Gold: Germany’s Trust of US as Custodian Is Under Review

This started with Germany in 2013, it will end with Germany

Prediction. When the US is done repatriating its gold... Germany will begin calling the rest of its own back from the US and UK. This started with Germany in 2013, it will end with Germany - VBL’s Ghost on X.com

Gold in the Basement: Germany’s Reserve Trust Is Under Review

The longstanding assumption that Germany’s gold reserves are safe in New York is no longer taken for granted. Political shifts in Washington, public calls for increased transparency, and broader concerns about U.S. reserve integrity are prompting parts of Berlin’s political establishment to reassess the wisdom of maintaining large-scale gold holdings abroad.

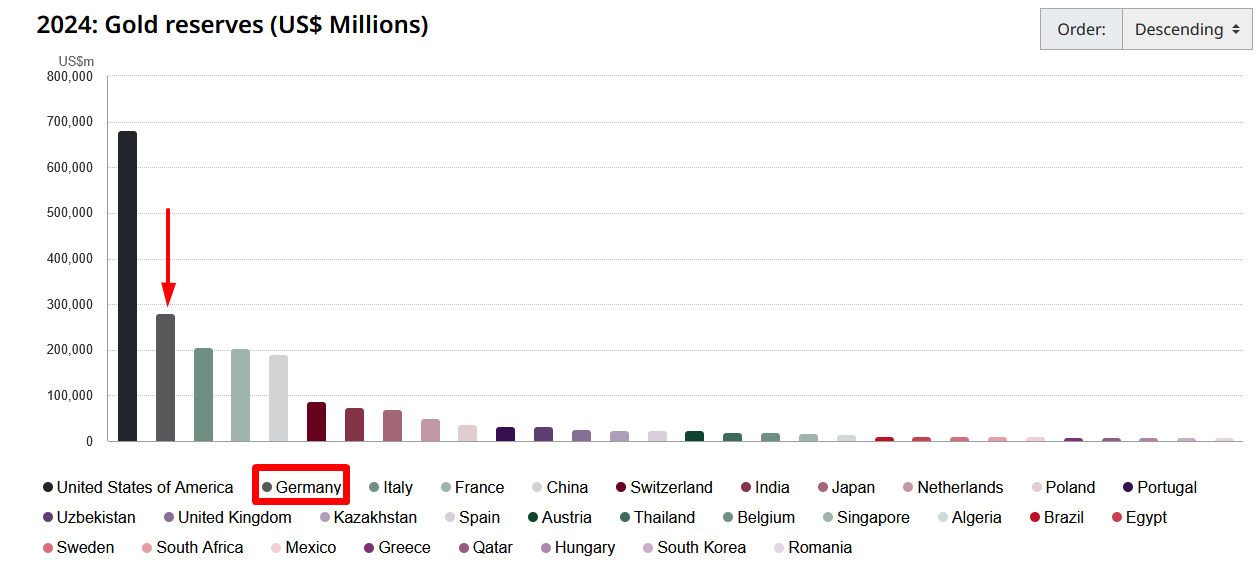

Germany maintains the second-largest national gold reserve globally—behind only the United States. Approximately 1,236 metric tons, or 37 percent of that reserve, are reportedly stored in the vaults of the Federal Reserve Bank of New York. The original rationale, developed during the Cold War and later reinforced during the euro’s formative years, was that such an arrangement allowed Germany rapid access to dollar-denominated liquidity in the event of crisis.

That assumption is no longer immune to scrutiny.

Political Voices Begin to Question the Arrangement

Marco Wanderwitz, a member of the center-right CDU and outgoing Bundestag lawmaker, has revived questions about the security and transparency of the New York-held gold. “Of course, the question now arises again,” he told Bild, referencing his long-standing skepticism. In 2012, Wanderwitz called for physical inspections of Germany’s gold bars and greater public accountability from the Bundesbank. That campaign was unsuccessful at the time, but the political context has shifted.

Markus Ferber, a fellow CDU member and representative in the European Parliament, has taken the issue further. Ferber is calling for Bundesbank representatives to personally audit the New York holdings: “Official representatives of the Bundesbank must personally count the bars and document their results,” he told Bild.

A Familiar Precedent: Repatriation from Paris

This is not the first time that Berlin has faced public pressure to rethink gold storage abroad. In 2013, amid heightened eurozone uncertainty and populist demands for national control over strategic assets, the Bundesbank repatriated hundreds of tons of gold from Paris. The justification then was strategic redundancy: since Germany and France shared a currency, maintaining reserves in Paris was no longer necessary.

The outcome was a rebalancing of Germany’s gold portfolio. As of today, more than 50% of the country’s gold is held in Frankfurt, 13% in London, and 37% remains in New York. It is the New York allocation — once a symbol of transatlantic trust — that is increasingly viewed as a geopolitical liability.

“It does not keep me awake at night. I have complete confidence in our colleagues at the American central bank.” — Joachim Nagel, President of the Deutsche Bundesbank (February 2024)

Such reassurances, while firm, may not be sufficient to suppress growing calls for verification.

External Voices Enter the Debate

Adding to the tension is the increasing circulation of doubts about the transparency of U.S. gold reserves themselves. Elon Musk and prominent crypto-linked accounts have amplified the call for a formal audit of U.S. gold holdings. While such statements are often dismissed as social media noise, their effect is not negligible when political legitimacy is already strained.

The Bundesbank, for its part, has maintained a consistent line. President Nagel emphasized in February that the relationship with the Federal Reserve is built on trust and institutional integrity. Nonetheless, the response from critics is predictable: in a world where trust is increasingly seen as endogenous — and revocable — physical custody is back in focus.

Systemic Implications and Strategic Signaling

If Germany were to repatriate additional gold from New York, the implications would extend beyond mere logistics. Such a move would represent a public reassessment of the utility and safety of the dollar-based reserve system. Even if not intended as such, it would serve as a signal — to markets, to the transatlantic alliance, and to other central banks managing reserve portfolios under similar arrangements.

In the aftermath of the 2022 freezing of Russia’s central bank assets, central bank reserve diversification has already accelerated. A German decision to reduce its exposure to New York vaults would not be interpreted in isolation. Other reserve managers, particularly in emerging markets, would take note.

Conclusion: Between Symbol and Substance

Germany’s gold in New York has long been treated as a solved issue — a rational hedge within a trusted system. But trust, once taken for granted, is increasingly a variable subject to political reassessment.

The presence of 1,236 tons of German gold beneath Manhattan may still be safe — in theory. But as history repeatedly shows, in the world of sovereign finance, optics are not separate from substance. The mere appearance of risk can become the risk.

If political voices in Berlin continue to gain traction, a fresh round of repatriation could follow. Not because anything has gone wrong — but because too many things could.

Stay tuned…

Wish to know where are my country's ones... Even if technically they aren't my country's ones but the chartered banks ones... Just to say...

I suppose 1/3 local, 1/3 Fed, and the other 1/3 between Bank of England and Bank of France.. But they are so mum here that I'm not holding my breath on better explanations..

And, if I may ask to better minds, how is regulated internationally the ownership of central bank's gold?

What I mean is (accordingly of what I believe):

Bank of Italy is a stock corporation where the stock ownership is divided by the banks who are formally the owners. But, the same applies to the other western countries as well?

Bundesbank is a German state/people bank or the same as Italy, a corporation of german banks? Bank of England and France?

You in Usa have the Treasury that formally is separate from Fed, being Fed like our Bank of Italy...

Up to 1982 Bank of Italy (if I remember correctly) was a branch of our Treasury department, but then separated and privatized to the usual suspects...