Founders Recording: Fear/Greed Indicators, Master Archive List

Evolution, use, and what they tell you in different markets

Hi: Here is Sunday’s Founders Class recording. Enjoy.

Topics include:

Fear Greed indicators

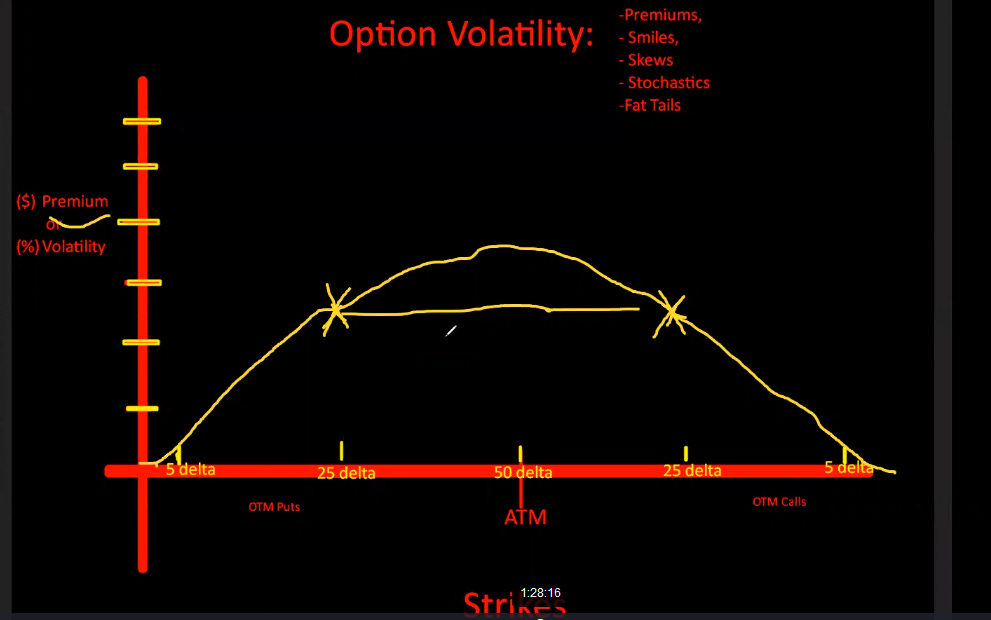

Volatility

Why Vol moves up/down when mkt moves

Players and their behavior dictate volatility

Skew as predictor of volatility movements

various market skews, volatility behaviors and why

Modelling the behavioral with volatility graphs

***passcode at bottom***

Here is the preview:

Over 30 Recordings In Library Now

We now have over 30 class recordings available to premium subscribers totaling over 60 hours of market discussions.

Most of these can be accessed on the main page using the search tool. Here is a saved search to get you started.

These are university level (and topically part of a Masters curriculum this fall) explanations of market phenomena covering futures, options, commodities, and market structure of equity markets.

Some of them are relatively current events, some historical perspectives. Some are “old man” war stories. Several are responses to Founders requests, like the Pay For Order Flow class and other concepts that Zerohedge pointed out (many times) about Robinhood’s questionable business practices.

Here are a few popular ones:

Many, as you may imagine, are centered on Precious metals. When time permits these will all be catalogued for easier access.

Some Slides From This Weeks Class: