we provide a background on Gold, Silver, and the mining companies. We discuss the root fundamental drivers and historical tendencies and provide a lengthy discussion on the fundamental drivers over the next 15 years. We detail how current valuations set the stage for a new secular bull market to come. Finally, we cover the gold mining and junior resource sectors, which have amazing potential that will begin to come to fruition once the secular turn is in place.

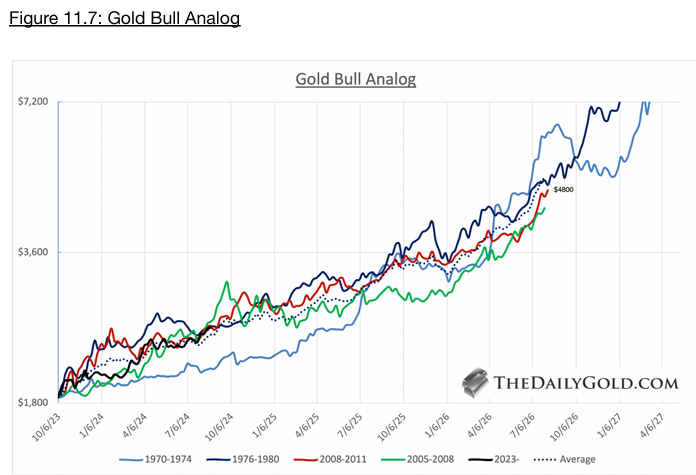

Cyclical Targets

The two advances in the 1970s reached roughly $14,000 and $9,000 in 2027. Those targets are excessive, as one was the final blowoff move, and the other began at an artificially low price. Nevertheless, a target of $7,000 to $8,000 in 2027 to 2028 is not unreasonable. Keep in mind that the four best cyclical advances were followed by a 45% decline (1975-1976), two secular bear markets, and a 30% decline (2008). The more spectacular the move to the upside, the more likely a cyclical bear market will follow, entailing a 30% to 40% correction.

The analysis of the long-term technical outlook for Silver is simpler than Gold at this juncture, as Silver has yet to break past its massive base at $50. Upon a break past $50, Silver has a measured move of $96. In other words, a clean break above $50 should lead to $100.

Secular Targets

A secular peak in Gold and Silver (and any market) has two parts: price and time. Regarding price, the first three charts in this chapter support targets of $20,000 for Gold and $1,000 for Silver. Targets of $30,000 for Gold and even $1500 for Silver are not unreasonable.Remember that prices would spend little time in the upper half to the upper third of those targets.

Concerning timing, the secular peak could come from the mid-2030s to the decade's end. Considering the timing of the secular peak in the stock market and Gold breaking out against the 60/40 Portfolio, the peak could be closer to the middle of the next decade unless these events do not occur before 2027.

Secular peaks in inflation and commodity prices have occurred roughly every 30 years, with historic inflationary and interest rate peaks occurring every 60 years. Both support a secular peak around 2040.

Sent the link to the family mailing list. Asked them to skim the book and decide for themselves. Hopefully some of them are starting to listen a little bit.