GoldFix Weekly: Time to Get Up and Go

Milling-Stanley Interview

Housekeeping: Sunday’s Founder’s Class will be 3 p.m. ET. Michael Moor will be joining us to discuss the Gold, Oil, Natural Gas, and Bitcoin markets as well as his particular approach to technical analysis. Zoom Link Here. Founders use usual password please. See you tomorrow!

SECTIONS

Market Summary: weekly recap

Precious: analysis

Reports: research

Technicals: active trading levels

Podcasts: GoldFix and Bitcoin

Charts: related markets

Calendar: next week

1. Market Summary

Another disappointing week in equities, but it may possibly be a slowing of the descent into “heck”. Why? Because the tech sector closed strongly on Friday. This even while the Dow sank more than it did the previous week. Why is that possibly good? Because it may be in part a rotation back out of safer stocks and back into Tech to take risk on again. How confident are we; not very yet.

Because if we are wrong, then this is instead a broadening of the selloff as the “safer” stocks are no longer doing well. The tech rally on Friday would then just have been a dead-cat bounce. But it is on our radar. Call it an inflection point for stocks. Here’s the market recap.

All major US equity indices are now lower on the year with the Nasdaq Composite the worst-performer and The Dow the best.

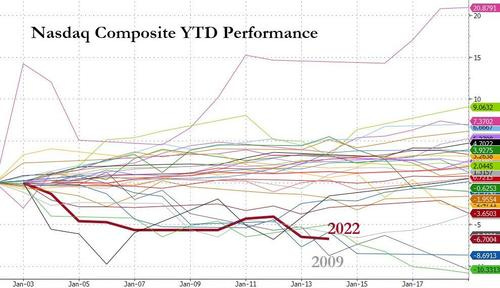

In the last 30 years, only 2009 saw a worse start to the year for the Nasdaq Composite…

The Nasdaq ripped higher Friday to get back to even on the week

Small Caps and The Dow were the week's laggards.

Nasdaq bounce today was AGAIN perfectly off the 200DMA (and The Dow fell back below its 50DMA).

Sectors

Most Banks were battered -with JPM suffering its biggest post-earnings decline in at least 20 years

Goldman, JPMorgan, and Morgan Stanley all dropped into the red for the year. (2)

Meanwhile, WFC is up almost 20% YTD (2)

More than 36% of the stocks in the Nasdaq are down at least 50% from their 52-week highs (1)

Discretionary spending on home improvement and restaurants got hit (3)

Energy stocks did well again directly as beneficiaries of higher oil. (4)

Notable is that Exxon’s dividend is still in the 5% area even after a strong couple months. (4)

If rotation out of tech and into shorter duration inflationary hedges continues, it might hold up well.

Defensives and Cyclicals both ended down just short of 1% on the week with Cyclicals playing the high vol ride.

Speculatively speaking, shorting tech and buying value/ nat resources is what has worked for 4 months running. From last week’s Premium Report

Frankly, we think the big boys have been positioning themselves for this the past 4 months. That doesn’t mean rebalancing is a bad idea. It means it is possibly a good idea now. But it was definitely a better one 4 months ago

Tech stocks continued to be bashed relative to value as the rebalancing we discussed at length last week did in fact start to take hold. But worse is that tech stocks that are not yet profitable continued to get punished. Unicorns suffered.

ZH writes:

The longest-duration

,hyper-growth and non-profitable tech companies crashed further this week, now down a shocking 49% from record highs in Feb 2021 (down 7 of the last 9 weeks)...

There’s that word again; Duration. From The Rise of Duration section last week:

Duration in stocks is a relatively new thing. Generally speaking, growth and tech stocks are perceived as longer duration. Value stocks, whatever that actually means these days, are seen as short duration.

Stocks are overvalued but bonds are as well. Therefore we (Goldman) want you to buy less overvalued (undervalued?) stocks that have solid dividends. Get out of your tech stocks.

Some are seeing parallels to the 2016 oil patch disaster stemming from unprofitable shale oil projects. Samantha LaDuc of LaDucTrading noted:

Y’all remember the oil industry recession from 2014-2016? Yeah that. The energy company patch lost over $66B from bankruptcies not including market cap losses leading into bankruptcies. Just sayin’- small/mid-cap, previously-parabolic tech looks eerily similar - Source

Small Tech and Shale Oil are entirely different industries with one important commonality: