Energy Exclusive: The US Has Declared War on Brics Oil- Brynne Kelly

One Year Later and Nothing Will Ever Be the Same in Oil Again. The US is Building a Wall Between the EU and non-western oil. The West seeks to economically isolate BRICS nations

Background: Global Changes Hit Oil

Last year showed the importance of Geopolitics as molder of economic relationships. Upsetting the geopolitical balance, as done by four major events this past couple years, the trickle-down effect slowly but very predictably must work its way through the system. [EDIT- is it did in the 1970s inflation before. So it is happening again]Those four recent events in chronological order were: The Pandemic (revealing fragile supply-chains), the Ukraine/Russian war (started deglobalization), Western sanctions ( hastened the ROW’s desire to exit USD), and Zoltan’s ensuing commodity collateral crisis (a by product of rising mercantilist-protectionist policies).

Very recently an observation Zoltan had at the structural level was now hitting up in BOA’s astute strategist Michael Hartnett's macro analysis.

That note entitled Weekly Part 1: Echoing Pozsar, Hartnett says "War is Inflationary" started with the following:

The concepts Zoltan Pozsar wrote that GoldFix shared over the last year are now filtering from the Big Structural Picture (Zoltan’s domain) to the Macro level (Hartnett’s expertise)

In short: What was theoretical, is manifesting in the real world now and headed to a gas pump near you

This Sunday, Brynne Kelly did her weekly newsletter on Oil and shared it with us. While the events discussed had no immediately discernable impact on oil prices; a definite pattern presented itself along the lines of big picture-stuff filtering down to economic policy. Enjoy: Brynne and Vince

Oil: One Year Later and Nothing Will Ever Be the Same

By Brynne Kelly and VBL

The week did not have any particular event fireworks compared to the last 8 months or even the last 8 weeks. But there were some very real, very important changes worth noting last week. These will effect the way we do business going forward and may affect price (or spreads) overnight as these things can do sometimes.

Suez Canal Surcharge Increases- makes Dubai less competitive

WTI Invades Brent- makes US a bigger supplier

EIA Bearish Report Questioned- makes global prices drop

Futures Structure - shows global inflation is baking in

We are definitely seeing the longer term effects of the world-split and anniversary of the Ukraine/Russian war manifest in practices, policies, and inflation-risk on a more permanent basis. Here are a few of them…

1- Suez Canal Surcharges to Increase

On Tuesday, February 14 Egypt's Suez Canal Authority (SCA) said it will increase transit surcharge fees for crude oil and petroleum product tankers. The new 25% transit fee surcharge will apply to product tankers transiting the canal both ways starting April 1, 2023.

The “Temporary” Old Hikes

According to the circulars, the surcharges are for both laden crude oil and petroleum product tankers. They include increases from 15% currently to 25% of normal transit fees, while empty (ballast) tanker surcharges will increase to 15% from the present 5%.

These are increases to already existing surcharges themselves in place for less than a year started May 1, 2022. The fresh hike increases were explained by the SCA as due to: "[S]ignificant growth in global trade, the improvement of ships’ economics, the Suez Canal waterway development, and the enhancement of the transit service.”

For perspective, here are the reasons for the prior increases set in May 2022

[T]he increase in surcharge has been made because of the significant growth in global trade, the improvement in the ships' economics, and the enhancement of the transit service the agency provides. These surcharges are temporary and may be amended or wholly rescinded if the maritime market conditions warrant it.

The new reasons are almost exactly the same as the old reasons with one important exception. This time we didn't see them say it was temporary.

In response to the 2022 rate increases, an analyst told CNBC that while the rise in Suez dues wouldn't have a “massive impact” on trade flows, it will fuel ongoing inflation.

“Oil prices are currently dropping and so if the canal prices itself out against the competition (which is going round Africa) then the Canal Authority would lose out,” said the chairman of Mandarin Shipping, Tim Huxley.

Therein lies the rub. Last year's increases were meant to be temporary and keenly kept an eye on in order to avoid opening the door for the longer trip around the 'Horn' of Africa as a cheaper, competitive alternative.

The Permanent New Hikes

Yet, Instead of these 'temporary' increases being short-lived, they will now be increased again in April 2023. Clearly the last hike didn't have a 'massive impact' on trade flows - the door was NOT opened significantly for the alternative route. Increased fuel and insurance costs had kept the longer Horn route less competitive.

The SCA seems to now be exploring their convenience advantage more aggressively. They believe rates can increase again without undermining their competitive advantage over the longer route. This is possibly based on increased shipping costs making Horn costs increase. At the simplest level, it increases the cost of Dubai and other Middle Eastern oil delivered to Europe.

Suez Importance

The canal is the shortest route connecting Europe and Asia, and nearly 12% of global trade by volume transits through it daily. According to the Suez Canal Authority, almost 19,000 ships sailed through the canal in 2020, or 51 ships per day on average. About 5% of world's crude oil, 10% of oil products and 8% of LNG seaborne flows transit the canal.

Crude Benchmarks in Relation to the Suez Canal...

Saudi Arabia, being critically located near the Suez Canal, can take advantage of European vs Asian pricing dynamics and arbitrage opportunities. They monitor the Brent/Dubai oil spread and make price decisions accordingly through changes to their monthly Official Selling Prices (OSP's) to different regions based on these dynamics.

The EverGreen Addendum

In March 2021, the Evergreen container ship named Ever-Given famously got stuck between the two banks of the canal, obstructing the Suez entirely. This caused an immediate rise in the price of Brent crude oil- from $63.90 per barrel to $67.00. We wrote about this back in March 2021.

Imagine if something like this were to happen again throttling Middle East oil. This risk will be played up we bet in the future. What the Strait of Hormuz used to be for us, the Suez will be for them.

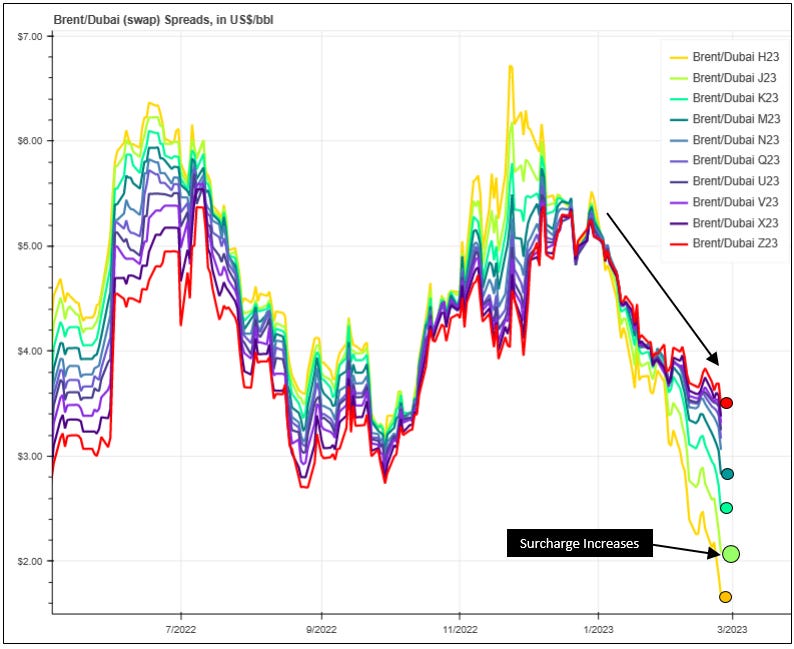

Effect on Global Oil Spreads

Saudi Arabia has been raising its prices to reflect new-found demand in Europe and cutting prices to Asia as it looks to compete with Russia. For March delivery, they set their Arab Light OSP to northwest Europe at 50 cents a barrel above ICE Brent for March, $2.00 a barrel higher than its price for February. The official selling price for March-loading Arab Light to Asia was raised by 20 cents a barrel from February to $2.00 a barrel over Oman/Dubai quote. Both increased by $2.00 a barrel, which should have little impact on the Brent/Dubai spread.

That leaves the marginal increase in Suez Canal rates to tip the scale. Meaning, shouldn't Brent oil increase relative to Dubai IF there is demand for both grades and other price factors seem to be stable?

However, the price of Brent has continued to weaken relative to Dubai this year, signifying even less demand pull from Europe. The market is either more efficient than we knew, or it is widely inefficient given these changes. Hard to say, but it is on our radar.

Overtime, this should lessen the competitive advantage of the Suez and with it, Dubai oil as a European import. We took out Russian oil. Dubai is next.

2- WTI Invades Brent

Changes to the basket of crude assays used to set the price of Dated Brent cargo's are set to begin in June 2023 when Platts will Include WTI Midland Cargoes in the Dated Brent Assessment.

These physical cargoes can be bid or offered in the Platts Market on Close assessment process for inclusion in Dated Brent from the first publishing day in April 2023, with the associated June Cash BFOE value assessed from February, 2023.

If nothing else, this serves to further cement the US as an exporter to the world. Another seemingly temporary event made more permanent perhaps.

Platts Specs

According to Platt's, any WTI Midland cargo nominated into the cash mechanism should meet the following standards:

A cargo of WTI Midland crude produced in the Permian Basin, which meets the Platts WTI Midland specification; it should have passed through Platts-approved pipelines.

The freight adjustment factor is designed to allow CIF and FOB cargoes to play an equivalent role in the Dated Brent benchmark, and will be extended to cover WTI Midland on its inclusion.

Platts has applied FAFs on CIF-delivered North Sea cargoes in Dated Brent since 2019, to account for freight costs and bring equivalence to FOB cargoes.

Since WTI Midland loads in the US Gulf Coast, Platts will determine the value of an FOB North Sea cargo of the grade based on 80% of the freight costs for a cargo loading on equivalent dates in the North Sea.

Platts proposed in February 2022 a starting rate of 40% for WTI Midland cargoes but, on hearing feedback, will implement a FAF of 80% from the start. For WTI Midland, this FAF will be applied to the sum of the cargo’s freight rate from an average of the five established Dated Brent North Sea terminals to Rotterdam and associated port fees.

It is not Platts’ intention to include a quality premium on WTI Midland in the first instance. QPs are intended to increase the relevance of higher valued crudes to the level of the most competitive grades, typically Forties and Brent/Ninian, ensuring they are a more economically deliverable option despite their higher values. Analyzing historical data.

Platts also feels that a QP for WTI Midland will not be necessary but can review this over time.

As the chart below shows, US continues to increase exports. Therefore it relies more on global demand to provide a home for incremental production. The inclusion in the Brent contract should make this relationship more sticky.

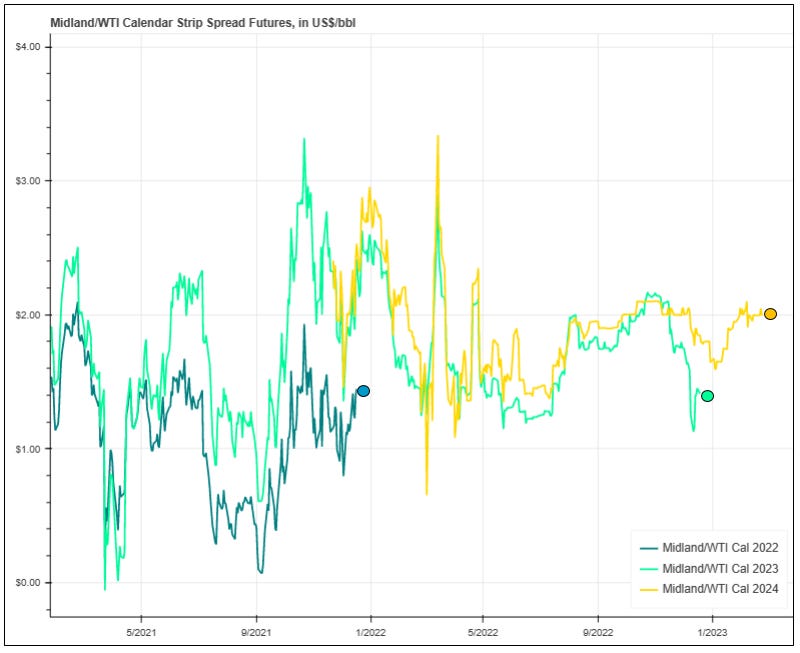

While the inclusion of WTI Midland in the Brent benchmark is notable, it has yet to make much of an impact on WTI/Brent spreads. The only place we find strength is in the Midland/WTI spread which has increased slightly since the beginning of the year.

Cushing crude oil is depressed relative to the rest of its global benchmarks, and against it's exportable Midland counterpart. If transport costs to Europe remain unchanged, this should increase the value of Brent relative to WTI.

Geopolitical Comment:

These first two developments, the increase in Suez fees and the Midland inclusion in Brent taken together increase the competitive advantage of the USA as Europe's supplier at Middle East oil's expense. The market's structure is being altered as the Ukraine War continues. Geography and friend-shoring may matter even more as things evolve in this bifurcated de-globalizing environment. An Oil Wall may be going up between East and West.

The next two developments below are indicative of increased rehypothecation in WTI oil, and more baked in inflation. The first being conjecture on how we make global oil prices drop more. The second being an empirical tell-tale sign that domestic products prices will remain high locally overtime despite the machinations.

3- EIA Bearish Report Questioned

The EIA has reported roughly a 60 million barrel increase in inventory since the start of 2023. As a result, there has been some talk that the EIA was overestimating inventory builds, and deliberately overestimating crude stockpiles in an attempt to keep a lid on prices. The suggestion is that the EIA is using it's 'weekly adjustment' factor to balance supply/demand without explaining where this oil has come from.

Key weekly crude oil quantities are linked through the following balance relationship:

Domestic Production + Imports = Refinery Inputs + Exports + Stock Change.

RE the Stock Change- the takeaway for traders in each week’s data that can decide millions of dollars in position wins or losses - is basically the difference between total stock builds and stock draws.

In comments carried by MarketWatch this week, the EIA’s DeCarolis said in a direct response to the controversy:

“Ideally, the adjustment would be zero since the crude oil supplied has to go somewhere, but there is a degree of uncertainty associated with each term, stemming from imprecise statistical sampling and modeling inaccuracies." Something to keep an eye on, but not driven by much more than speculation at the moment.

There is actually nothing really mysterious about the weekly adjustments made by the EIA as all the information is easily searchable online, with the agency even having published a blog or two over the years to help people better understand these.

Net WTI Effect

One thing that rising US oil inventories HAS done, however, is to depress US oil relative to the rest of the world.

4- WTI Futures Confirm Inflation’s Return

From December through January it seemed apparent that inflation had peaked and was well on its way back down. Future rate hike fears were receding and Oil was well off its highs. Contango was creeping outward along the WTI futures curve.

Inflation is Reheating

But two reports in successive weeks this February have put that story on hold. Friday's PCE (The Feds own preferred inflation gauge) rose at its fastest pace since June. This happened after the week prior's PPI had come in very hot.

The result: Fed expectations of rates have gone from 4.25% to 5.25% over that time according to CME rate futures. Many have started talking of a terminal rate reaching 6% now adding another 75bps to the current level. So in Fed terms,inflation, and the perception of rate hikes to come, has taken a turn for the worse.

The Federal Reserve’s preferred inflation gauge rose last month , an alarming sign that price pressures remain entrenched in the U.S. economy and could lead the Fed to keep raising interest rates well into this year.

Goldman's Chris Hussey summarizes the recent disinflation hopes evaporating (and confirmation of the sticky backwardation) on Friday perfectly:

[P]olicymakers - notably central bankers - have indicated that they are for the most part data dependent, providing further support to the view that we are in a higher-for-longer rate environment.

Oil and Bonds

When markets think the Fed has inflation beat, rate-hike worries kill Oil along with the backwardation. But the creeping contango we had for a while seems to be rolling off. This implies either the Fed is fearful of Oil again, or the hikes are a policy error and something will break very soon. We think both may be true (the PIMCO default hints at housing risks) but to make a commitment-- this is likely either backwardation being more efficiently predicting inflation than Fed data, or Gasoline season is temporarily putting a bid in spreads.

Historically, inverted yield curves tend to co-exist with backwardated Oil ( with no ME war), and as the yield curve uninverts from Fed inflation fighting taking its toll, oil spreads also back off.

Well.. we are now looking at yield curve inversion increasing last week while backwardation reasserts itself. It shouldn't be long before a certain bank starts advising its clients on Supercycles again, maybe

Anyway, the oil market and the bond market have a lot in common right now. We wouldn't be surprised if Powell had Dec/Dec on his screen next to the 2s and 10s bond spread.

As a corollary: The main policy solution as long as Net-Zero is is in play to get oil down for good is to lessen it seems. Why? Because future supply production will almost definitely be more expensive.

Bottom Line: Change is Here

This week and for the foreseeable future we are seeing de-globalization and geopolitical pressures affect prices, market structures, and regional relationships via international policy implementations The policy makers (DOE, Platts, Fed) and regional businesses (SCA) have been busy rethinking things a year after the War started. Brent cargoes, Regional fees, and inflation perceptions are making more permanent changes in the marketplace. While these developments have yet to move markets in any meaningful way, they may change the way we trade oil for years to come as the market digests their effects.

Each of the above four events either benefit the US at the expense of BRICS oil, or are manifestations of that “benefit” in the form of steeper backwardation, possibly manipulated futures data, higher inflation and tighter monetary policy to combat said inflation.

Someone will argue that all of the trade/economic/inflationary problems experienced now and cemented-in going forward are a result of the policy changes we are implementing— just as it was in the early 1970s. And they will be correct.