Today is the Fed’s likely last rate hike for a while. A celebration is in order; for they actually got through a rate hike cycle without capitulating to some crisis they created.

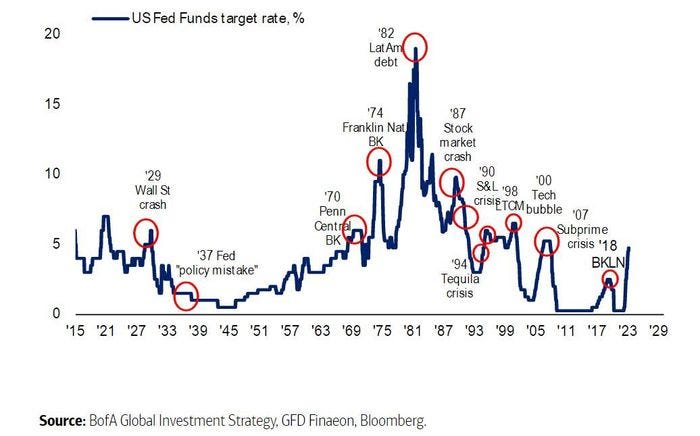

Yes, they created or contributed to several crises including but not limited to: The current bank collapse, the CS event, The SNB need to borrow from us, and the non-transitory inflation that started this whole mess. But they did not capitulate on rates. So what now?

The Fed will almost certainly hike by 25 bps as far as the market’s participants and every bank analyst is concerned. We take nothing for granted anymore, but those are the facts. That is what the market is positioned for.

If they do not hike, everything moons. If they hike more.. they are insane.

Next up, the forward guidance outlook.

Then a summary of how Goldman and JPM are looking at things. Plus one large bank thinks maybe no hike at all!

Forward Guidance

Divergence is huge on what comes next after today. There may be even disagreements within Fed membership. All analysts ( publicly) as well as Fed members (privately) will have an opinion on what comes next and then cite reasons behind them.

Easing: due to banking stress

Holding the Line: until we know more

More Tightening: inflation isn’t anywhere near dead

We think Holding a Biased Line will be what they intend to communicate. It is after all, about having options now. The Fed is likely to give little clue as to direction, and to keep as much discretion toward future policy actions or shifts until their hand is forced. Simply put, they will be vague and we think biased towards more hikes.