Founders: Standard Charter Says Bitcoin $100,000 Not a problem

Very nice walkthrough on how miners (don't) make money

Bullion Bank 2.0: Control the Miners, Control the Price

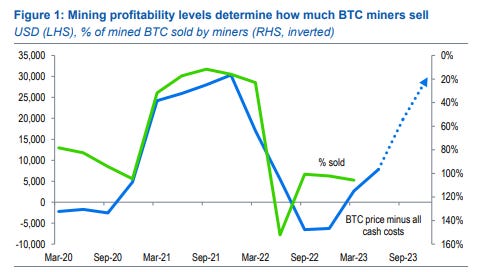

The SC report on mining economics is very good for the mechanics of Bitcoin mining. The behavior of these guys is suspiciously like Gold miners and Oil drillers in the 90s, (when they make money, they don’t hedge production and actually speculate long) as in Texas Hedgers…

At recent prices,they have been selling 100% of new BTC; at USD 50,000 we think they would sell 20-30%

That statement alone implies there are many miners who are not consistently profitable and can be driven out of business

We may write this up for premium after a serious read. Considering the Bitcoin push to cannibalize gold, it all makes sense.

But suffice to say, every day this product looks more and more like a market that will be really spoofed as power consolidates.. extremely fun for agnostic trading.. painful for the believers. But that isn’t for a while yet.

This market structure plays right into the JPM silver market model and the old Goldman Gold market model.

Get the Producer flows as hedging clients and get the largest investment institutions to use your firm as clearing broker and you sit in the middle and trade both sides… a Bullion bank’s dream.

Today:

Standard Charter Bitcoin Report***

JPM Market View Changes*** MARKO

JPM Morning Briefing

STIFEL Morning Research

GSTrader Multi mkt comments

GSTrader: Morning Email