Founders: S&P most at-risk from rates in 20yrs

Assessing the “cheap” bear play opportunities now

Summary:

BOA is suggesting that if you are bearish, that longer dated puts offer the best risk reward of anything out there.

If you agree with their rationale and even agree with their valuation (we do) , it might be better to buy a lottery ticket, and be prepared to keep buying them every month for 6 months for better payoff potential and better defined risk mgt.

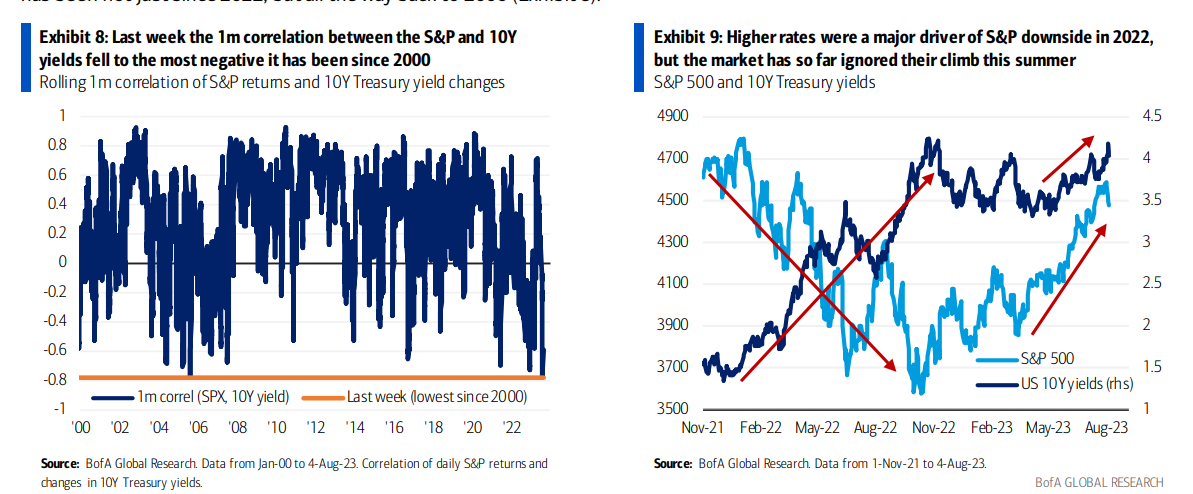

The Potential Catalyst: Rate/ Stock Divergence

Hartnett’s team is noting the “cheap” bear play opportunities now

Should concerns about recession keep fading (our economists dropped their recession call in last week’s US Econ Weekly) and fears of inflation or a tighter-than-expected Fed return, there is a risk that higher rates once again become a headwind for stocks.

Puts are as cheap as they have ever been going back 20 years and stocks are beginning to show signs of interest rate related stress.

What Does it Really Mean?

You will begin to see calls from other banks ( Not BOA, they are straight shooters) telling you this is bearish. IT IS NOT BEARISH

What it is is this:

The market is not hedged against bearishness. Therefore, the payout if the market were to drop might be very asymmetrical.

Therefore the risk/reward right now is in being long downside protection.

That does not mean it will necessarily pay off. This is what a lottery ticket feels like.

CORRECT: The lottery is as big as it has ever been… how can you not buy a ticket?… is the correct way to look at this.

INCORRECT: the market is due for a selloff, look at how cheap puts are.

Lottery Ticket Time

We have extensive experience with this type situation from a metals and equity perspective.

Also Today:

JPM Morning intel

GSTrader 1 China centered

GSTrader 2- Recap yesterday

BOA: Hartnett’s rate risk expanded on by his team

Gold Levels