Housekeeping: This is the PM GoldFix post combining AM emails with additional intraday posts.

Contents

Morning Rundown:

Macro-Economics/Commodities:

Geopolitics/Elections:

Founders:

(NEW) GOLDFIX Intraday Chat

Market Recap as warranted

Morning Rundown:

Macro-Economics/Commodities:

Geopolitics/Elections:

Founders:

(NEW)GOLDFIX Intraday Chat:

Intraday analysis, commentary, and observations in threaded form

Market Recap:

The gold market worked its way lower all day today this coincided with dollar strength and stock strength. Silver was strong most of the day only giving up the ghost and going negative very late in the session. The primary driver of stocks and probably gold as well today was Scott Bessent's comment off a wire service at around noon saying “Bessent sees the escalation with China situation unsustainable”.

Moments after that statement Politico reported that it may take months to reach any final trade deal with China..

Taken together and at face value it would seem that the White House is replying or responding to concerns about the lack of communication and then letting the world know that we're in the process. They did not come from the President, it came from the Secretary of the Treasury.

Taking it not at its surface and noting that the quote came from the Secretary of Treasury, but the negative spin came from Politico, it implies that some expectation management is happening and media seeks to dampen it but no material changes are near. The topic was relief for stocks and they finished up two and a half percent.

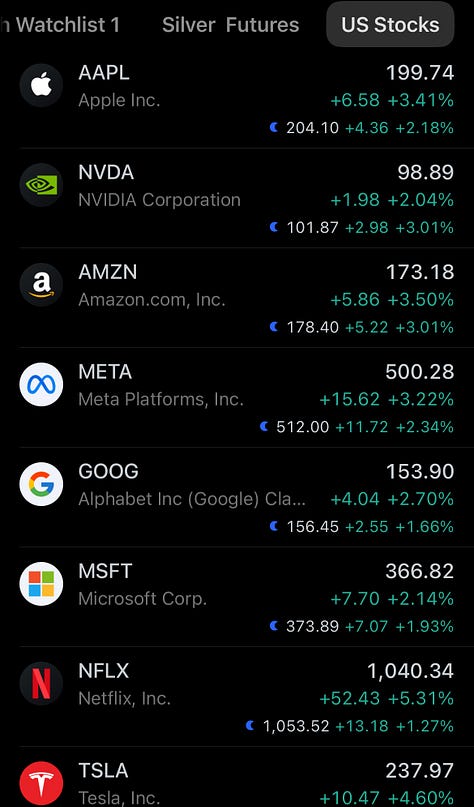

Gold finished down 1 1/4 per cent. Silver finished down about a half of a percentage point. Copper remained very strong. Oil worked its way higher again.

The standout would have to be Bitcoin in that it was strong on its own today and then rallied a little bit more when stocks caught a bit

There's another concept that's worth mentioning here. The hard (official after the fact) data is coming in very strong consistently. It's notable that the hard data lags the soft data. Soft data has been coming in very weak.

It's worth understanding that Jerome Powell has made it clear he's only interested in following the “hard end” or official data and has passed on using soft data to guide his actions. This goes back to the grievous error he made during COVID. Then he said he would work with the soft data because he didn't want things to get too bad. Post that episode he has vowed to stick to only finalized hard data and not make decisions based on temporary intro report news. We would also note that he did not use that explanation when he decided to lower interest rates a full percentage point right before the election.

If he's once again making a mistake by ignoring the soft data this time then maybe things will get very bad.

Anyway; It looks like the president and his administration are responding. Are they throwing us a bone because they have something working or are they scrambling behind the scenes. We will see.

Final comment as we're typing this president Trump just said that China’s tariff won't be anywhere near 145 percent . That's what you'd say if you were trying to turn the market higher. It's a little disturbing that he talked about Japan a couple of days ago, And what has to be extremely logical for the US to work on first— but now he's talking about China. Nothings final here, but this is what it looks like when the horse trading breaks down a little bit.

Circling back to gold, today's price action was not good. We've seen these days before and the market comes right back. We'd be more inclined to buy on a dip than by odd strength right now.

One more thing Tesla’s earnings came out. The stock is up 10 bucks from 238 to 248 right now.

Good night.