Founders Friday: Look out Above

In the time it took us to write this, Gold has rallied $13.00 and Silver has rallied 25c reinforcing our beliefs of what was just written above.

“In the end everybody folds.”

- ZH in response to this morning’s China-stimulus announcement

Good Morning:

We are off the desk today, and here is something to start your day, with our monthly Founders Friday bonanza to keep you busy. (Hartnett as well). Some thoughts.

Markets.

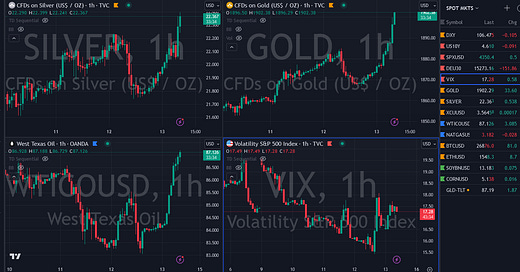

Gold is up $23 and Silver is up 39 cents. This is all happening while the dollar is stronger, Bonds are stronger, and bank earnings came out this morning with Wells Fargo and JPM both beating earnings estimates. Oil is up over $3 as well.

Stocks on the other hand, despite (or because of) earnings are softer.

Buy Season on Ramp.

The banks are most certainly gearing up for Buy season now.

Shanghai traders are done selling their extra gold, and US CTAs still need to cover. It all looks very very good.

Weekend Fear.

Today’s markets look and feel like what they do before a news event, not after one. Historically people *do* get very nervous on Fridays during middle east problems. This could be one of those days. It certainly feels like it.

If it is, and nothing eventful happens over the weekend, don’t be surprised if Monday is an “opposite day”.

But if Monday is not a down day, then this is real and could begin to accelerate into Buy Season for Gold and Silver.

Big Picture Reminder.

Market behavior today is also a microcosm of the next 3 years in our opinion. A world where the decision to fight inflation loses out to the tendency for politicians to spend too much, as the quote at top of page infers.

Overnight News.

The earnings aren’t the story. That trajectory for markets was well in hand starting at 4 a.m. and is merely continuing the overnight trend. It is hard to put a single cause for this and it is likely a convergence of drivers but there are those likely macro (non war) drivers.

China, in the face of poor data, announced it is considering a new “stabilization fund” to prop up markets. Stabilization fund means fiscal stimulus, possibly like direct payments to citizens. This could be part of the bazooka everyone has been waiting for.

While there is no meaningful escalation in the ME war: Russia is tellling its citizens to come home and nations are becoming more vocal with opinoons, as varied as they are.

Yesterday’s Data.

Yesterday’s CPI was softer than it looked. Why? Because the data reported is increasingly stale in comparison to the real time data.

Put another way, the disinflationary forces (mostly in housing) are accelerating while the data we read is based on older “Real time” data.

The data itself reinforced the soft landing story

Risk.

We closed our bond long yesterday for a loss and will close out Gold long this morning for a gain

The combo trade put on right before the war was Short Dollar, Long Bonds, and Long Gold.

We are quite pleased to say… we have NEVER put on a combo portfolio before where Gold bailed out the losers.. Shape of things to come maybe?

We haven’t had time to go through them this morning but we have JPM, 3 GSTraders, MS, DBReid, TS Lombard on Credit, below. Hartnett is up top..

ADDENDUM- HOLY SH*T

In the time it took us to write this, Gold has rallied $13.00 and Silver has rallied 25c reinforcing our beliefs of what was just written above. Look out Above!