2 p.m. Founders Discussion… Recording available next week

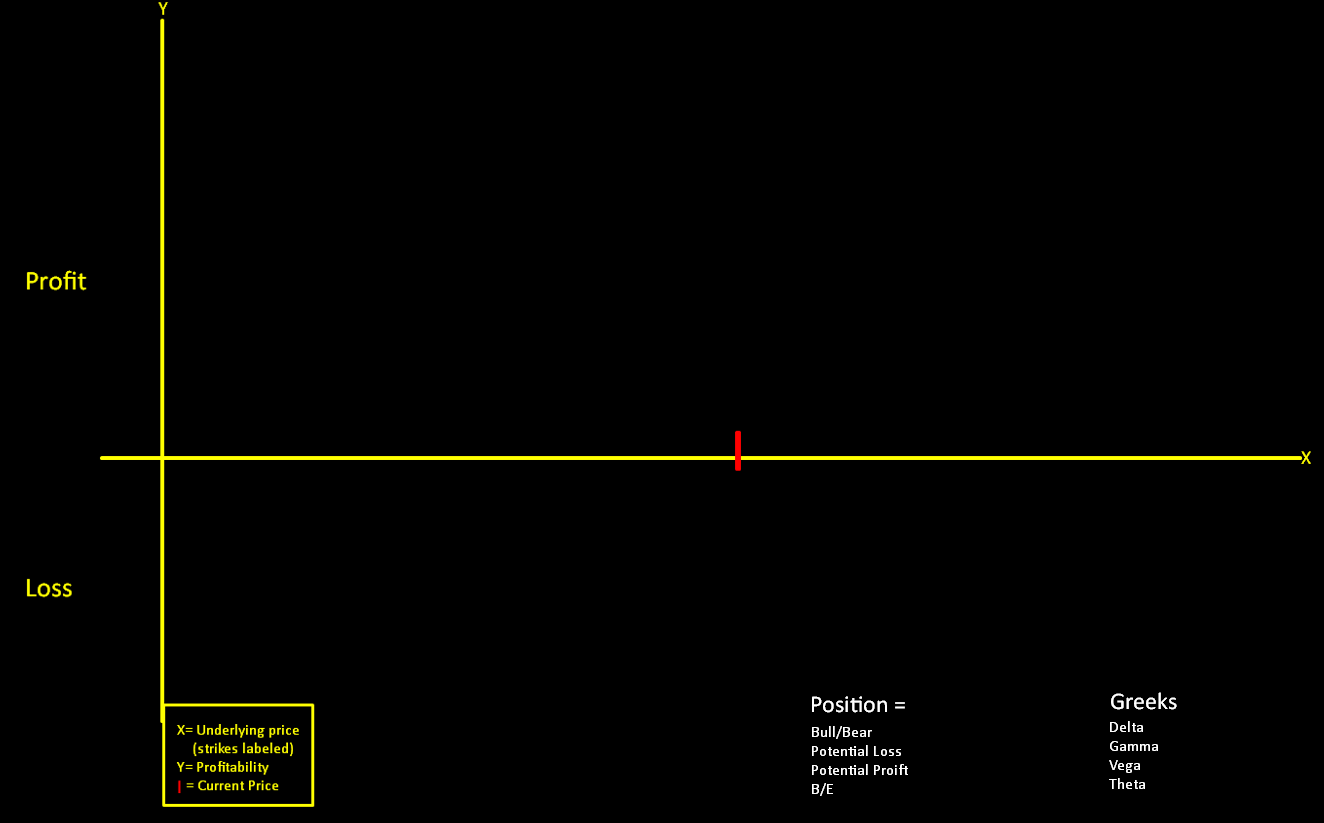

Blank Graph

Directional (bull/bear spread) Butterflies: the most well defined of trades in terms or R/R and payoff/odds

As a risk manager and trader: You either start with or consider finishing with a butterfly in all directional trades. All trades can become butterflies

Delta = probability of expiring in ITM

Risk reward = Payoff/Odds

Risk / Reward

Call = L/UL

Call Spread L/L

Ratio Call spread 1x2 UL/L

The Butterfly’s Quantified R/R tells you everything more precisely and anchors expectations helping you decide what kind of R/R you wish to take at any point in time

CoT Slides