Fort Knox holds "Nothing But Moths and IOUs"

Connecting the Dots Between Zoltan Pozsar and Egon von Greyerz

Good morning: The following is a re-edit of yesterday morning’s post with some relevant quotes and graphics added. It should read better in this format.

Fort Knox: Nothing But Moths and Half-Eaten IOUs

Contents: (950 words)

A Bold Claim from the Comex Trading Floor

Vanishing Gold Reserves

IOU Expansion Under Clinton and Greenspan

Mutual Benefits and Suppressed Gold Prices

Demand for Monetary Gold Dies

Erosion of Trust and Limited Supply

Russian Confiscation and Its Aftermath

Nations Demand Their Gold Back

The Scramble When Nations Call

China: Gold’s Slow and Steady Rise is No Accident

A Bold Claim from the Comex Trading Floor

Years ago, a floor broker with deep ties to major bullion banks made a startling statement: Fort Knox holds "nothing but moths and half-eaten IOUs." We all laughed back then. But as time passed, I realized he was right.

Recently, something Egon von Greyerz said brought that old memory rushing back:

"In reality, a central bank only holds an IOU issued by a bullion bank. If the central bank attempts to reclaim its gold, it will never get it back, as the gold has likely been sold to buyers in China or India, who have purchased it outright with no obligation to return it."

The Vanishing Gold Reserves

It's true. The Fed, the Treasury, and most central banks, when it comes to Fort Knox gold, only hold IOUs issued by bullion banks that have already sold the borrowed metal. Over the years, that gold has found its way into more patient hands. There's simply not as much investable gold available as there was decades ago, even with new production.

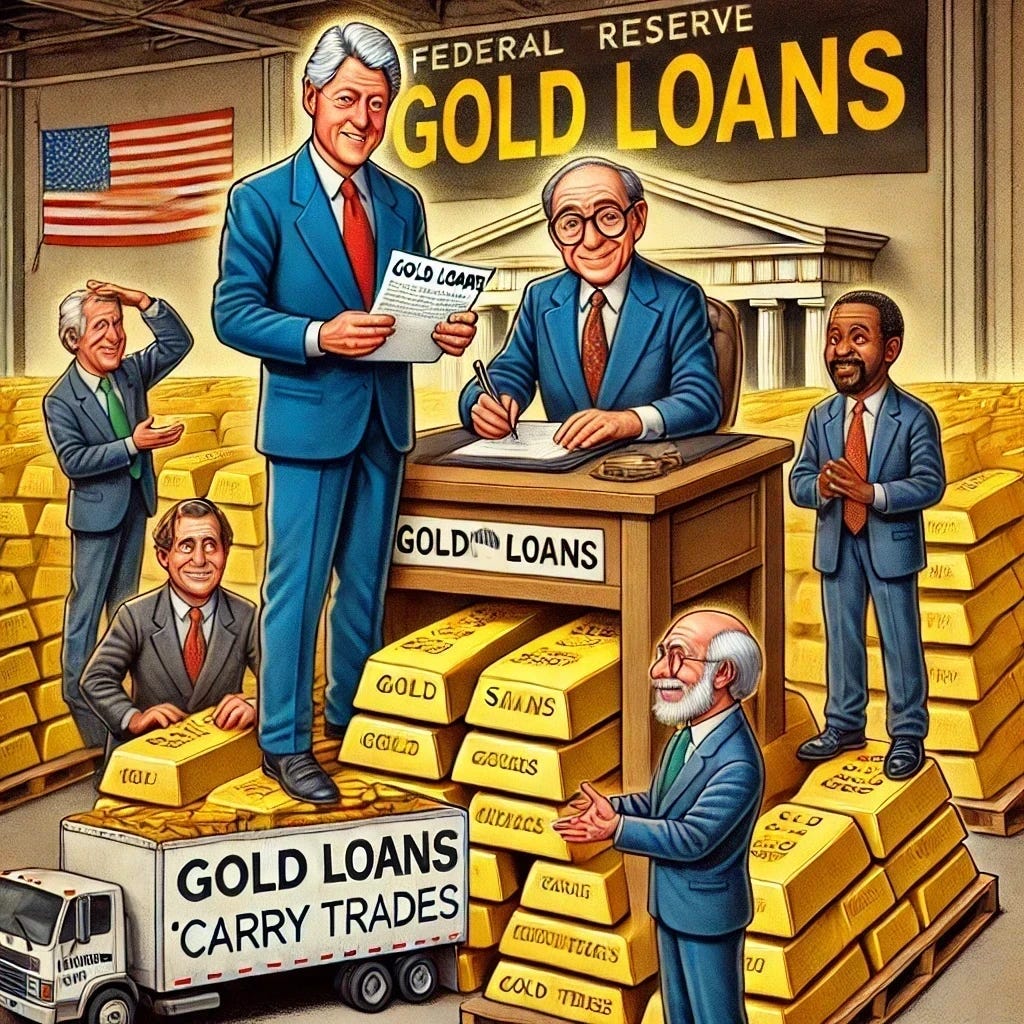

IOU Expansion Under Clinton and Greenspan

This IOU process ramped up during the Clinton era, with Greenspan encouraging bullion banks to borrow gold for carry trades. Goldman Sachs and Citigroup led the charge back then. But why did this happen?

Mutual Benefits and Suppressed Gold Prices

They did it because it benefited both parties. The U.S. earned a small yield on their gold IOUs as the gold was "borrowed," providing a way to keep purchases from directly impacting the pricing system. The bullion banks got dollars for carry trades, and together they kept gold prices lower, as much of the borrowed gold was sold into the market publicly at times.

Greenspan was thrilled. The suppression of gold prices kept fears of inflation at bay and satisfied the bond vigilantes.

Demand for Monetary Gold Dies

What they didn't anticipate was that nations storing gold with the U.S. would eventually want it back.

Frankly, why would they want it back? Gold's value was priced in dollars. Anyone wanting their gold could be bought off with a yield for deferring delivery.

"I'll give it back to you next month; here's 1% yield on it. You don't need it; you need the cash it can give you anyway."

And this worked for decades because everyone trusted the U.S. As long as this continued, gold deliveries could be delayed indefinitely with USD interest payments. Gold was effectively demonetized in this way.

The Erosion of Trust and Limited Supply

But over time, trust in the U.S. eroded, especially after events like the Global Financial Crisis sounded alarm bells worldwide.

In a September 2021 interview that was the subject of an early GoldFix post, John Paulson was asked, "Do you think that gold is a good investment today?" His response from Paulson: Gold Goes Parabolic This Time Around

"Yeah, we do. There's a very limited amount of investable gold. It's on the order of several trillion dollars, while the total amount of financial assets is closer to $200 trillion. People [will] try and get out of fixed income. They try and get out of cash. And the logical place to go is gold."

That was a wake-up call to pay closer attention.

The Russian Confiscation and Its Aftermath

Shortly after, the Russian confiscation in 2022 shattered the already diminishing trust in a heartbeat. It sealed gold's fate as the only logical replacement for nations selling U.S. Treasuries to avoid confiscation.

Nations Demand Their Gold Back

One by one, countries wanted their gold returned from U.S. coffers and could no longer be bought off with USD. Now, they actually have a use for their old and newly acquired gold—to secure their own wealth (replacing Treasuries) and back their local trade.

But Gold has been shorted in carry trades using futures for bullion bank profits since 1993. This is why, if you opened Fort Knox now, you'd find nothing but moths and half-eaten IOUs.

The Scramble When Nations Call

So now, every time a foreign nation wants its pledged gold back, the U.S. says, "Give us some time."

The U.S. then calls the bullion banks, looking for their IOUs.

And the bullion banks start scrambling to find gold. Remember Germany in 2016-2017?

The headline on the Bloomberg story above is misleading. Germany asked for their gold back in 2013. We did not have it handy for them and asked for 7 years to get it to them. We got it to them “ahead of deadline” only to have Germany re-smelt it to “new” specifications

Gold’s Slow and Steady Rise is No Accident

Ultimately, this is why the West can't allow gold to rally to its true price overnight. Our Treasury market and the world’s banking system could possibly collapse. That is also why the ECB can't (and won’t) revalue gold overnight. But they are getting ready to.

Pre Confiscation: Gold and US Bonds move in tandem indicating Gold pricing closely related to opportunity cost of holding interest bearing securities.

Post-Confiscation: As Gold rises, US Treasuries Drop reflecting purchases of Gold concurrent with sales of US Bonds and traded considerably less regard for opportunity cost of interest income lost.

Ultimately, gold must rally to appease China, which is tired of it being manipulated lower—but not too fast, or it hurts everyone, including China. The “opportunity cost” correlation observed post 1971 and undone in 2022 will resume only after the world is better balanced financially and the beta of this pair has reset. Gold will be higher.

I am in the process of converting part of my retirement account into a Precious Metals IRA and this makes me worry that the gold inside of it may be confiscated by the US Gov.

1. Are my concerns justified?

2. Should I just fill it with silver and platinum to avoid this?

3. Can you please comment on these [loaded] questions?

How do we spell mid management at a cultural level- the only serious pushback was Ron Paul. It’s like being on a bus that’s driven buy a cokehead-MOAR when they catch on.