They (the Fed) have no control over goods prices …But they also know that they have a lot of control over services inflation – which, unlike goods inflation, is mainly a function of domestic nominal factors.

April 2022, Zoltan Pozsar

One year after the above statement, Goods inflation is lower but re-accelerating, while services inflation is still borderline raging. The Fed got lucky

Today:

Market Rundown

CPI Prep: moderating still

Zen Moment: Vampire Rabbit

1- Market Rundown

Good Morning. The DX is down 8 ticks. Bonds are slightly weaker. Stocks are mixed and net unchanged. Gold is up $6.00. Silver is up 10c. Crude oil is down a nickel. Nat Gas is up 2c. Crypto is down about 1% net. Grains are mixed with only Soy being up so far.

CPI Today

2- CPI Prep

Consensus: Cooling off

Headline: Dropping to 5.1% Y/Y from 6.0% in March, (0.2% M/M from 0.4%)

Core: Rising to 5.6% from 5.5% in March, (0.4% M/M from 0.5%)

Goldman

(GS, JPM, MS full analysis at bottom)

We expect a 0.37% increase in March core CPI (vs. 0.4% consensus), corresponding to a year-over-year rate of 5.60% (vs. 5.6% consensus). We expect a 0.13% increase in March headline CPI (vs. 0.2% consensus), which would lower the year-over-year rate to 5.12% (vs. 5.1% consensus)

What Goldman thinks is key this month: Cars, Planes, and Rent

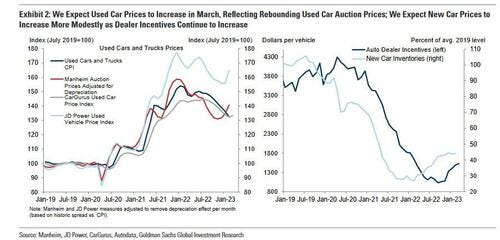

Autos: Used cars will be a focus rebounding to up 0.5% and New cars will be up only 0.2% due to dealer incentive increases. While microchip supply constraints and supply disruptions from China’s Covid wave are likely to fade going forward, expiring leases keep upward pressure somewhat.