German Energy Rationing Begins

Russia likely to reduce or cut off Natural Gas heading into winter.

UPDATE: 8:38 a.m. ET: This came across the tape while we were writing:

*GERMANY DOESN'T RULE OUT INTERVENING IN GAS PRICING: HABECK 7:35a.m.

It implies the EU is going to do a full court press to keep gas prices lower this winter. If they cant boost supply, they will aim to cut demand.

Translation: They expect a Russian cut off, rationing, price fixing, and subsidies to ensue. Which spells inflation for years to come beyond a single heating season.

Bottom Line

Yesterday, News broke of a German city rationing hot water to its citizens. The news is actually potentially worse than the headline. This winter may be a very dangerous one, especially in Europe.

Then we got wind of Hamburg, Germany’s second largest city considering rationing as well.

Hamburg Germany is mulling over the potential rationing of hot water as the energy crisis worsens.

"In an acute gas shortage, warm water could only be made available at certain times of the day in an emergency," Hamburg's environment senator Jens Kerstan told German newspaper Welt am Sonntag on Saturday.

Kerstan also spoke with the German daily newspaper Hamburger Abendblatt and warned, "We are in a much worse crisis than most people realize." -

Not Just Hot Water, All Heating Ability

Landlords are rationing hot water as a result of utilities reducing the ability to heat their water. Utilities, we believe, are being mandated to conserve Natural Gas in anticipation of a Russian counter attack if price caps go into effect. In fact, they are in the process of normalizing flows by reducing their dependence anyway now. Mandated conservation is the next logical step.

The German Site Bild ran a story on this

Translated from German: "Hot water only at certain times...You are informed that hot water flows only in the morning, from 4 to 8 a.m., lunch from 11 to 13 o'clock, in the evening from 17 to 21 PM.

"German Landlords Start to Limit Hot Water, Heating Hours...The measure was taken by a housing cooperative in the small town of Dippoldiswalde and would affect 600 apartments managed by the cooperative"

How We Got Here

G7 threatens Oil price caps

Russia must consider cutting off energy flows to the EU

EU countries brace for winter by rationing

Since the price cap threat on Russian oil was unleashed at the G7 last week described in: G7 Communiqué: Economic War Declared on June 28th; Western leaders have been preparing for potential retaliation by Putin.

JPMorgan detailed why an energy counter attack is a growing possibility in their July 1 report on Oil covered in JPM Says $380 Oil Possible If Russia Retaliates

Hence, it now appears more likely that export cuts could be used as leverage in our view. Given the high level of stress in the oil market, a cut of 3.0 mbd could cause global Brent price to jump to $190/bbl, while the worst-case scenario, a 5 mbd cut, could drive oil price to a stratospheric $380/bbl.

Russia is increasingly likely to simply cut back or cut off its Oil and Natural Gas flows to the EU now. The idea being: If you are capping Russia’s prices (which hurts Russia in more ways than one), then we will sell to the east or not at all.

Natural Gas is Likely Weapon of Choice

While oil gets all the headlines, it is Natural Gas that is the most likely weapon to retaliate at first. Why? Because Russia derives much more revenue with Oil than it does with natural gas.

Russian Gas Pipelines to China, built for such an occasion…

JPMorgan:

The most obvious and likely risk with a price cap is that Russia might chose not to participate and instead retaliate by reducing exports. Therefore a cutting off of Nat Gas flows to Europe costs them less in revenue.

They could cause acute damage in a coldsnap while reducing their economic inflows less.

Who Suffers Most?

The largest importers of Russian gas in the European Union are (Southern) Germany and Italy, accounting together for almost half of the EU's gas imports from Russia. Other larger Russian gas importers in the European Union are France, Hungary, the Czech Republic, Poland, Austria and Slovakia.

Which is why southern Germany, so dependent on Russian gas, is beginning to “ration” hot water. It is also why we feel the most expeditious (and heinous) next play would be for Russia to reduce or cut off Natural Gas heading into winter. They wouldn’t even have to cut off oil. Then see how the west reacts.

US Implications

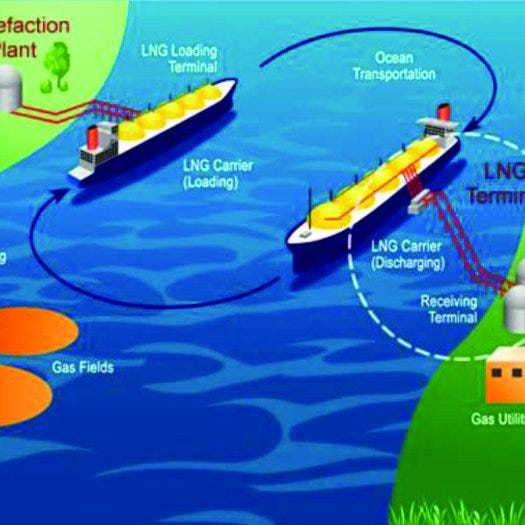

If this fear is realized, Natural Gas prices should also rocket higher here as the US will continue selling its own Nat gas for a profit to the EU in the form of LNG.

The only two things we see changing that calculus should the worst come to pass in Europe are:

mild winter weather, and

the willingness of the US to “help” Europe.

If those should happen, especially with the speculative and panicked buying that will ensue prior to such a reversal of trend, then expect gas prices to collapse from all the speculators running for the exits. In either case, being short what you cannot be afford to be short is dangerous in the EU.

Finally: If you are wondering where this all ends up. it ends with Central Bank Digital Currency being mandated to direct money to those people and parts of the economy where it is needed most.

End

ICYMI: JPM’s report