Hartnett’s Flow Show Report:

Hartnett reminds us today of something Zoltan said recently about the 60-20-20-20 portfolio concept in Zoltan Pozsar's Trade Recommendations

We are right now, at the intersection of Pozsar Street and Hartnett Avenue as far as Bonds and Commodities are concerned.

Bottom line:

Nothing has changed. If financial conditions tighten, look out below. Thus far the pullback is “healthy”, but not if we get below 4200 in SPX. In first half, Bearish sentiment was tailwind for stocks. In second half, not so much.

Other video highlights and insights

These are the commodities to watch (chart)

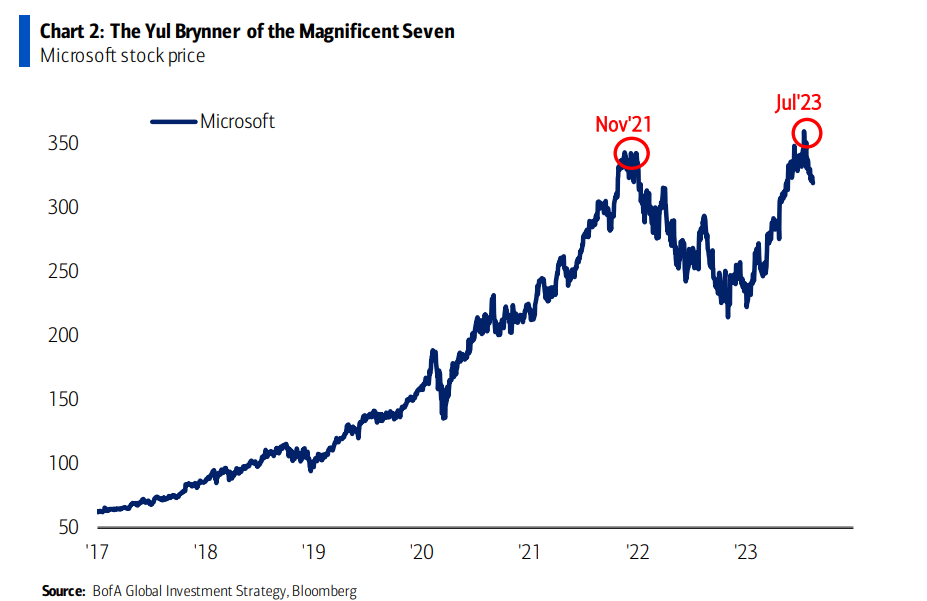

Magnificent 7 performance hangs on MSFT now

Put buying is alarmingly high now

Sell the rip, don’t buy the dip if he’s right

Buy REITS, China stocks if int’l policy response to help China surfaces

If crypto and tech stocks turn up, could be end of rate hikes

Secular inflaitonary headwinds killing cyclical tailwinds in Bonds

China is a mess, and yet…

Sell the last rate hike still the play ( chart)

More slides below