Good morning!

Today is Fed day, and a very significant one in that it is the only one since forever they actually finished what they started without (publicly) bailing out something they broke.

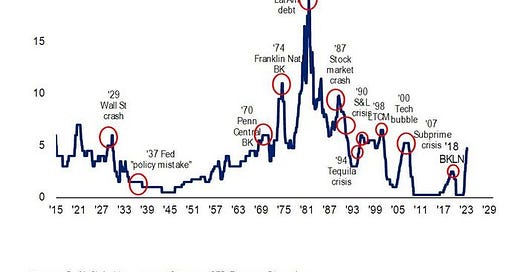

Rate Hike Generated Crisis History…

We are breaking the better of these reportsdown and summarizing them for easier to digest use given the market behavior yesterday.

***Look for a regular Premium report in an hour or two with breakdowns***

For now.. here are several in raw form. and a very quick summary explanation.

Bank analysts will diverge possibly greatly on what comes next:

Easing (banking stress)

Holding the Line (balanced factors) or

More Tightening (re-emergent inflation).

All will cite drivers like those in parenthesis behind their explanations.

For days like this, the Fed statement will be extremely important as they comb it for clues as to Fed direction.

As of yesterday’s bank-driven selloff the market consensus was the following:

90% chance of Fed hiking the rate by 25bps to 5.00-5.25%, down from 95% the day before the regional bank route

Tiny chance the Fed cuts in June, as opposed to 20% chance of a June hike the day before

The predicted rate path forward…

If you are trading this stuff, today is to be treated like 2 trading sessions. Before 2pm and after 2pm. If you are not trading them.. Enjoy

GS, JPM, MS, and more below