Out of pocket today, but thought this relevant given Gold’s recent behavior and wanted to get it to everyone.

Since the embargo of Russian Gold exports, there have been no metals reports and few oil ones. So we started looking for some clues. Goldman’s most recent price target has been $2500 for months and they have not changed that yet.

This is the most recent Goldman comment on Gold to the best of our knowledge

We will go into this in more detail this weekend.

On Gold From June 14th

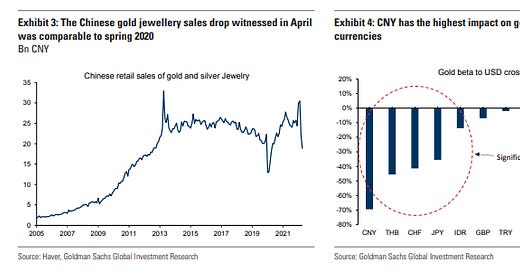

Past Wealth shocks on average were good entry points for gold: Using the broad-based dollar as a proxy for the Wealth factor, we look at past periods of sharp dollar appreciations. We find that historically during these periods gold initially falls together with the dollar but then rebounds even as the dollar remains elevated.

This demonstrates that a wealth shock is typically a good time to buy gold for medium-term investors as price tends to undershoot its fundamental value.

This view is supported by a positive Chinese gold premium (it was deeply negative during the lockdowns in 2020) which signals confidence of importers in a longer-term rebound of Chinese demand. Overall our economists and FX strategists see moderate dollar depreciation into the year-end.

Full report below