Morning Markets

Good Morning.

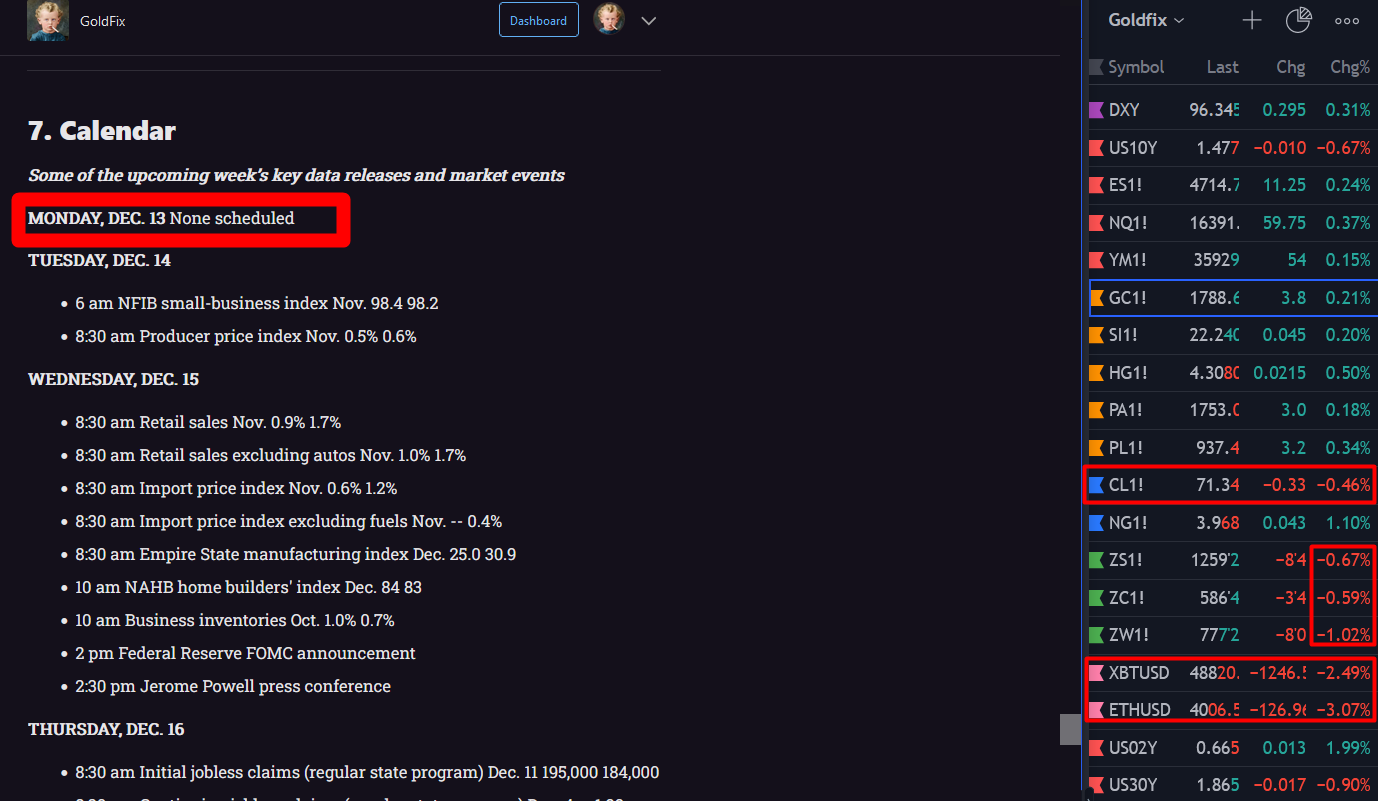

No Data today. Markets are all stable with the exception of Crude oil which is reacting violently to OPEC announcements last night. The dollar is stronger as is Gold.

We had a good discussion on Sunday largely focused on how to use Market Profile. A couple Founders had asked about it and the “trend day” concept so we thought it appropriate to work through it. More on that below

GoldFix Podcast

Bitcoin Podcast

Guidance

About 20 central banks are due to hold meetings this week, including the Federal Reserve, the European Central Bank and the Bank of England. Fed Chair Jerome Powell and his colleagues are expected to announce the acceleration of asset purchases tapering on Wednesday as the U.S. faces the hottest inflation since 1982. For the ECB meeting Thursday, the decision seems more finely balanced with economists seeing little change to the previously announced policy path. At the Bank of England, last month’s dashing of expectations to hike rates is likely to be repeated as fresh concerns over the pandemic outweigh inflation fears. - Bloomberg

Top News Headlines from last night (ht ZH)

Almost 20 central banks meet this week, including the world’s biggest. No surprise that volatility term structures in the major currencies remain inverted as the market awaits forward guidance that could shape trading for the better part of 2022

The Bank of Japan offered to buy 2 trillion yen ($17.6 billion) of government bonds under repurchase agreements after repo rates jumped to a two-year high

Turkey’s central bank intervened in the market by selling FX after the lira tumbled past 14 to the dollar for the first time, piling pressure on a central bank that’s forecast to keep cutting interest rates this week despite rising inflation. The decline came after S&P Global Ratings lowered the outlook on the nation’s sovereign credit rating to negative on Friday, citing risks from the “extreme currency volatility”

The ECB’s biggest decision this week is to decide if it can still call the current inflation spike “transitory.” The answer will have a huge bearing on the euro-area economy, which is already dealing with resurgent coronavirus infections, new restrictions and lockdowns, and uncertainty about the omicron variant

ECB Vice President Luis de Guindos is self-isolating after testing positive for Covid-19 on Saturday, the ECB said in a statement posted on its website. Guindos hasn’t been in close contact with ECB President Christine Lagarde over the past week, according to the statement. The Spaniard, who is double- vaccinated and has very mild symptoms, will work from home until further notice

Two doses of the Pfizer Inc. and AstraZeneca Plc. vaccines induced lower levels of antibodies against the omicron variant, increasing the risk of Covid infection, according to researchers from the University of Oxford.

Zen Moment

Coffee cat is not relaxed

Founders Sunday Class

Peter Steidlmayer invented market profile. I was lucky enough to have a guy working for me who was taught directly by him.

Here’s a quote from a book of his I own.

"I also knew it was important to keep the learning process separate from making money. To me, what others regarded as success, whether it was immediate financial gains, or the good opinion of others, was not real success, because it might not have a real foundation. The foundation for being successful was in the learning; the real definition of success was improvement in my ability to function, improvement in my performance as compared to the background of what I was before. I felt that most people didn't take the time to learn and didn't make a commitment to keep learning once they began to make some money."

We spent 2 hours on his Market Profile topic Sunday.

***Passcode at Bottom of Post ***

In this class we walk through things you just cannot get from a website. Things that also make using any market profile website or system that much easier. Like:

Types of Trading Days: there are really 3, not 6.. so don’t stress

How to use it right away: why and how letters are used

How to trade a day after the Initial Balance is set.- it’s all about Trend vs Normal Variation.. and avoid ”Running Profiles”

What does “rotation” really mean?- needed for trend day identification

Why is the Initial Balance so important?- the auction process foundation

Why does it work better in localized markets?- why 24 hour markets are a problem, but can be traded in multiple sessions

What does it look like on other systems: Candles, Bollinger bands

We also touched briefly but meaningfully on the Gold Commitment of Traders report and how professionals use it with this week’s numbers.

Thank you to the members who contributed to the conversation as well. Great topic choice guys.

Founders Class Slides

What a running profile looks like and when they occur

How to interpret Commitment of Traders in Gold

Why a trend day is called that