Housekeeping: This weekend we expect Brynne Kelly to join us in the Founders Class to discuss oil and Natural Gas. It will be great.

Good morning:

Markets are taking a drubbing. Much of our day so far has been focused on the geopolitical changes on our radar. Thoughts on that are beneath the fold.

As for markets, here are a couple morning quick comments we already made:

On the markets being lower this morning:

options expiry in stocks today..... how we open is not necessarily how we close

On the Peloton disaster yesterday:

Imagine having a business that grew aggressively because of a pandemic only to be destroyed because their prospects for new customers for the next two years are zero. They mined all the gold that was to be mined

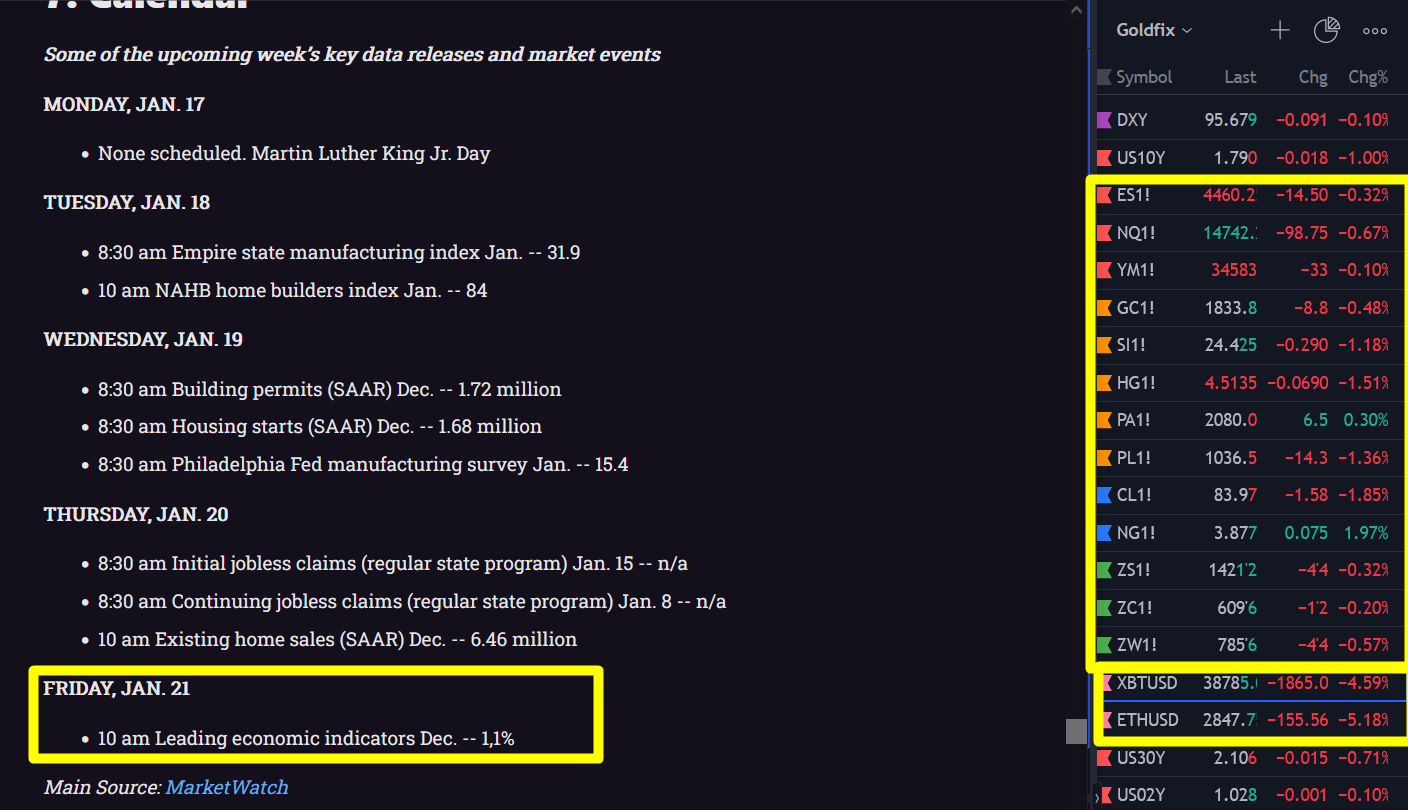

Today’s Data

Zen Moment:

Global Dominance is Changing Hands

Something on our mind at GoldFix has been how does China make their play if/when they do to take more economic dominance over the West? The parallels of how the USA overcame the USSR is something worth noting.

Although the outspending on guns is what took them out, it was something else which was of interest here. We did it passively; at least in the public eye. All we had to do was push on a wet wall and it came down. The USSR did it to themselves.

Point is: this is where China is heading. If they “win” its because we collapse upon our irresponsibility for the last 15 years or so. But what could be a catalyst for our actual demise?

Then this tweet from Zerohedge came across our feed, it rang an alarm. They said:

China has launched a new round of increasingly aggressive easing to avoid property collapse/GDP contraction. Fed will soon tighten. The two can't diverge for long or there will be major crisis... so how do they converge. If you said Fed will follow China, you are right- Source

The point that we are fighting inflation while they are fighting recession is what alarmed us here.

Whether you agree with the opinion that our Fed will capitulate and start reprinting is entirely up to you. We do think it is highly likely

and may be the lesser evil. Especially if it is done in combination with some draconian trade rules and fiscal changes. Less globalism will be the result

Either way, things are shaping up as a closing of the global network in what is fast becoming a mercantilist system.

Mercantilism Returns

Mercantilism is an economic practice by which governments used their economies to augment state power at the expense of other countries. Governments sought to ensure that exports exceeded imports and to accumulate wealth in the form of hard currency that can be used for international trade in a low trust environment. Like Gold, Silver, or possibly Bitcoin now.

Mercantilism Break Out:

Mercantilism was and is an economic policy that is designed to maximize the exports and minimize the imports for an economy.

It promotes imperialism, colonialism, tariffs and subsidies on traded goods to achieve that goal. The policy aims to reduce a possible current account deficit or reach a current account surplus, and it includes measures aimed at accumulating monetary reserves by a positive balance of trade, especially of finished goods. Historically, such policies frequently led to war and motivated colonial expansion.[1] Mercantilist theory varies in sophistication from one writer to another and has evolved over time. Source

What Happens Down the Road?

Mercantilism was undone by Globalism. Global capitalism realized that if you are trading with someone, you aren’t at war with them. The bad part of Globalism is your population bears the economic pain of that policy when they screw up.