Market Rundown

Good morning. The dollar is slightly stronger. Bonds are weaker. Stocks are up 40-90 bps after a very whippy morning ranging between up 1.5% to unchanged. Gold is up $7 after failing to achieve escape velocity for now in the high teens earlier. Silver is up 22 cents. Oil is up 38 cents after getting hammered the last few days. NatGas is up 37 cents, over 6%. Crypto is down 50bps. Grains are mixed with Corn higher.

Here’s today’s data:

PPI 0.3% M/M; Exp. 0.2%; Last 0.2%PPI 7.4% Y/Y; Exp. 7.2%

PPI came out stronger than expected on strength of brokerage fees (people paying to exit?), and vegetables as ZH somewhat humorously notes:

PPI hotter than expected because brokers somehow raised prices amid huge outflows and tomatoes soared over 40%- Zerohedge

Inflation is Dead, Long Live inflation

Michael Hartnett, BOA’s equity macro guru, notes several things of interest to us and commodity people in general this week. Inflation, Recession, and how markets act right after the “Last Rate Hike” of a cycle are among them.

ON INFLATION

He believes that “Inflation will fall in '23.” But the Big 3 secular themes for 2020s remain very supportive of inflation.

Climate change- retooling energy is expensive

Shift from globalization to regionalization- supply chain rebuild

Inequality to inclusion- more fiscal spending, expanded safety nets

These are themes we are familiar with, especially the second, in light of our multiple posts identifying Mercantilist regionalization as policy successor to Neo-keynesian globalization as early as last year.

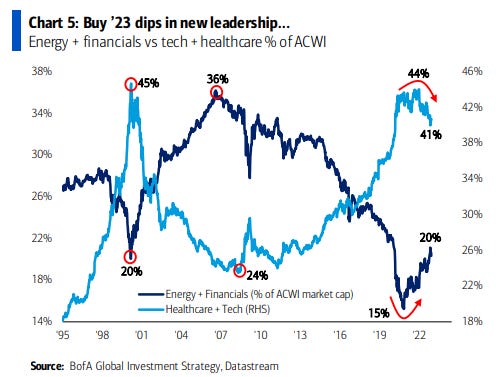

All of these are secular trends are inflationary. What is more, he feels in asset performance terms leadership shift from deflation to inflation assets is still at an early stage.

ON RECESSION

He games out when the bigger recession may start:

In 10-12 weeks because among other things the Yield curve is at its most inverted since Oct'81.

or

In the 2nd half of 2022 (also among many other things) because: US gasoline prices have halved in recent months which is a tailwind for consumer spending

INFLATION MEANS VOLATILITY BOTH WAYS

Very interesting macro analysis. If you get the era right, 90% of the work is done for you it seems. That answer to market behavior post a last rate-hike depends on which secular situation we were in. For example: the 70s/80s were inflationary. The 90s/10s were disinflationary. Last rate hikes in cycles within the 70s/80s had markedly different effects on asset classes than last hikes in the 90s/10s era.

For example. The last rate hike of a cycle during the Great Inflation of the 70s yielded much bigger corrections in Gold versus during the Goldilocks era of the 90s/10s. Presumably that is also a comment on how much Gold had rallied before the hike cycle during the Great inflation versus how moribund it was during Goldilocks. Similarly, the Dow rallied much further post the last rate hike of a cycle during the 70s than it did during the 90s. Conclusion: inflation means volatility in both directions.

More Below…