Breaking: Silver Nears 2011 Highs as Physical Market Fractures

"It's a Race to Secure the Future"- Scottsdale Mint CEO

Silver Nears 2011 Highs as Physical Market Fractures

Silver Nears 2011 Highs as Physical Market Fractures

US Premiums and LBMA Illusion of Liquidity

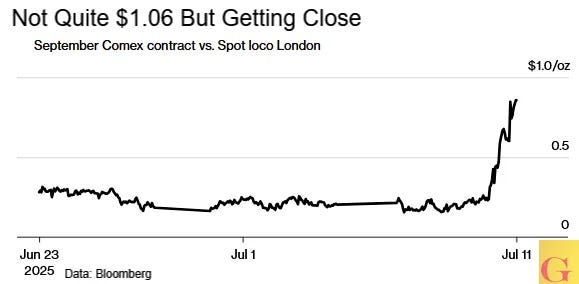

Silver prices broke out to their highest level in over a decade, reflecting rising tension in global bullion markets. Spot silver jumped as much as 4% to $38.47 an ounce, while US futures contracts for September delivery traded at $39.12. The resulting spread between London spot and New York futures is unusually wide, suggesting a breakdown in normal arbitrage flows.

Under typical conditions, such divergences are closed quickly. The fact that they persist points to a fundamental dislocation—one where demand is pulling metal out of available supply channels faster than it can be replaced.

Goldman: Silver Buying Surge Not Overdone

Yesterday, Goldman’s Trading desk noted large Silver ETF flows and offered their impressions of this latest leg higher in the Silver Rally.

Before we get into the returning tariff situation as the direct contributor to price, it is very important to back up a little bit to what is driving Trump’s tariff behavior, global protectionist measures, and ultimately to the US future economy. Silver’s price is only a symptom; a symptom of inept risk management and abusive bank behavior for decades, but a symptom nonetheless.

Lets take a look at the catalyst for the cascading prices higher in all metals, while staying focused on Silver.

Cold War 2.0 is a Mineral War

When Mercantilism manifests, It’s a matter of national security. In this clip, Josh Phair of Scottsdale Mint explains how important this is becoming.

Josh’s full video can be viewed here rehosted by GoldFix , or in its original format where you can also follow Josh on Social Media.

The Ghost of Tariffs Returns

A similar divergence emerged earlier this year when the White House floated the possibility of tariffs on silver imports. That prospect sent US futures higher and prompted traders to move physical bullion into Comex-eligible warehouses in New York. Lease rates spiked as metal was tied up in transit.

In January during the US Gold Repatriation event and the Tariff fears, the spread between US Silver prices and London Silver prices reached $1.06 while Gold reached $50 differential (chart below), an unheard of and completely irrational event if the metal London says it holds was actually available.

This indicated the volume metal in London available for sale and delivery was much lower than stated by the LBMA; this despite laughingly insincere protests that it was only logistics ( “It’s heavy”) delaying deliveries by LBMA executives This week makes it clear that particular problem was never rectified

That rush ended once Washington clarified that silver would be exempt from trade levies. But the damage had been done. Arbitrage flows had already depleted London’s float, and the knock-on effects are now surfacing.

Lease Rates Confirm Market Tightness

One-month implied lease rates for silver in London reached an annualized 4.5% on Friday. That is well above the near-zero baseline and a clear signal that silver is scarce in the lending market.

Most silver stored in London sits inside ETFs and is not readily available for borrowing. Bloomberg data show that silver-backed ETF holdings rose by 1.1 million ounces on Thursday alone. Those inflows tighten the float further.

Daniel Ghali of TD Securities points to the earlier arbitrage trade as a key factor. “Our estimates of LBMA silver’s free-float now stand at its lowest levels in recorded history,” he wrote in a note to clients. Ghali warned that the market remains vulnerable to a physical squeeze. “Silver’s illusion of liquidity tells us that silver markets will only rebalance through some form of a squeeze on physical.”

Structural Demand Meets Supply Deficit

Silver is now up 33% year-to-date, outperforming gold. The rally reflects silver’s hybrid nature as both a financial hedge and an industrial input. That industrial demand—especially for solar panels—is growing. The Silver Institute projects a fifth consecutive year of global supply deficit.

The metal’s role in clean-energy production makes any shortfall in physical inventories more consequential. With spot inventory tightening and borrowing costs rising, silver is again behaving more like a commodity in scarcity than a liquid financial instrument.

I think the PAL/PLAT outperformance is because EV mandates and tax credits are going away making ICE’s back in play and also possibility of Russian sanctions which supplies most PAL. Huge stockpiles from covid are now stabilized so these metals could go more and totally stop listen to GS or the banks that ONLY want to steal YOUR potential profits after you did all your research.

Hi Vince,

Re your digital gold a soon wall st securitization thing:

I like the theory.

1. How do we participate in the process (besides owning gold)?

2. What empirical evidence will you want to see to increase your conviction?

Thanks