Bottom Line: The Yen Correlation is Back

There is little to no overt Gold commentary in this week’s BOA CTA analysis. There are updated charts and CTA signals included here. What there is however is plenty of Yen commentary; And this is significant if not outright predictive for Gold

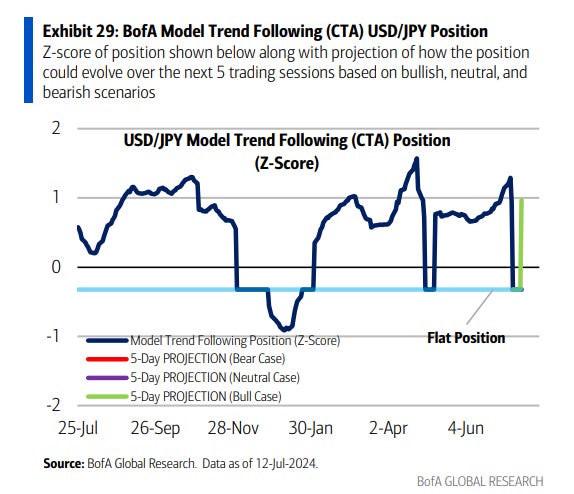

In the moments after Thursday’s US CPI print was released, USDJPY declined more than 2% on suspected FX intervention from Japan’s Ministry of Finance. Heading into this move, our model had CTAs quite stretched in their USDJPY long

If last week’s behavior was any indication, then the directional trends that began as CPI dropped: namely increased perception of a fed rate-cut with commensurate Dollar weakness and softening tech stocks— then the yen will continue to strengthen and Gold along with it.

There are Zero CTA Yen longs, only shorts who will cover in a rally…