Housekeeping: Good Morning

“Crypto and Gold are at all-time highs because the market is sniffing out a Fed that's going to tolerate higher inflation, which will give them, of course, weaker policy credibility.”

Summary:

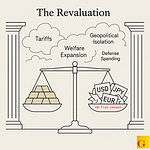

For The Fed to witness recent harsh inflation upticks and offer little to no pushback against it or for that matter the market’s persistent expectations of rate cuts means implies a tolerance for a higher inflation level is here.

It implies the target has been raised if not completely discarded.

It also means the Fed is worried more about recession than inflation now.

The market sees this and is betting Powell has thrown in the towel on his 2% inflation target.

Hartnett’s Flow Show analysis goes through the signs this is in fact happpening

Hartnett’s Key Insights:

Fed may be more worried about Recession than Inflation for three reasons:

because weaker Jobs implies recessionary slowdown

and because the STIRS market continues to think Fed will ease in June despite bond yields creeping higher, exploding Gold and BTC prices

Fed also not doing much talking down rate cut hopes yet

Therefore: market sniffing out Fed tolerating higher inflation targets. His forward-looking indicators are now starting to point to Stagflation as the risk as a result.