Housekeeping: Many will be receiving GoldFix Weekly for the first time. It is different than the dailies. This post is more like a magazine. The content touches many areas of markets. GoldFix complete watchlist here

**NO FOUNDERS CLASS THIS WEEK **

Index

Market Summary

Commodities:

Stock Sectors:

Bonds:

Crypto:

Gold’s Path Gets More Certain

Dollar/ Rate Correlations Return

China’s Dilemma

Popular Posts

Calendar: Fed Week

Charts

Research

1. Market Summary

The week started quietly but ended with dramatic market moves. Services PMI plunged, inflation expectations spiked, and Trump’s actions sent the dollar and crude falling while stocks, crypto, and gold soared.

Worth Watching

OVERVIEW:

The Dow led gains, with all major indices finishing positive. The S&P 500 hit a record high, with 68% of its components rising for five consecutive days, marking its longest streak since 1928.

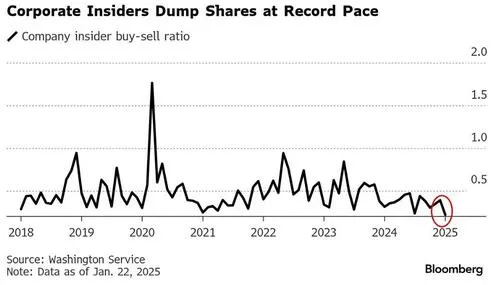

ZeroHedge noted that as the S&P 500 hit record highs, insider selling surged. The buy-sell ratio hit its lowest level since 1988, signaling mounting concerns about valuations.

Bullish sentiment dominates, but dollar volatility, insider selling, and valuation concerns hint at potential turbulence ahead.

Commodities:

OIL: Crude fell for 5 straight days, its biggest weekly drop in three months, dipping below its 200-day moving average.

Hartnett: “Flip Oil longs to Gold” was right

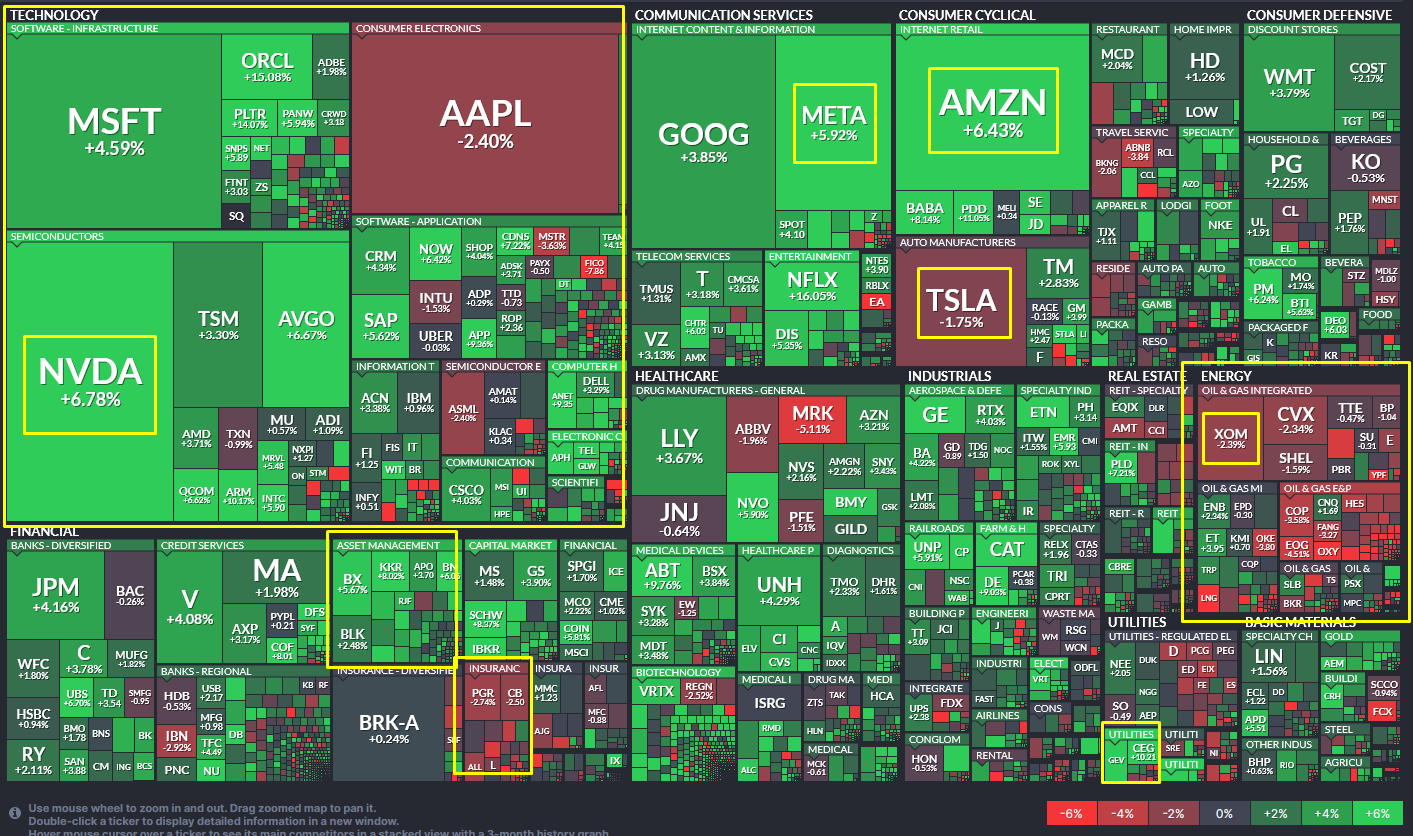

Stock Sectors

Finance did well

Healthcare and insurance were both violently mixed

Energy got hammered

Rate sensitive stocks were strong along with BigTech

Bonds:

BONDS: Yields ended the week unchanged, further decoupling from the stock market’s gains.

DOLLAR: dropped sharply, marking its worst week since July 2023 as exemplified in short term rates as well in the top right corner

Crypto:

BITCOIN: climbed for a second week, flirting with record highs. Gold rose for the fourth week in a row, just shy of a new record close.

GoldFix Friday WatchList:

Complete Watchlist Here

2. Gold’s Path Gets More Certain

Overall, we’d say things are pretty much set for Gold now as far as Western buyers are concerned. Specifically, when an incoming president is still an unknown in policy implementation terms, big western players (Macro D, RIA managers and larger CTAs) will sit on their hands in making Gold decisions until they can more clearly see the landscape.

That landscape almost always distills into what they think the USD will do under the President. If they foresee a weaker dollar, they will not buy Gold until they see a dip if *they* buy at all. If, on the other hand, they see a weaker dollar in the near future, they start buying ASAP.

Last week, we saw Trump’s campaign ambitions (Tariffs and a stronger USD) run into the reality of a weaker dollar (with much cheaper oil) as an easier path for him to launch his MAGA agenda. Tariffs remain on the table for sure, especially for China (and that is why China will keep buying), but tariffs are not the first weapon of choice. Bessent said as much in— Bessent to MAGA: A weak dollar powers a boom.

We find it unlikely that across-the-board tariffs, as currently reported by the media, would be enacted at the same time as he moves to fix the immigration crisis. The tariff gun will always be loaded and on the table but rarely discharged. Of course, strategic and national security issues around China will remain.

In combination, western players finally got a clear signal that Trump was going to back-off on Tariffs for now, while pursuing cheap energy and simultaneously leaning on Powell for lower rates. In sum: Western buying stepped up after collectively believing the USD path will be lower as was described in these three stories last week

A Reminder: Powell gets his chance to push back Wednesday next week. The more aggressive buying is probably betting he will not do so. We shall see. Either way, assume buying Monday and Tuesday next week is hot money and not to be trusted