Hi.

Goldilocks is F*cking toast

Big week just ended. Almost nothing on metals, even with the rally in gold. Fascinating. We have our suspicions.

No ZOOM discussion.. just too much on the plate right now. Put some risk on and have to assess the situation.

Short version: Long Gold/Short 20yr Bonds for a macro trade (1 to 6 months) and sussing out what makes me very wrong (deflation), what the canary in the coal mine would be (JPY maybe), why am sort of wrong (QE means bonds MAY outperform gold a little), and very right (No matter what happens except harsh deflation Gold will be more buoyant.. maybe).

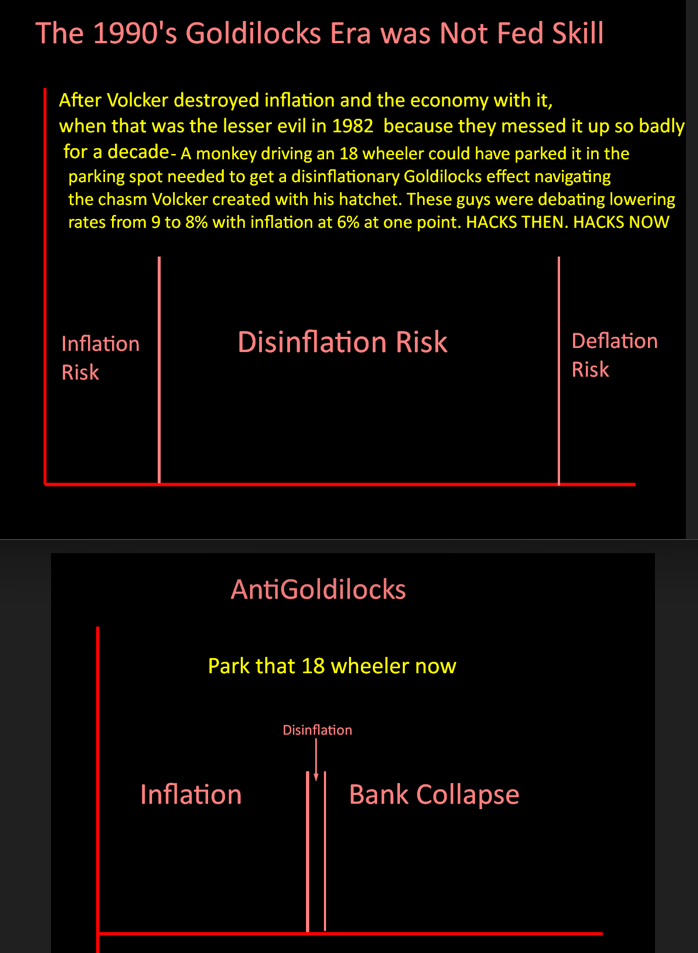

The Reason: Anti-Goldilocks is manifesting

Ideally: no QE… but no more hikes. But if hike again.. now Gold acts like risk hedge for more bank failures, not worried about inflation getting squashed.

In Extremis: long the last safe haven if it all goes to shit. If they cancel the gold contract.. however.. uh oh…

Inflation fighting is dead: The Fed simply cannot have the yield curve remain backwardated anymore. Yes that is bullish for bonds at the short end, and maybe at the long end (if QE is hadicapped as coming) too. But its not bearish at all for Gold. adn Waht if QE doesnt come? waht if they let inflation work its WAY THROUGH THE SYSTEM… you get resteepening at higher levels

They must start considering backing off inflation fighting and that means letting longer yields rise while slowing the hikes on the short end. Simply put.. they are raising the inflation target in their minds.

GOLD IS PIVOTING FROM BEING AN INFLATION HEDGE TO BEING A SOLVENCY HEDGE WITH ALMOST NO PAUSE IN THE MIDDLE.

WHEN THE FED CURING INFLATION MEANS CAUSING INSTANT INSOLVENCY YOU GOTTA BE NUTS TO SHORT GOLD.. THE SWEET SPOT/GOLDILOCKS (DISINFLATION TAILWINDS) BETWEEN INFLATION AND DEFLATION IS DEAD

Confidence: about 1/3 of a max position for me and client. Will probably not take the client bigger.. they have low tolerance for 6 month trades these days.. lol

Reality: this is a little out of confort zone. Don’t know bonds as well as Gold obviously. If it distracts, just might take it off. FULLY expect a Gold smackdown while bonds do nothing in a week. lol thats why only 1/3

the better/riskier tradeis short 2 year long gold… or short stocks long margaritas

ALSO: Michael Moor is on vacation

Weekly Part 2 in a couple hours