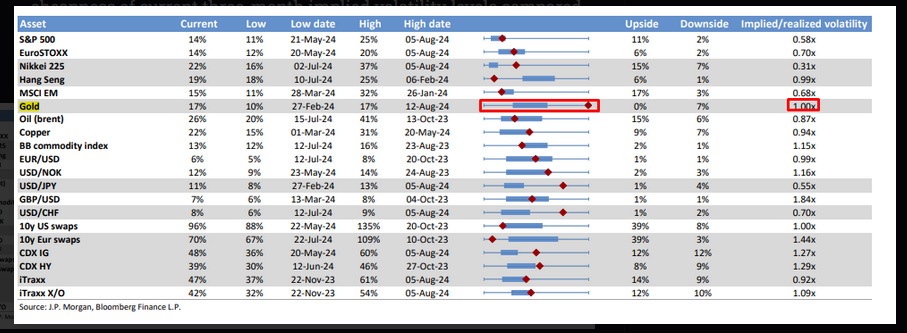

The last few days we had been discussing Gold in volatility terms with the bottom line comment that:

Gold vol and Skew tell us the market is closer to a pullback than a rally as long as no new news comes out. The news coming out is known.. BRICS, Election etc….A pullback is possible, and options will lead the selloff almost like a barometer.

Today, Goldman made a comment to that effect. We have that attached after a recap of previous statements on that topic.

Previously in Summary we opined:

Something screwy is going on with the banks not having any risk all of a sudden.

From: Why Are The Banks/Press So Bullish?- Aug 25th Skew is high, and the market is not moving enough to warrant it.. almost like the banks are afraid to sell it.

Vol is strong, and sticky, but noone is buying it…

Skew says beware- August 29th

This is an indication that speculators are not buying as much as they usually do. which is an indication that macro discretionary is less committed to gold options than it has been. It's not definitive at all.

Big JPM Gold Flows Analysis Aug 29

The weekly change also implies longs are slowly selling out which is also consistent with tapering momentum

Vol Good but Closer to the end than the beginning- Aug 29th

Bottom line, gold volatility is very overbought, but as long as the market volatility keeps realizing the implied, it will continue to remain big. It is not overbought yet. It becomes overbought when the implied volatility is high and the break-evens drop. So right now, it's not overbought.

…It could be overbought in a heartbeat, but- The key to that is it's a sign of a market that may be about to get toppy. It's not a reason to be, I'm bullish because the volatility is justifying itself. No, it's a sign to be careful. Absent an event, we are closer to the end than the beginning this next month