Housekeeping: No video discussion… Swamped with the UBS report. Find the GS most recent CTA report (covered last week) as well. Cheers

TL;DR

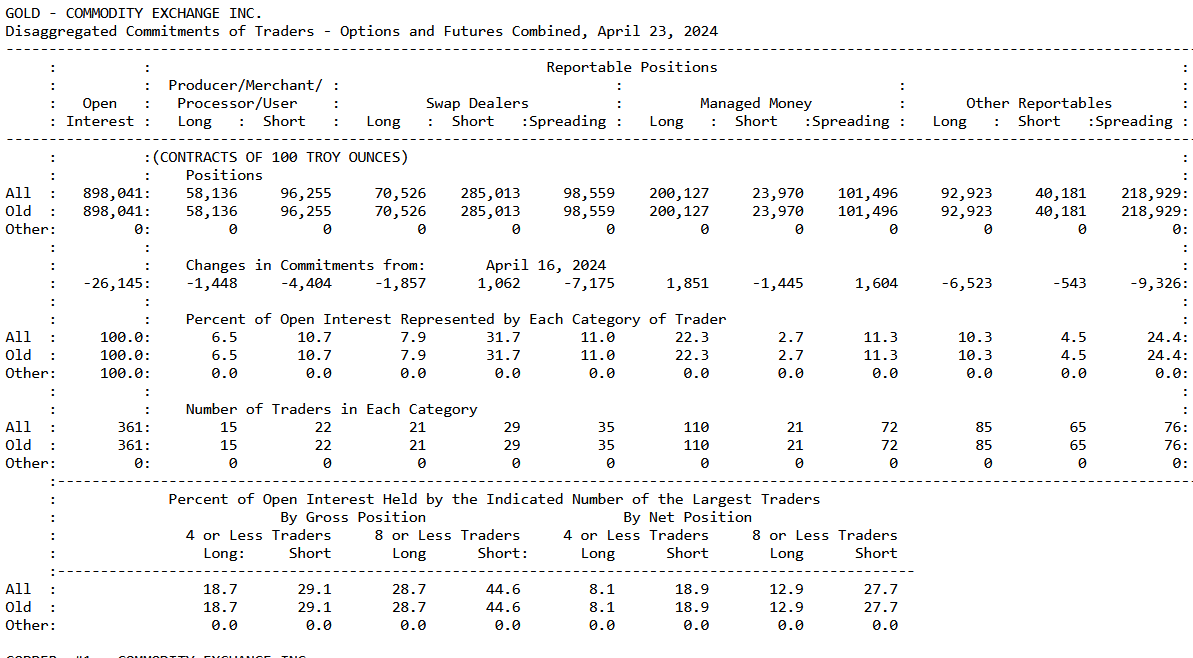

Funds definitely sold calls to Banks

more margin hikes may be coming

somebody got hurt.. just like Dec 3rd.. maybe a bank

BiS bailed someone out then just like now.

Producers bought puts smart funds sold calls, regular funds sold calls

BEING LONG IS OK.. BUYING DIPS Below that wick IS NOT in my biased opinion.

Staying away from bullion except for really short dated option punting or meaty call spread selling against long miner position in rallies

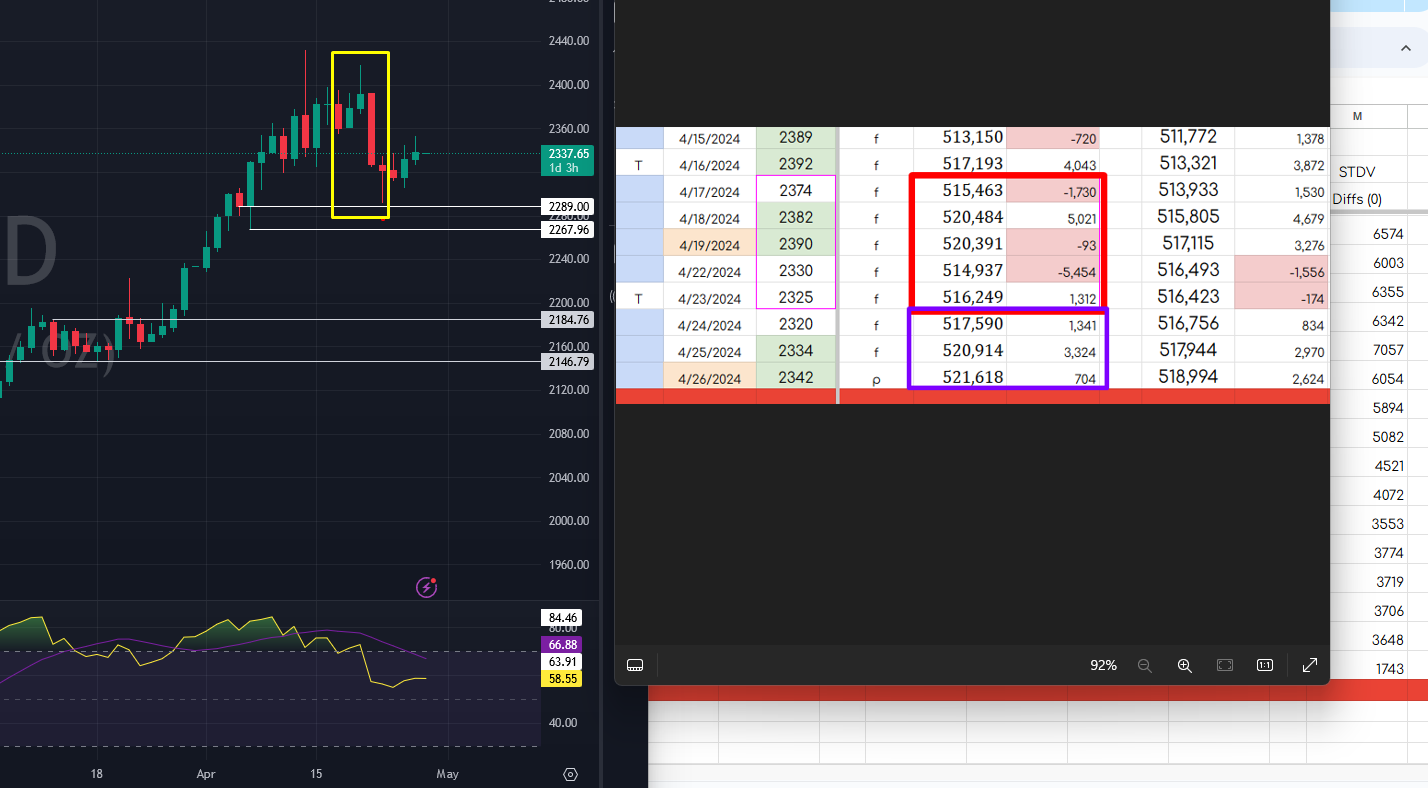

Today’s analysis visually looks like: