"Gold remains the preferred near-term long position, with a price target of $2,700 per ounce by early 2025."

Contents: (1200 words)

Introduction

A Tactical Shift in Commodity Strategy

Oil Market Caution

Delayed Copper Rally

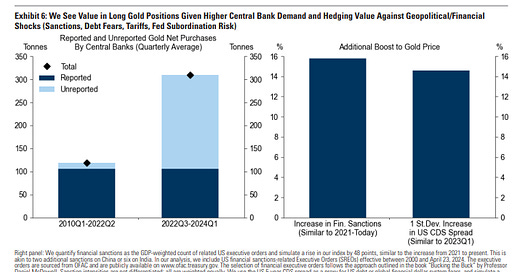

Strong Bullish Case for Gold

Risks in Broader Commodity Market

Conclusion In context of seasonality and BRICS/Election Events

Short term: 90 Day Horizon

Intermediate Term: 3 to 6 months

Longer Term: 2 Years+

Key Slides

Final Word: Don’t Judge a Book by it’s Cover

1- Introduction

A brand new report from Goldman Sachs, titled "Go for Gold," is out. The best intro we can give is this audio one sent out yesterday here.

Here is our full analysis. Bottom Line. Gold is the only game in town for Commodities the next month or so at least. Context matters a great deal this time of year