What Happened? We are providing a simple summary for now. At bottom however is all the research we have looked at on this today. All of it came out during the day. We’ve also included Micheal’s Post close Gold TA comment

Gold and Silver

Gold rallied mightily off the lows $49.40 just shy of a $50 rally today- as did Silver on the news. And they did not back off all day. Here is why that happened.

US Bonds and The Dollar

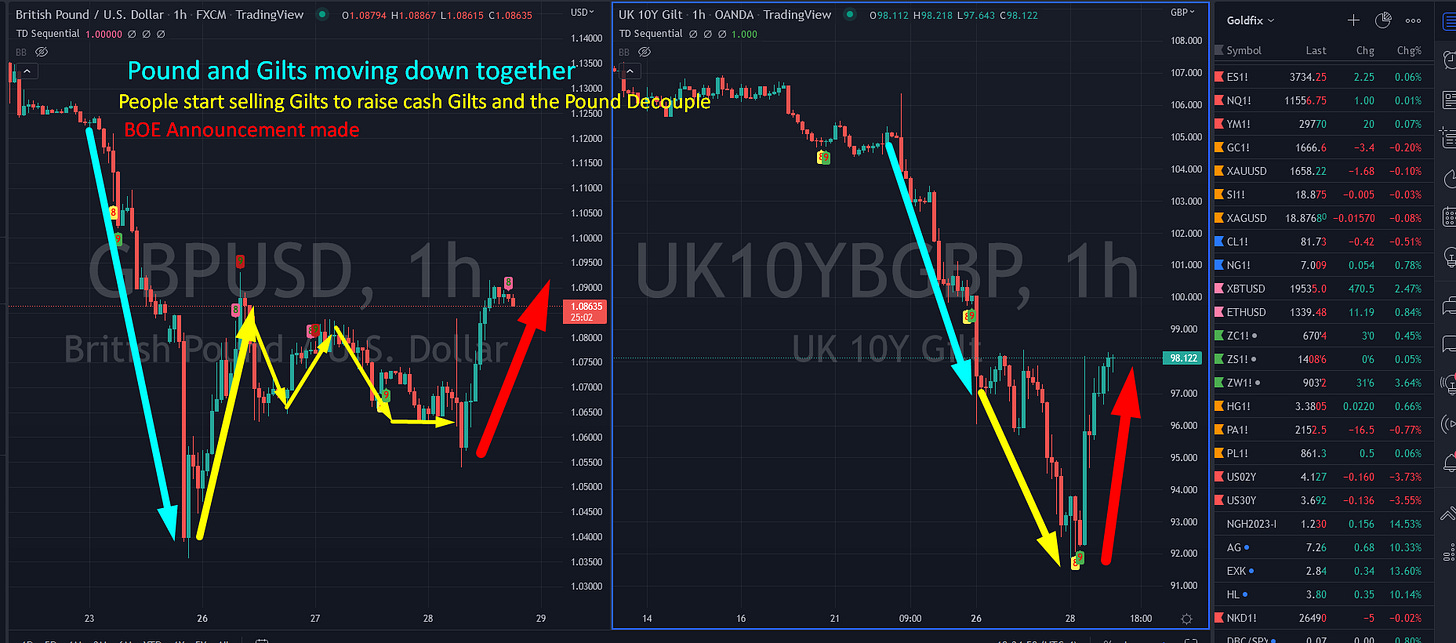

Volatility in The British Pound and The Gilt Exploded

What Happened?

In order to stop the panic selling in both the British pound and the Gilt (British long bond) the BOE not only paused its QT operations, but it is actually buying bonds again.

Today The BOE announced they were re-starting QE for a limited time. Here are the main headlines.

Bottom line:

1- They will stop selling bonds and reducing their balance sheet before it even started

*BANK OF ENGLAND: IN LIGHT OF CURRENT MARKET CONDITIONS, THE BANK’S EXECUTIVE HAS POSTPONED THE BEGINNING OF GILT SALE OPERATIONS THAT WERE DUE TO COMMENCE NEXT WEEK

2- They immediately started actually buying bonds today to prevent the bond from collapsing

*BOE TO CARRY OUT TEMPORARY BUYS OF LONG-DATED UK BONDS STARTING FROM SEPT. 28 (as in immediately)

3- They are using new currency reserves (printing more money) to do this

*BOE BOND BUYING TO BE FINANCED WITH NEW RESERVES

4- They insist they will keep raising rates to fight inflation while doing this

[We] WILL NOT HESITATE TO CHANGE INTEREST RATES BY AS MUCH AS NEEDED TO RETURN INFLATION TO THE 2% TARGET SUSTAINABLY IN THE MEDIUM TERM

Why?

Short answer: The British pound had come under extreme pressure the past few days. Today the problem spread to the Gilt market (British Bonds).

The underlying reason was the growing concern that raising rates and starting QT to control inflation would be extremely bad for the economy and the market was pricing in an inability to was to stay this course.

Common sense: spending money that you not have while assuring the people you borrow it from that you will pay it back in the future eventually puts you in borrow from Peter to pay Paul situation. When interest rates go up, you cannot find money to borrow form one to pay the other. It is the anti-Goldilocks concept. Paraphrasing Buffet we think: when the monetary tide ebbs ,we get to see who is swimming naked.

Why did Gilts sell off too?

The thing that triggered the action today was a negative reinforcing cycle commonly associated with margin calls from over-leveraged positions. The increased volatility of the GBP and Gilts caused margin calls which fed off of each other and started an avalanche of sell orders due to forced liquidations.

Why did the BOE react so harshly and quickly?

Their stated reason was:

"[If] dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability"

The real reason was according to the FT: "Thousands of pension funds have faced urgent demands for additional cash from investment managers in recent days to meet margin calls, after the collapse in UK government bond prices blew a hole in strategies to protect them against inflation and interest-rate risks."

What Type of investment did The Pensions Hold?

Bloomberg noted a specific type of investment called an LDI ( Liability Driven Investment) managed by fund managers who handle the UK pension funds (among others). These extremely long-dated assets tied to Gilt valuations received margin calls in the form of needing more collateral to continue carrying those positions. These are not short term investments.

In simpler terms: Higher interest rates are making money for carrying positions harder to come by. Any position using leverage in the form of borrowed money, derivatives, and long-dated exposure is extremely susceptible. LDIs check all three of those boxes.

When yields fall on Gilts these pension funds get margin money back. When yields rise, they must put more money in.

Leverage and Old Assumptions is the Reason it Happened

The models that are used to assess margin requirements in these “Buy and hold” investments are based on historical numbers going back years. Therefore the models were working under the assumption that Gilts were very stable instruments (like your home) with low volatility. Working on that assumption, Managers typically pull all the money out they can ( like big home equity loans to buy other stuff) and overlever these stable instruments.

The odds of a problem are extremely small since these are very stable assets. But when everybody is doing it for the same reason, and something does happen, the problem is systemic. So if everyone is borrowing against their Gilts (your home) and something like the Great Financial Crisis of 2008 happens, the whole system freezes up and can collapse.

A partner at AON investments put it succinctly

“Any pension fund which has used even moderate levels of leverage are struggling to keep pace with the [volatile] moves,” You have a bit of a death spiral potentially where pension funds in particular are being forced to sell because they’re breaching their leverage agreements with their LDI counterparties.

And so pensions had been selling anything that was not nailed down to raise cash to make LDI margin calls. LDIs have a history of being very stable which is why they get so leveraged. However due to their very long durations, they can be very difficult ( like 1000 homes that default) to liquidate in a pinch.

So, the BOE bailed out their Pensions via buying their own bonds with new money.

Nomura today:

Accordingly, today’s action from the BoE is pure and simple a PENSION FUND BAILOUT from said margin-call liquidation spiral….period, end of story, full-stop

A historically stable asset that everybody was comfortable owning and using as a piggy bank to borrow money from to invest in other assets.

The Market Reaction

The markets reacted swiftly and violently to the BOE actions.The Pound market stabilized. The Gilt market soared on the news. Long term Gilt yields moved as much as 70 bps immediately.

We believe that this changes nothing and the problems that caused this situation are not resolved at all. Things may go back to something closer to normal, but nothing is fixed at all.

Kick the can down the road is becoming hide the pea as Central Banks are now looking more and more like they must either consider themselves married to all the assets they have bought over the years and start monetizing the debt by just printing much more money— or we get a hard reset and a new global monetary system to keep things stable.

There is a lot we can add here in several directions but it is better for now to just tell you what we see. This is everything that happened during the GFC now happening in another asset class. Let that be your reference point for the event if you can.

“They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October. The purchases will be unwound in a smooth and orderly fashion once risks to market functioning are judged to have subsided.”

There will be knock on implications. Anything is game now for selling. Nomura again:

Despite the local stabilization from the above BoE actions, we are now entering the period of this “Macro Vol” impulse where similar “un-economic” selling is a next wave, “systemic” concern for markets—i.e. not just the “pension margin call spiral,” but too, hypotheticals in the form of year-end / tax-loss selling risk >>> spiraling redemptions at mutual funds adding pressure to the already deep selloff in assets

And as these types of “second-order” unwinds begin to ripple-out into the market, the spiral of forced-selling to make cash-calls is further evidence that widespread deployment of leverage across strategies from the halcyon days of QE and the Central Bank “Vol Suppression” era is no more, and that systemic de-leveraging is now at an acceleration point, particularly as “risk free” assets used as collateral turn to “meme-stocks”

This is far from over.