Housekeeping: This report is probably the best of the bunch here from a macro POV. They argue—and we write up— at the end of the day, it is time for Gold miners to begin to track gold price just like oil and copper producers do. We would add, stock portfolio managers like fundamentally-driven market analogs with a target.. especially when their MAG 7 stocks are cracking

Contents: (1200 words)

Overview

Structural Repricing: Why This Time is Different

Margin Expansion and Cost Containment

Reinvestment Discipline and Capital Allocation

Valuation Dislocation and Market Underappreciation

Reserve Life and the Decline in Discoveries

M&A Remains Dormant — For Now

Implications and Strategic Positioning

Full Slide Deck

Conclusion: Structural, Not Cyclical

Gold Mining in a Rising Price Environment: A Structural Shift Underway

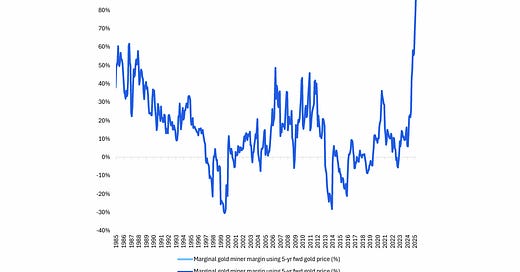

The report offers a detailed account of how gold miners are navigating an environment of structurally higher gold prices, distinguishing itself from previous cycles through the persistent nature of both demand and cost inflation. CITI raises a core thesis: this is not a short-term spike in gold, but a fundamental repricing of the metal that may alter how mining companies behave, particularly in regard to reinvestment, dividends, and cost discipline.

Mining investors have known this all to be true. But soon everyone else will. Note: The bank makes a case for lower gold in their analysis as well. Keep that in mind— it might not be smooth sailing especially if the broader market (stocks or gold) sells off.

The heart of the work described herein is this:

The miners have been disciplined for years,

the banks have not paid attention due to flashier stocks

and the investment community in combination with higher Gold prices is now forcing all of them to take note.

These behavioral factors in combination with the macro economic drivers lining up as described below, make this a once in 40 year event whose time may have (finally) come

Enjoy!