GoldFix PM: Back to “Normal”

GoldFix PM

Housekeeping: Good afternoon

Morning Rundown:

Macro-Economics/Commodities:

Geopolitics:

Founders:

GOLDFIX Intraday Chat:

MAgGa and MAuGA Hats here…

RECAP: Pain

Price Action.

U.S. 10-year Treasury yields were slightly lower on the day, down 2 basis points, while the dollar was mixed and finished marginally weaker, down about 4 basis points. Equities were softer. The S&P 500 closed at 6,908, down 21 points, trading in a relatively narrow range just below all-time highs. The Nasdaq underperformed, falling 129 points to close at 25,517, finishing off its highs.

Metals saw extreme volatility. Gold made another new overnight all-time high with spot trading near 4,550 before selling off sharply during U.S. hours, making a low near 4,300. Gold finished the day down roughly $200, or about 4.4%. Silver was even more volatile, trading as high as 83.75 in spot before falling to a low near 70.54 and closing at 72.12. Palladium collapsed, down about 15.8% or $304, trading from a high near 1,955 to a low around 1,611 and closing near 1,621. Platinum also sold off heavily, closing at 2,093 after trading as high as roughly 2,478, down about $353, or nearly 14.5%.

Big hangover starting maybe. But a reminder of just how crazy this month has been for metals. Gold and silver are still positive on the month.. silver by over 15%… crazy…

Energy was firmer. Oil rose about 1.5% to close near 57.94, while natural gas finished near 4.09 after a largely doji-style session despite being up more than 1%.

Drivers:

Market mechanics drove the move. Both gold and silver erased a significant portion of recent overbought conditions in a single session. Volatility was notably higher during Asian hours than during U.S. trading, and Shanghai silver futures narrowed their spread versus Western spot prices at the highs. That pattern reflects physical prices being pulled toward futures before a broader decline across the complex. There were no additional market-moving headlines, leaving positioning, liquidation, and tape behavior as the primary drivers.

Positioning and context:

The session reflected textbook behavior of an overbought metals market reverting toward trend, with both gold and silver moving back toward upward-sloping trendlines. The compression in Shanghai-Western spreads at the highs is consistent with historical capitulation-type setups seen across commodity markets. The concentration of volatility in Asian hours points to the pressure originating outside Western trading sessions.

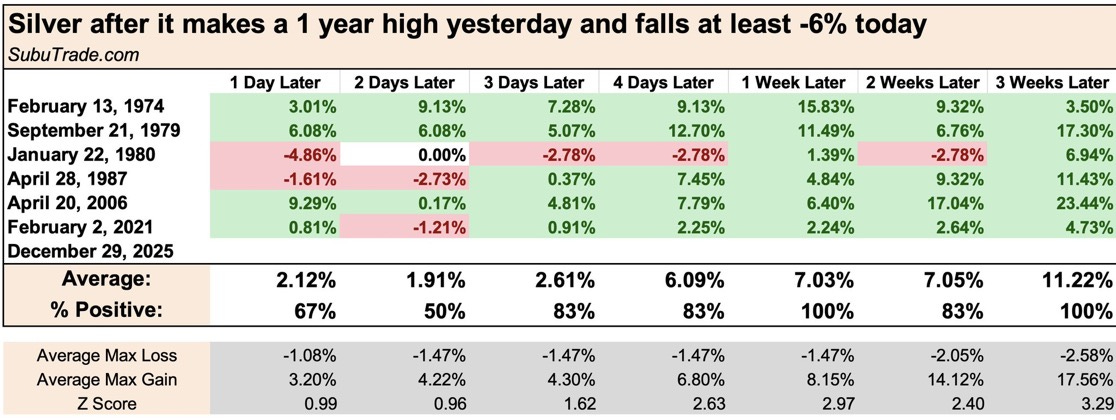

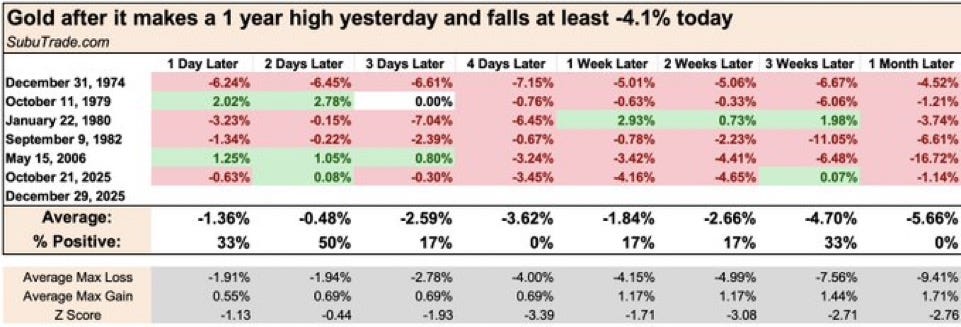

Note the two charts below silver and gold significantly diverge after market clearing events like today. Gold tends to continue lower whereas Silver tends to bounce. This is because historically Silver gets over sold a lot faster than Gold does.

We’ll see what the rest of the week brings, but no one should be hopeful for anything that makes sense in either direction over the rest of the week as this is the end of the year, and there will be more liquidations of smaller players, pushing the market around as if it were a data point day

Everyone knew that COMEX would eventually step in and cool off the markets.

It’s a big club and we ain’t in it.

NO likes ..today...

When a..drive by whip saw drives silver up 10.3 % on day, and smacks it back even more the next

that Kittyco calls..."profit taking" and its called...normal session behaviour...I call it Bullshit....

Oil was up, on new Iran tensions and more war is coming....oh...lets dump our insurance hedges...

I wonder...what..Buffet is up to...next