Use transcript and keyword search for each topic

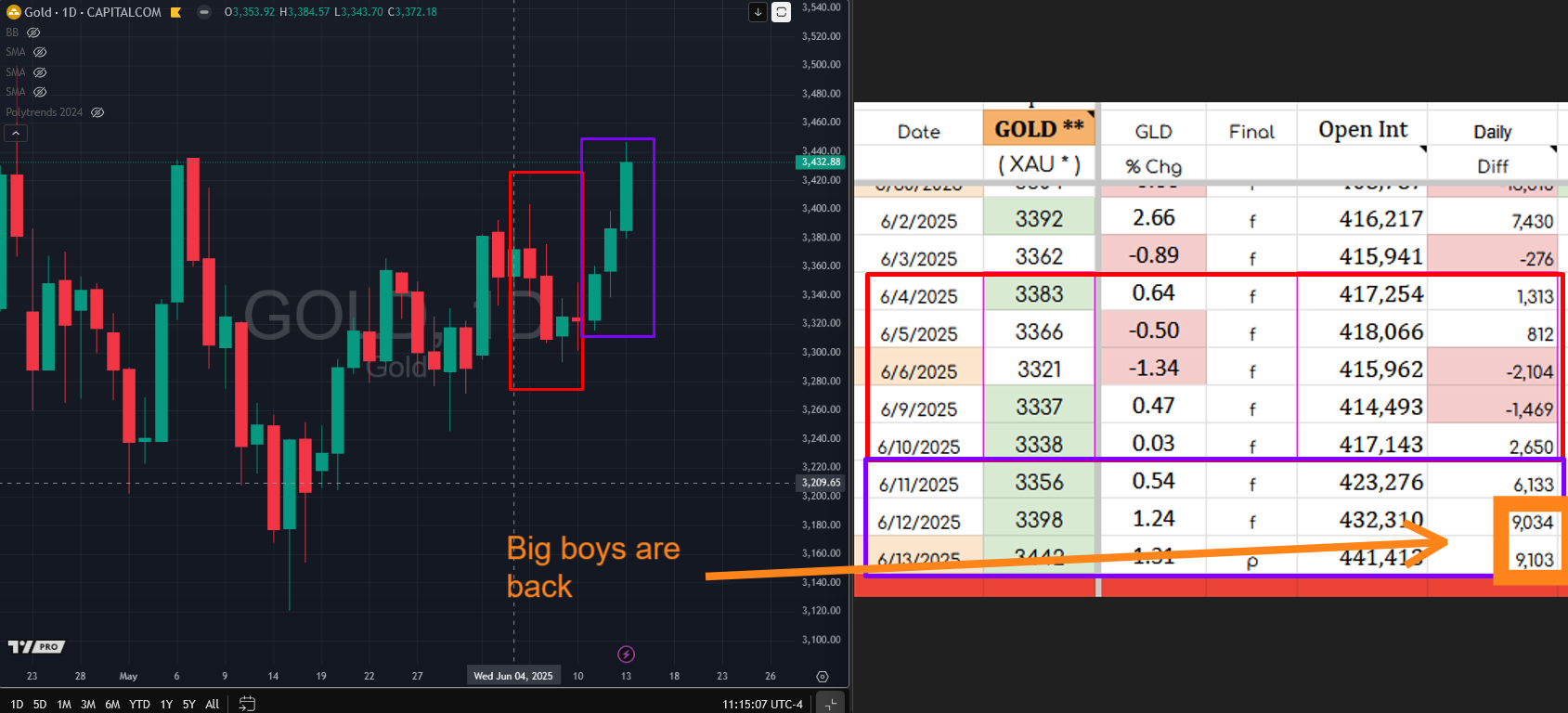

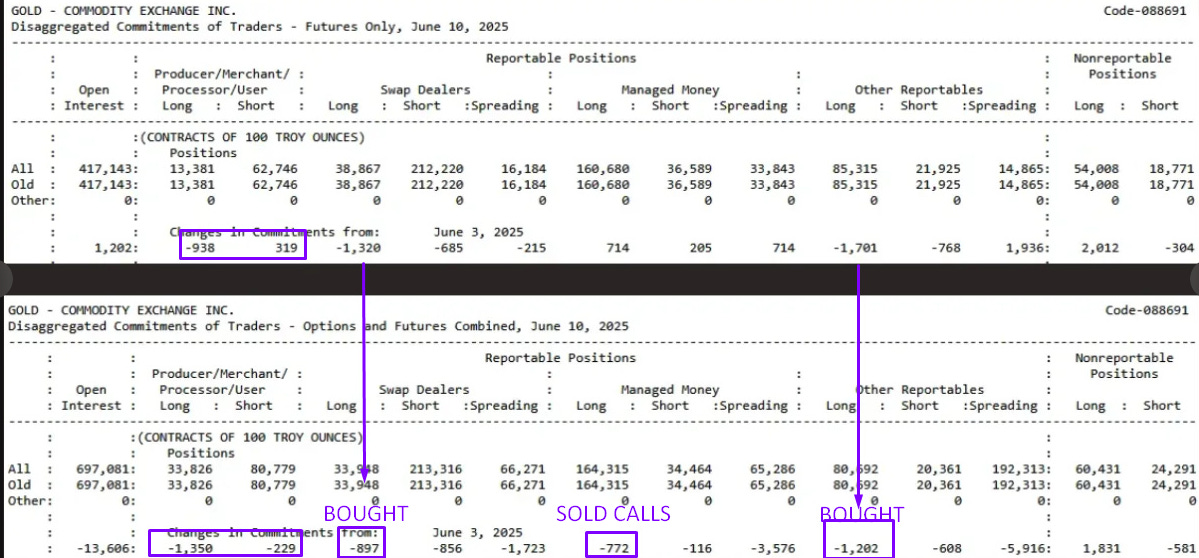

1. Open Interest and Commitment of Traders (COT) Analysis

Initial discussion of silver and gold futures activity

Focus on open interest changes and trader sentiment

Setup of market context using COMEX data

2. Bollinger Bands and Technical Trading Strategies

Silver trade example

Introduction to using Bollinger Bands as signal filters

Expansion into breakout criteria and risk management via options

3. Options Behavior and Derivative Insights in Metals

Exploration of call buying by long swap dealers

Analysis of options flow vs futures positioning

Discussion on dealer hedging behavior and embedded signals

4. Macro Discretionary Traders and Market Psychology

Identification of 10,000+ OI spikes as macro entries

Contrast between macro behavior and CTA trend followers

Commentary on who’s driving direction in current markets

5. WTI vs. Brent Oil Structural Shifts and Global Demand Centers

Eastward shift in oil market pricing centers

Complexity of oil contracts (ICE vs CME)

Brief reflections on demand shifts post-North Sea

6. The Role of China in Physical Gold and Silver Demand

China's buying patterns (Shanghai hours vs fix buying)

Central bank influence and changes in behavior

Structural discussion around OTC vs COMEX dynamics

7. Middle East Geopolitics and Implications for Oil and Gold

Extended dialogue on Israeli-Iran conflict

Implications for oil supply and safe-haven flows

Interplay between diplomacy, military signaling, and commodities

8. Caucasus Region’s Strategic Importance in Global Energy and Trade

Historical and geopolitical value of the region

Reference to Brzezinski's The Grand Chessboard

Strategic pipelines, Caspian control, and Silk Road context

9. Volatility Cycles and Liquidity Behavior in Commodities

Volume-per-price movement ratio framework

Use of “fishhook” price-action models

Trading sheet concept: reading buying strength through OI behavior

10. Fish hook origin: Educational Commentary on Historical Market Behavior and Trader Psychology

Anecdotes from options trading floor-

Real-time behavioral examples from banks and funds

Application of theory to trade execution and risk management

Gold:

Silver:

short dealers are NOT happy here

fear vs greed now