Includes Goldman's Oil report backing off their Supercycle thesis at bottom.

Brynne Kelly 3/19/2023

Contributions VBL

TL; DR

The US now habitually exports its excess oil and covers its refined product shortfall with imports. The whole country is, on balance, short cracks; and the DOE/ Admin will likely rely on newfound confidence in its ability to tamp down demand financially while not changing the fundamental calculus to address the shortfall. Surviving Heat season almost guarantees this

Backdrop

California Gov. Newsom announced Thursday the creation of a new independent watchdog within the California Energy Commission “charged with monitoring California’s petroleum market on a daily basis to ensure market participants play by the rules. The division would be able to: access to new information require refiners to give access to new data, give subpoena power to compel production of other data/records investigating potential misconduct (manipulation) and lastly refer violations of law to the Attorney General for prosecution.”

On the surface of things, this is odd since the California Energy Commission not long ago found “no evidence that gasoline retailers fixed prices or engaged in false advertising.”

Dave Noerr countered the implicit accusations saying: “The growing difference between the price of crude oil and the retail cost of gas and diesel as well as the additional cost Californians pay compared to every bordering state and the rest of the U.S. is due to any number of things"

He then went on to list 8 of them:

Sacramento surcharge, cost of California, growing of Government, Low Carbon Fuel Standard, Cap and Trade Program, Vapor recycling requirements, Data collection ,and Air quality mandated equipment replacements

He went on adding:

"So California, the fact of the matter is, you are paying the same or less for the crude oil contained in a gallon of gas or diesel. You are just paying a lot more for government,”

Finally, Noerr sternly pointed out that in1988, "the state of California only imported about 4.5% of all the oil that they consumed in their state, but now they import over 70%

“If you wonder what happens when you give up energy independence, that’s what’s going on.”

We would add things aren't much better on the refined products side. In 1982, California had 43 operational oil refineries and a population of nearly 25 million; today they have only 11 operational oil refineries and a population of nearly 40 million.

In California as in the rest of the USA, demand is up, production is down, and politicians are getting a head start on the seasonal finger pointing They may be a little worried again as well. Given what happened last year and the extreme measures needed to take gas prices down mid-season, maybe they are sweating a little? Short some 3-2-1's maybe? Who knows. But lets check in elsewhere

China Refined Exports Dropping

On the Asian side, a Reuters survey shows that China's diesel exports could fall to an eight-month low in March. Refiners refiners are focusing on their own demand and increasing domestic stockpiles ahead of planned refinery overhauls.

China customs data showed exports of the industrial and transportation fuel are estimated at 400,000 to 770,000 tonnes compared with estimates of about 2 million tonnes in February,according to JLC, Longzhong, Refinitiv, and two China-based trade sources. Diesel exports were last at similar levels in July 2022,

This could bring the combined March exports for all three products - diesel, gasoline and jet fuel - to between 1.5 million and 1.94 million tonnes, at least 50% lower than February's estimate of 3.9 million to 4.15 million tonnes, the survey showed.

Banking Fears

Multiple Bank crises also definitely had significant impact on WTI.

Depending on how you look at it, fears of contagion in the banking sector exacerbated the above, or the above was exacerbated by fears of contagion in the banking sector. Either way, traders on the fence pulled the trigger with the combination of events

We could get increased liquidity into the markets to stave of the crisis and that would support Oil. But, unless it is straight QE, most of that money will stay on the banks' balance sheets in loan form, as opposed to Powell's money printer raining down on everyone. Right now, they are all trying to stop depositor defaults, not prop stocks.

The market appears to be taking this into account as exhibited in cracks While crude oil prices were getting clobbered last week, refining margins, consistent with the above news items, were on the rise.

Crude Oil takes a hit, Gasoline and Distillate Not as Much

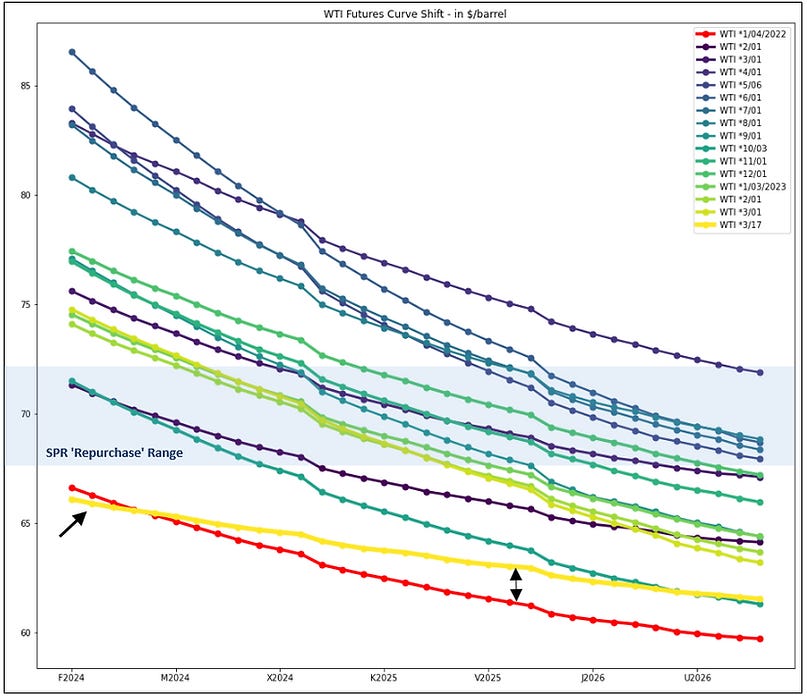

The calendar 2024 - 2027 WTI futures curve retreated on Friday to levels not seen since January 2022. The elusive $67 level came and went, and with it initial hopes that an SPR "put" existed. Way back in October, 2022 the US Department of Energy (DOE) stated:

...the President is announcing the Administration intends to repurchase crude oil for the SPR when prices are at or below about $67-$72 per barrel, adding to global demand when prices are around that range. As part of its commitment to ensure replenishment of the SPR, the DOE is finalizing a rule that will allow it to enter fixed price contracts through a competitive bid process for product delivered at a future date.

But, as of last Friday's close, WTI oil futures are below the bottom-end of the 'repurchase range' regardless of the expiration you choose.

WTI Calendar 2024-27 Curve Back to 2022 Opening Levels, Although Curve is Flatter

Chart Comment: Note the curve has a flatter trajectory with spot essentially at the same $66 area going back to 2022 (red vs yellow). While this is neither bearish nor bullish short term, it does imply the rising cost of production (something touched on before) going out on the curve and/or no drop in demand. This market, for now, is base-lining at higher levels.

SPR Bid: Cancel If Close?

We have three new pieces of information further casting doubt on the administrations intentions on buying oil back

First: We had a real test of the SPR "Put" last week- and no purchasing announcements were forthcoming.

Second: President Biden's administration has actually delayed by roughly a year the return of more than 8mn bl of crude borrowed from the SPR. The delays were approved as recently as last week, when the US DOE revised two "exchange" contracts it negotiated with Shell, delaying the return of 3.6mn bl of crude to the SPR until 2025.

Third: In a note from Rapidan Energy Group we heard the Energy Department is unlikely to begin refilling the Reserve before the end of Q2, even though oil prices have slumped into the range the administration has targeted to purchase oil for the cache.