Housekeeping: Michael Oliver of MSA joined the GoldFix Founders group this Sunday to discuss Metals, Stocks, and more. Later this week an abridged/edited version will be published for Premium

Podcast Topic Flow Outline

SECTIONS

Why Gold No Longer Trades Like It Used To

The Banks Blink

Central Banks Take Over Gold

Stock Market Comfort Phase

Leadership Does Not Rotate in Bubbles

Oil: The Last Inflation Trigger

Gold’s Acceleration Phase Begins

TIMESTAMPED TOPICS

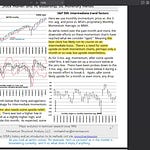

00:00 — Gold COT: Why the Market No Longer Trades Normally

02:30 — Banks Begin Covering Shorts

05:00 — Options Reveal Bank Panic

07:30 — Futures Liquidity Breakdown

10:00 — Banks Regain Buy-Side Visibility

12:30 — Collapse of the Old Gold Market Structure

14:30 — Central Banks Replace Speculators

18:40 — Michael Oliver Joins

20:00 — Stock Market in Topping Transition

23:30 — Long-Term Momentum Breakdown Risk

25:30 — Leadership Illusion in Tech Stocks

27:30 — Nvidia Will Lead Lower

30:30 — Stocks vs Monetary Metals

33:30 — Oil Momentum Turning

38:30 — Oil as Inflation Trigger

42:30 — Gold Long-Term Bull Structure

44:30 — Asset Class Shift Toward Gold

PART I — Vince Lanci: CFTC COT Gold Market Structure

00:00 – 02:30

COT Methodology & Market Behavior Shift

• Why COT used to matter more

• Trend week structure explained

• Open interest behavior during trend weeks

• Introduction to abnormal positioning patterns