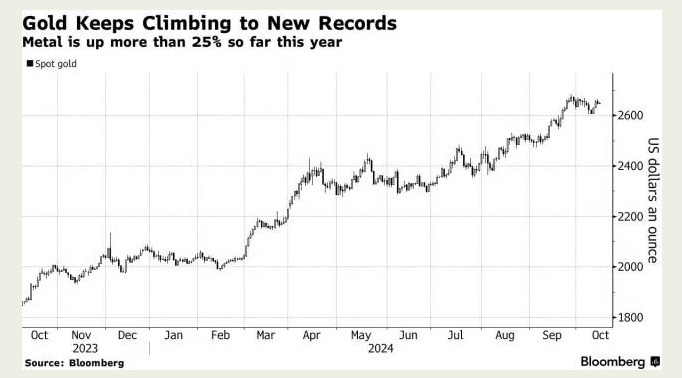

Bloomberg reported yesterday (link) from the LBMA’s Miami conference. Here is a breakdown of what they saw.

Gold purchases by central banks have been a major force behind this year’s record-breaking rally in bullion. Normally, officials don’t give much warning before making moves to increase their holdings.