Housekeeping: Good Morning. CPI today and while it is extremely important for market participants, the variance between all the banks predicting is very tight. That means the surprise, if there is one, can roil the markets.

Plus, noone has a handle on what Powell will do of late, with some continuing to think a Pivot is coming, while more and growing are thinking it won’t happen any time soon.

Market Rundown:

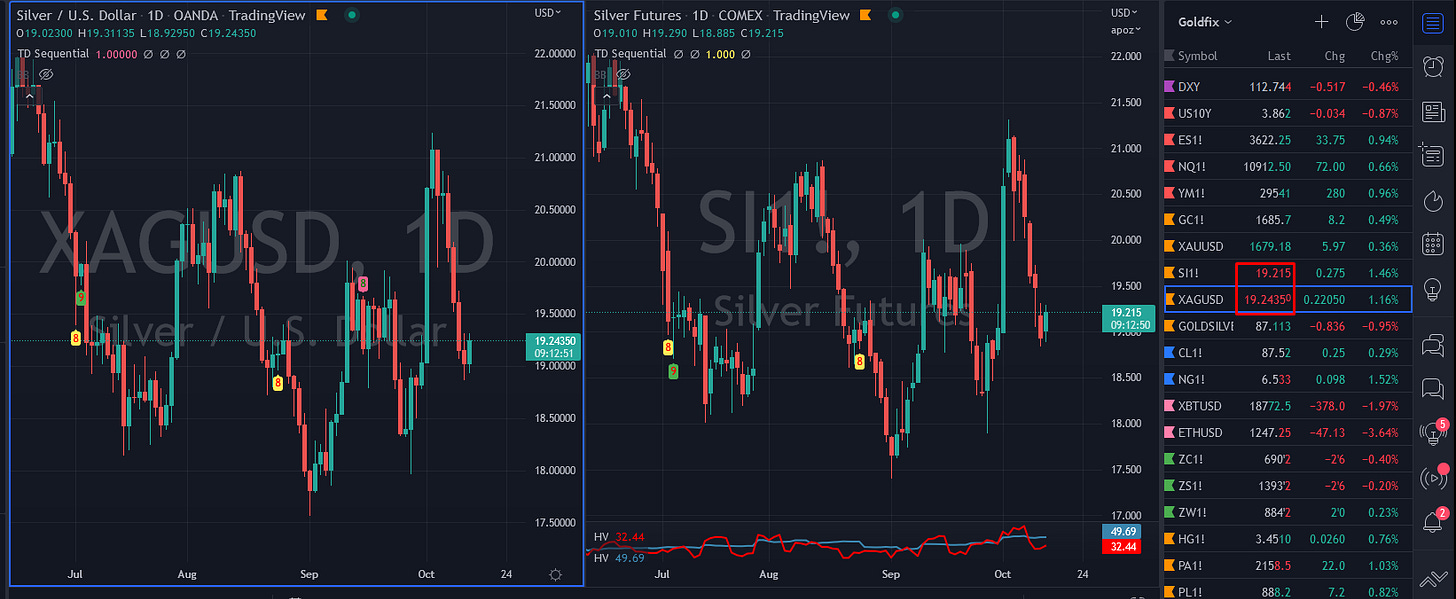

The dollar is down 61bps. Bonds are slightly firmer. Stocks are all stronger between 75 and 110 bps. Gold is up $10. Silver is up 32 cents. Oil is up 44 cents. Nat Gas is 12 cents higher. Crypto is down bucking the pre CPI position squaring.

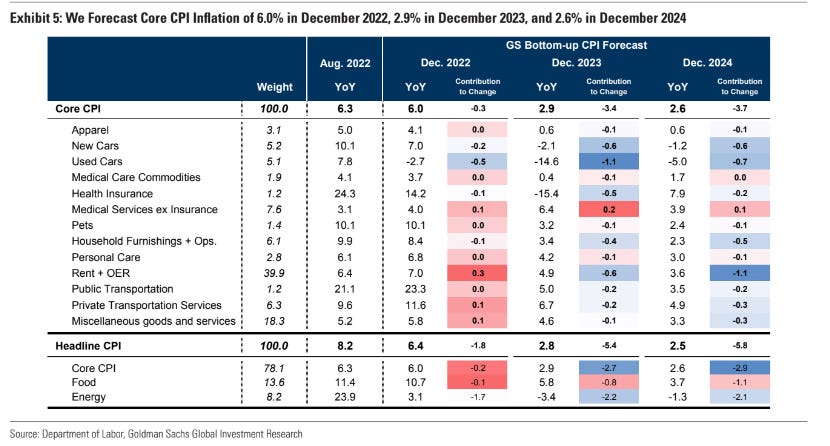

Goldman’s CPI Preview

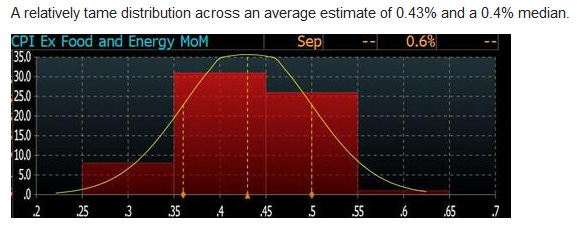

We expect a 0.41% increase in the core CPI in September, corresponding to a 0.2pp increase in the year-over-year rate to 6.50%, and expect a 0.26% increasei n headline CPI, corresponding to a 0.2pp decline in the year-over-year rate to 8.10%

JPM’s Morning Briefings for Oct 12 and 13

This week’s CPI will be the most important catalyst into the November 2 Fed meeting; 75bps feels like a foregone conclusion but the following 2 meetings lack a consensus. Mike Feroli’s CPI estimate for Headline YoY is 8.1% (0.3% MoM) and for Core YoY is 6.5% (0.45% MoM)

CONTINUES AT BOTTOMZero Hedge’s Pre CPI Post Notes JPM’s likely market behavior:

CPI prints above 8.3% -> this will be another -5% day. The Sep 13 CPI print, when the whisper number was a miss but got a beat instead (8.3% vs. 8.1% consensus; 8.5% prior) triggered a 4.3% decline in the SPX as Credit outperformed.

CPI prints 8.1% - 8.3% -> also a negative outcome, with SPX -1.5% - 2%, potentially characterized by a buyers strike. The bigger concern here, according to JPM, is the bond market repricing to increase the probability of a 75bps hike in December.

CPI prints 7.9% - 8.0% -> this is likely enough to stage a rally, perhaps +75bps – 100bps. Currently, Bloomberg's mash up of economic forecasts show 2022 Q4 averaging 7.2%, meaning that if we see an 8.0% print this week, then the next two prints need to average 6.9%.

CPI prints below 7.9% -> should this come to fruition, JPM thinks a +2-3% day is most likely, though if we see CPI gap down more than 60bps (largest is the move from 9.1% to 8.5%) the move could be larger; then calls for a Fed pause/pivot may become deafening.

That’s JPM’s trader take, as opposed to a retail marketing piece

Moor Analytics Technical Levels at bottom as well